Starwood 2009 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

that we will be able to refinance our indebtedness as it becomes due and, if refinanced, on favorable terms. In

addition, there can be no assurance that in our continuing business we will generate cash flow at or above historical

levels, that currently anticipated results will be achieved or that we will be able to complete dispositions on

commercially reasonable terms or at all.

If we are unable to generate sufficient cash flow from operations in the future to service our debt, we may be

required to sell additional assets at lower than preferred amounts, reduce capital expenditures, refinance all or a

portion of our existing debt or obtain additional financing at unfavorable rates. Our ability to make scheduled

principal payments, to pay interest on or to refinance our indebtedness depends on our future performance and

financial results, which, to a certain extent, are subject to general conditions in or affecting the hotel and vacation

ownership industries and to general economic, political, financial, competitive, legislative and regulatory factors

beyond our control.

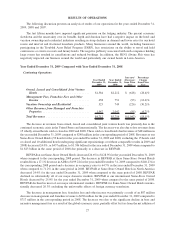

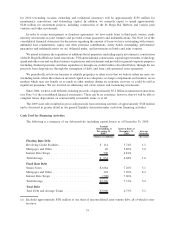

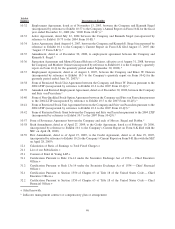

We had the following contractual obligations

(1)

outstanding as of December 31, 2009 (in millions):

Total

Due in Less

Than 1 Year

Due in

1-3 Years

Due in

3-5 Years

Due After

5 Years

Debt ............................ $2,957 $ 5 $ 774 $1,038 $1,140

Interest payable .................... 1,094 207 390 261 236

Capital lease obligations

(2)

............ 3 — 1 — 2

Operating lease obligations ............ 1,049 87 155 131 676

Unconditional purchase obligations

(3)

.... 308 86 136 80 6

Other long-term obligations ........... 4 1 3 — —

Total contractual obligations ........... $5,415 $386 $1,459 $1,510 $2,060

(1) The table below excludes unrecognized tax benefits that would require cash outlays for $499 million, the

timing of which is uncertain. Refer to Note 14 of the consolidated financial statements for additional discussion

on this matter. In addition, the table excludes amounts related to the construction of our St. Regis Bal Harbour

project that has a total project cost of $735 million, of which $353 million has been paid through December 31,

2009.

(2) Excludes sublease income of $3 million.

(3) Included in these balances are commitments that may be reimbursed or satisfied by our managed and franchised

properties.

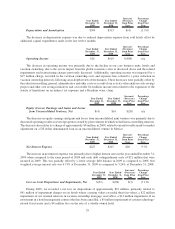

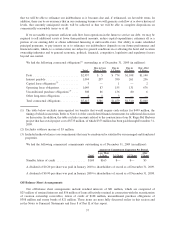

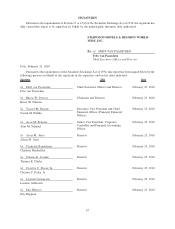

We had the following commercial commitments outstanding as of December 31, 2009 (in millions):

Total

Less Than

1 Year 1-3 Years 3-5 Years

After

5 Years

Amount of Commitment Expiration Per Period

Standby letters of credit .................. $168 $165 $— $— $3

A dividend of $0.20 per share was paid in January 2010 to shareholders of record as of December 31, 2009.

A dividend of $0.90 per share was paid in January 2009 to shareholders of record as of December 31, 2008.

Off-Balance Sheet Arrangements

Our off-balance sheet arrangements include residual interests of $81 million, which are comprised of

$25 million of retained interests and $56 million of loans effectively retained in connection with the securitization

of vacation ownership receivables, letters of credit of $168 million, unconditional purchase obligations of

$308 million and surety bonds of $21 million. These items are more fully discussed earlier in this section and

in the Notes to Financial Statements and Item 8 of Part II of this report.

37