Starwood 2009 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

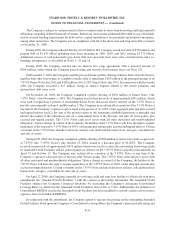

repay the remaining liability and, if the Company does not repay such liability, the Company is required to pledge

certain receivables as collateral for the remaining balance of the liability.

Note 17. Discontinued Operations

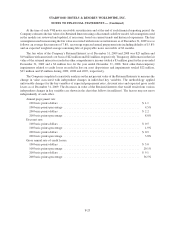

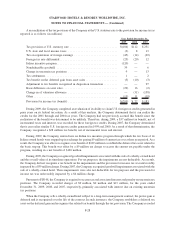

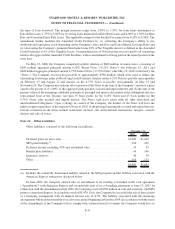

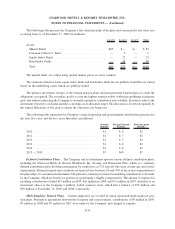

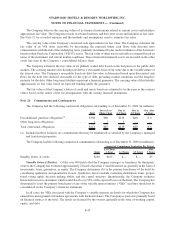

Summary financial information for discontinued operations is as follows (in millions):

2009 2008 2007

Year Ended December 31,

Income Statement Data

Gain (loss) on disposition, net of tax .............................. $76 $75 $(1)

Income (loss) from operations, net of tax ........................... (2) 5 11

For the year ended December 31, 2009, the $76 million (net of tax) gain on dispositions includes the gains from

the sale of the Company’s Bliss spa business, other non-core assets and three hotels. The operations from the Bliss

spa business, and the revenues and expenses from two hotels which are in the process of being sold, are included in

discontinued operations, resulting in a loss of $2 million, net of tax.

The assets sold in 2009 and the two hotels recorded in assets held for sale at December 31, 2009 were

reclassified in the December 31, 2008 balance sheet as assets held for sale in order to segregate the discontinued

operations assets from continuing operations assets. The impact of the current assets and liabilities related to the

discontinued operations were not reclassified as the change was inconsequential.

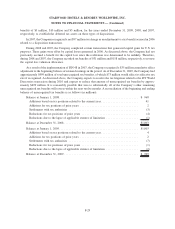

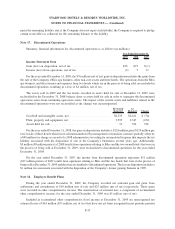

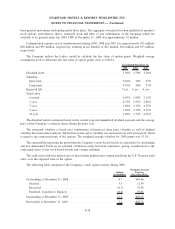

Previously

Reported

As

Restated Change

Goodwill and intangible assets, net.......................... $2,235 $2,161 $ (74)

Plant, property and equipment, net .......................... 3,599 3,347 (252)

Assets held for sale ..................................... 10 336 326

For the year ended December 31, 2008, the gain on dispositions includes a $124 million gain ($129 million pre

tax) on sale of three hotels which were sold unencumbered by management or franchise contracts partially offset by

a $49 million tax charge as a result of a 2008 administrative tax ruling for an unrelated taxpayer that impacts the tax

liability associated with the disposition of one of the Company’s businesses several years ago. Additionally,

$5 million ($9 million pretax) of 2008 results from operations relating to Bliss and the two owned hotels that were in

the process of being sold at December 31, 2009, were reclassified to discontinued operations for the year ended

December 31, 2008.

For the year ended December 31, 2007, the income from discontinued operations represents $11 million

($17 million pretax) of 2007 results from operations relating to Bliss and the two hotels that were in the process of

being sold at December 31, 2009 and that were reclassified to discontinued operations. The loss on disposition includes a

$1 million tax assessment associated with the disposition of the Company’s former gaming business in 1999.

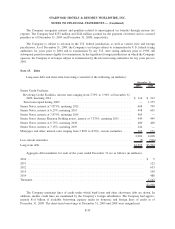

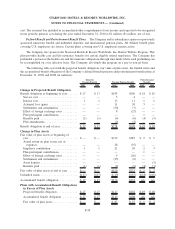

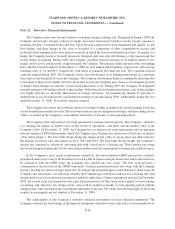

Note 18. Employee Benefit Plans

During the year ended December 31, 2009, the Company recorded net actuarial gain and gains from

settlements and curtailments of $10 million (net of tax) and $23 million (net of tax) respectively. These gains

were recorded in other comprehensive income. The amortization of actuarial loss, a component of accumulated

other comprehensive income, for the year ended December 31, 2009 was $5 million (net of tax).

Included in accumulated other comprehensive (loss) income at December 31, 2009 are unrecognized net

actuarial losses of $63 million ($53 million, net of tax) that have not yet been recognized in net periodic pension

F-33

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)