Starwood 2009 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

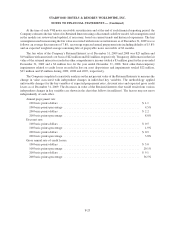

and Servicing. This topic improves the comparability of information that a reporting entity provides regarding

transfers of financial assets and the effects on its financial statements. This topic is effective for interim and annual

reporting periods beginning after November 15, 2009. The Company is currently evaluating the effect that this topic

will have on its consolidated financial statements.

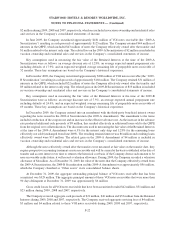

In June 2009, the FASB issued SFAS No. 167, “Amendments to FASB Interpretation No. 46(R)”

(“SFAS No. 167”), expected to be included in the Codification as ASC 810, Consolidation. This topic changes

the consolidation guidance applicable to a variable interest entity. Among other things, it requires a qualitative

analysis to be performed in determining whether an enterprise is the primary beneficiary of a variable interest entity.

This topic is effective for interim and annual reporting periods beginning after November 15, 2009. The Company

has estimated that the adoption of this topic will require consolidation of its existing securitized loan vehicles

resulting in additional assets (primarily accounts receivable and other assets) of $400 million, and additional

liabilities (primarily short-term and long-term debt) of $445 million based on balances at December 31, 2009.

Additionally, vacation ownership pretax earnings are estimated to increase by approximately $20 million in 2010.

The Company is still evaluating other aspects of the topic.

In October 2009, the FASB issued ASU 2009-13 which supersedes certain guidance in ASC 605-25, Revenue

Recognition — Multiple Element Arrangements. This topic requires an entity to allocate arrangement consideration

at the inception of an arrangement to all of its deliverables based on their relative selling prices. This topic is

effective for annual reporting periods beginning after June 15, 2010. The Company is currently evaluating the

impact that this topic will have on its consolidated financial statements.

In January 2010, the FASB issued ASU 2010-06 which amends certain guidance of ASC 820-10. The

amendment will provide more robust disclosures about valuation techniques and inputs to fair value measurements.

This topic is effective for interim and annual Reporting periods beginning after December 15, 2009. The Company

is currently evaluating the impact that this topic will have on its consolidated financial statements.

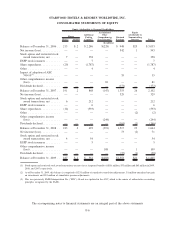

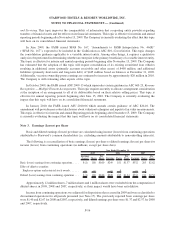

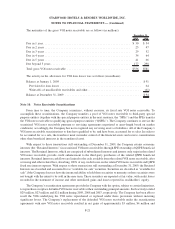

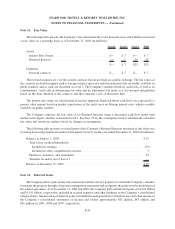

Note 3. Earnings (Losses) per Share

Basic and diluted earnings (losses) per share are calculated using income (losses) from continuing operations

attributable to Starwood’s common shareholders (i.e. excluding amounts attributable to noncontrolling interests).

The following is a reconciliation of basic earnings (losses) per share to diluted earnings (losses) per share for

income (losses) from continuing operations (in millions, except per share data):

Earnings

(Losses) Shares

Per

Share Earnings Shares

Per

Share Earnings Shares

Per

Share

2009 2008 2007

Year Ended December 31,

Basic (losses) earnings from continuing operations . . . . $ (1) 180 $0.00 $249 181 $1.37 $532 203 $2.62

Effect of dilutive securities:

Employee options and restricted stock awards . . . . . . — — — 4 — 8

Diluted (losses) earnings from continuing operations . . . $ (1) 180 $0.00 $249 185 $1.34 $532 211 $2.52

Approximately 12 million shares, 7 million shares and 1 million shares were excluded from the computation of

diluted shares in 2009, 2008 and 2007, respectively, as their impact would have been anti-dilutive.

Income from continuing operations was adjusted for dispositions that occurred in 2009 and were reclassified to

discontinued operations for all periods presented (see Note 17). The previously reported basic earnings per share

were $1.40 and $2.67 for 2008 and 2007, respectively, and diluted earnings per share were $1.37 and $2.57 for 2008

and 2007, respectively.

F-16

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)