Starwood 2009 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

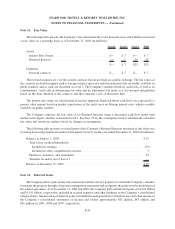

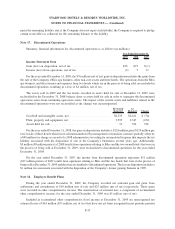

Note 13. Restructuring, Goodwill Impairment and Other Special Charges, Net

During the year ended December 31, 2009, the Company completed a comprehensive review of its vacation

ownership business. The Company decided not to develop certain vacation ownership sites and future phases of

certain existing projects. As a result of these decisions, the Company recorded a primarily non-cash impairment

charge of $255 million. The impairment included a charge of approximately $148 million primarily related to land

held for development; a charge of $64 million for the reduction in inventory values at four properties; the write-off

of fixed assets of $21 million; facility exit costs of $15 million and $7 million in other costs. Additionally, as a result

of this decision and the current economic climate, the Company recorded a $90 million non-cash charge for the

impairment of goodwill in the vacation ownership reporting unit (see Note 8).

Additionally, in 2009, the Company recorded restructuring and other special charges of $34 million, primarily

related to severance charges and costs to close vacation ownership sales galleries, associated with its ongoing

initiative of rationalizing its cost structure.

During the year ended December 31, 2008, the Company recorded restructuring and other special charges of

$141 million, including $62 million of severance and related charges associated with its ongoing initiative of

rationalizing its cost structure. The Company also recorded impairment charges of approximately $79 million

primarily related to the decision not to develop two vacation ownership projects as a result of the current economic

climate and its impact on business conditions.

During the year ended December 31, 2007, the Company recorded net restructuring and other special charges

of approximately $53 million primarily related to the Company’s redevelopment of the Sheraton Bal Harbour Beach

Resort (“Bal Harbour”). The Company demolished the hotel in late 2007 and is in the process of rebuilding a St.

Regis hotel along with branded residences and fractional units. Bal Harbour was closed for business on July 1, 2007,

and the majority of employees were terminated. The charge primarily related to accelerated depreciation,

demolition, and severance costs.

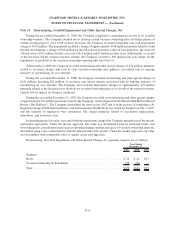

In determining the fair value associated with the impairment charges the Company primarily used the income

and market approaches. Under the income approach, fair value was determined based on estimated future cash

flows taking into consideration items such as operating margins and the sales pace of vacation ownership intervals,

discounted using a rate commensurate with the inherent risk of the project. Under the market approach, fair value

was determined with comparable sales of similar assets and appraisals.

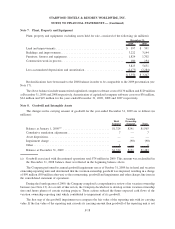

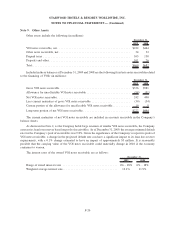

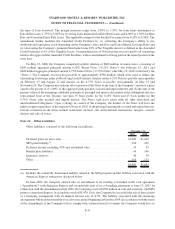

Restructuring, Goodwill Impairment and Other Special Charges by operating segment are as follows:

2009 2008 2007

Year Ended

December 31,

Segment

Hotel ...................................................... $ 21 $ 41 $53

Vacation Ownership & Residential ................................ 358 100 —

Total ...................................................... $379 $141 $53

F-25

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)