Starwood 2009 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

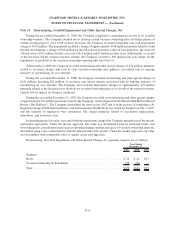

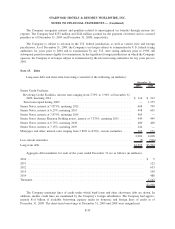

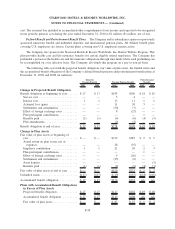

cost. The actuarial loss included in accumulated other comprehensive (loss) income and expected to be recognized

in net periodic pension cost during the year ended December 31, 2010 is $1 million ($1 million, net of tax).

Defined Benefit and Postretirement Benefit Plans. The Company and its subsidiaries sponsor or previously

sponsored numerous funded and unfunded domestic and international pension plans. All defined benefit plans

covering U.S. employees are frozen. Certain plans covering non-U.S. employees remain active.

The Company also sponsors the Starwood Hotels & Resorts Worldwide, Inc. Retiree Welfare Program. This

plan provides health care and life insurance benefits for certain eligible retired employees. The Company has

prefunded a portion of the health care and life insurance obligations through trust funds where such prefunding can

be accomplished on a tax effective basis. The Company also funds this program on a pay-as-you-go basis.

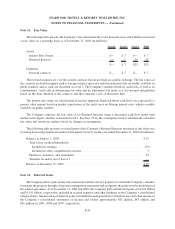

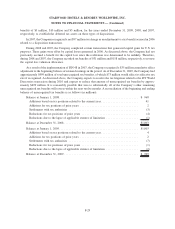

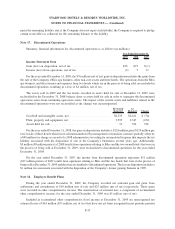

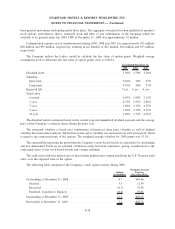

The following table sets forth the projected benefit obligation, fair value of plan assets, the funded status and

the accumulated benefit obligation of the Company’s defined benefit pension and postretirement benefit plans at

December 31, 2009 and 2008 (in millions):

2009 2008 2009 2008 2009 2008

Domestic

Pension Benefits Foreign Pension Benefits

Postretirement

Benefits

Change in Projected Benefit Obligation

Benefit obligation at beginning of year ...... $17 $17 $199 $206 $ 18 $ 20

Service cost ........................ — — 5 4 — —

Interest cost ........................ 1 1 13 11 1 1

Actuarial loss (gain) .................. — — 11 20 3 —

Settlements and curtailments ............ — — (50) (7) — —

Effect of foreign exchange rates ......... — — 8 (27) — —

Plan participant contributions ........... — — — — 1 —

Benefits paid ....................... (1) (1) (6) (6) (4) (3)

Plan amendments .................... — — (2) (2) — —

Benefit obligation at end of year ........... $17 $17 $178 $199 $ 19 $ 18

Change in Plan Assets

Fair value of plan assets at beginning of

year .............................. $— $— $132 $185 $ 2 $ 5

Actual return on plan assets, net of

expenses ......................... — — 28 (35) — —

Employer contribution ................ 1 1 21 20 2 3

Plan participant contributions ........... — — — — 1 —

Effect of foreign exchange rates ......... — — 9 (26) — —

Settlements and curtailments ............ — — (25) (6) — —

Asset transfer ....................... — — — — — (3)

Benefits paid ....................... (1) (1) (6) (6) (4) (3)

Fair value of plan assets at end of year ...... $— $— $159 $132 $ 1 $ 2

Unfunded status ....................... $(17) $(17) $ (19) $ (67) $(18) $(16)

Accumulated benefit obligation ............ $17 $17 $176 $174 n/a n/a

Plans with Accumulated Benefit Obligations

in Excess of Plan Assets

Projected benefit obligation ............. $17 $17 $117 $132 $ 19 $ 18

Accumulated benefit obligation .......... $17 $17 $115 $108 n/a n/a

Fair value of plan assets ............... $— $— $ 87 $ 57 $ 1 $ 2

F-34

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)