Starwood 2009 Annual Report Download - page 136

Download and view the complete annual report

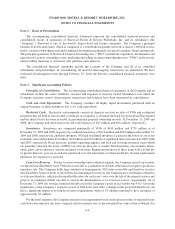

Please find page 136 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.campaign will not take place, all costs are expensed at that time. During the years ended December 31, 2009, 2008

and 2007, the Company incurred approximately $118 million, $146 million and $116 million of advertising

expense, respectively, a significant portion of which was reimbursed by managed and franchised hotels.

Retained Interests. The Company periodically sells notes receivable originated by its vacation ownership

business in connection with the sale of VOIs. The Company retains interests in the assets transferred to qualified and

non-qualified special purpose entities which are accounted for as over-collateralizations and interest only strips.

These retained interests are treated as “available-for-sale” transactions under the provisions of ASC 320 Invest-

ments — Debt and Equity Securities. The Company reports changes in the fair values of these Retained Interests

considered temporary through the accompanying consolidated statement of comprehensive income. A change in

fair value determined to be other-than-temporary is recorded as a loss in the Company’s consolidated statement of

income. The Company had Retained Interests of $25 million and $19 million at December 31, 2009 and 2008,

respectively. Additionally, as of December 31, 2009, the Company had $56 million of notes retained after the 2009

note sales.

Use of Estimates. The preparation of financial statements in conformity with accounting principles gen-

erally accepted in the United States requires management to make estimates and assumptions that affect the

reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the

financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results

could differ from those estimates.

Reclassifications. Certain reclassifications have been made to the prior years’ financial statements to

conform to the current year presentation (see Note 17).

Impact of Recently Issued Accounting Standards.

Adopted Accounting Standards

In August 2009, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update

(“ASU”) 2009-05, which supplements the guidance included in the FASB Accounting Standards Codification

(“Codification”), ASC 820, Fair Value Measurements. This ASU clarifies how an entity should measure the fair

value of liabilities and that the restrictions on the transfer of a liability should not be included in its fair value

measurement. The effective date of this ASU is the first reporting period after August 26, 2009. The Company

adopted this topic on September 30, 2009 and it had no effect on the Company’s consolidated financial statements.

In June 2009, the FASB issued Statement of Financial Accounting Standards (“SFAS”) No. 168, “The FASB

Accounting Standards Codification

TM

and the Hierarchy of Generally Accepted Accounting Principles a Replace-

ment of FASB Statement No. 162” (“SFAS No. 168”), included in the Codification as ASC 105, Generally Accepted

Accounting Principles. This topic is the source of authoritative accounting principles recognized by the FASB to be

applied by non-governmental entities in the preparation of financial statements in accordance with generally

accepted accounting principles. This topic is effective for interim and annual reporting periods ending after

September 15, 2009. The Company adopted this topic on September 30, 2009 and it had no effect on the Company’s

consolidated financial statements.

In May 2009, the FASB issued SFAS No. 165, “Subsequent Events” (“SFAS No. 165”), included in the

Codification as ASC 855, Subsequent Events. This topic establishes the period in which management of a reporting

entity should evaluate events and transactions for recognition or disclosure in the financial statements. It also

describes the circumstances under which an entity should recognize events or transactions that occur after the

balance sheet date. This topic is effective for interim and annual reporting periods ending after June 15, 2009. On

June 30, 2009, the Company adopted this topic, which did not have a material effect on its consolidated financial

statements.

F-13

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)