Starwood 2009 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

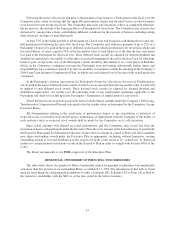

We calculate the stockholder’s percentage of Shares assuming the stockholder beneficially owned that number

of shares on March 17, 2010, the record date for the annual meeting. Unless otherwise indicated, the stockholder

had sole voting and dispositive power over the shares.

Name and Address of Beneficial Owner

Amount and Nature of

Beneficial Ownership

Percent

of Class

FMR LLC(1) ................................................ 20,250,185 10.72%

82 Devonshire Street

Boston, MA 02109

EGI-SSE I L.P.(2) ............................................ 14,750,000 7.81%

2 North Riverside Plaza, Suite 600

Chicago, IL 60606

BlackRock Inc.(3) ............................................ 11,683,191 6.18%

55 East 52nd Street

New York, NY 10055

Harris Associates L.P.(4) ....................................... 11,299,190 5.98%

Two North LaSalle Street, Suite 500

Chicago, IL 60602-3790

(1) Based on information contained in a Schedule 13G/A, dated February 16, 2010 (the “FMR 13G/A”), filed by

FMR LLC with the SEC, reporting beneficial ownership as of February 12, 2010. The FMR 13G/A reports that

19,198,731 Shares are held by Fidelity Management & Research Company (“Fidelity”), a wholly-owned

subsidiary of FMR LLC (“FMR”); 203,600 Shares are held by Pyramis Global Advisors, LLC, an indirect

wholly-owned subsidiary of FMR; 96,691 Shares are held by Pyramis Global Advisors Trust Company, an

indirect wholly-owned subsidiary of FMR; 751,000 Shares are held by Fidelity International Limited, a foreign

based entity that provides investment advisory and management services to non-U.S. investment companies

(“FIL”) and 163 Shares are held by Strategic Advisers, Inc., a registered investment adviser and wholly owned

subsidiary of FMR. According to the FMR 13G/A, FMR and Edward C. Johnson 3rd, Chairman of FMR, each

have sole dispositive power and sole voting power with respect to 19,198,731 Shares. Through ownership of

voting common stock and the execution of a certain stockholders’ voting agreement, members of the Edward C.

Johnson 3rd family may be deemed, under the Investment Company Act of 1940, to form a controlling group

with respect to FMR.

(2) Based on information contained in a Schedule 13D/A, dated November 17, 2009, filed by EGI-SSE I, L.P., EGI-SSE

I Corp., SZ Investments, L.L.C., and Chai Trust Company, LLC (collectively “SSE”) with the SEC with respect to

the Company, SSE has shared voting power and shared dispositive power over 14,750,000 Shares. On December 29,

2008, the Company and SSE entered into a confidentiality agreement to facilitate the sharing of information between

the Company and SSE. Pursuant to the agreement, SSE agreed to restrictions on its use and disclosure of the

Company’s confidential information and limitations on its ability to effect a change in control of the Company.

(3) Based on information contained in a Schedule 13G, dated January 29, 2010 (the “BlackRock 13G”), filed with

respect to the Company with the SEC, reporting beneficial ownership as of January 20, 2010. The BlackRock

13G is filed by BlackRock, Inc. (“BlackRock”) and reports that BlackRock has sole voting and dispositive

power with respect to 11,683,191 Shares. The BlackRock 13G reports that it amends the most recent

Schedule 13G filing, if any, made by Barclays Global Investors, NA and certain of its affiliates (Barclay’s

Global Investors, NA and such affiliates are collectively referred to as the “BGI Entities”) with respect to the

subject class of securities of the Company. As previously announced, on December 1, 2009, BlackRock

completed its acquisition of Barclays Global Investors, NA from Barclays Bank PLC. As a result, substantially

all of the BGI Entities are now included as subsidiaries of BlackRock for purposes of Schedule 13G filings.

(4) Based on information contained in a Schedule 13G/A, dated February 11, 2010, filed with respect to the

Company with the SEC, reporting beneficial ownership as of December 31, 2009, Harris Associates L.P.

(“Harris”) has been granted the power to vote Shares in circumstances it determines to be appropriate in

connection with assisting its advised clients to whom it renders financial advice in the ordinary course of

business, either by providing information or advice to the persons having such power, or by exercising the

power to vote. Harris has sole voting and sole dispositive power with respect to 11,299,190 Shares.

15