Starwood 2009 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

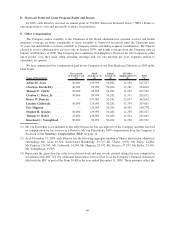

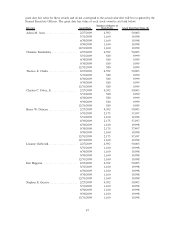

Executive Officer for each such event, calculated prior to the deduction of any applicable withholding taxes and

brokerage commissions.

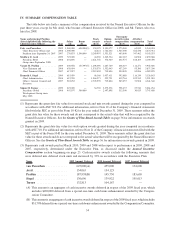

Name

Number of Shares

Acquired on

Vesting

(#)

Value Realized

on Vesting

($)

Number of Shares

Acquired on

Exercise

(#)

Value Realized

on Exercise

($)

Option Awards Stock Awards

van Paasschen............. — — — —

Avril .................... — — 23,962 348,749

Prabhu .................. — — 32,681 489,300

Siegel ................... — — 34,005 510,240

Turner .................. — — — —

IX. NONQUALIFIED DEFERRED COMPENSATION

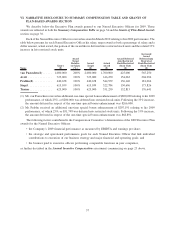

The Company’s Deferred Compensation Plan (the “Plan”) permits eligible executives, including our Named

Executive Officers, to defer up to 100% of their Executive Plan bonus, as applicable, and up to 75% of their base

salary for a calendar year. The Company does not contribute to the Plan.

Name

Executive

Contributions in

Last FY

($)

Registrant

Contributions

in Last FY

($)

Aggregate

Earnings

in Last FY

($)

Aggregate

Withdrawals/

Distributions

($)

Aggregate

Balance at

Last FYE

($)

van Paasschen .......... — — 130,418 — 501,732

Avril .................. — — — — —

Prabhu ................ — — — — —

Siegel ................. — — — — —

Turner ................ — — — — —

Deferral elections are made in December for base salary paid in pay periods beginning in the following

calendar year. Deferral elections are made in June for annual incentive awards that are earned for performance in

that calendar year but paid in March of the following year. Deferral elections are irrevocable.

Elections as to the time and form of payment are made at the same time as the corresponding deferral election.

A participant may elect to receive payment on February 1 of a calendar year while still employed or either 6 or

12 months following employment termination. Payment will be made immediately in the event a participant

terminates employment on account of death, disability or on account of certain changes in control. A participant

may elect to receive payment of his account balance in either a lump sum or in annual installments, so long as the

account balance exceeds $50,000; otherwise payment will be made in a lump sum.

If a participant elects an in-service distribution, the participant may change the scheduled distribution date or

form of payment so long as the change is made at least 12 months in advance of the scheduled distribution date. Any

such change must provide that distribution will commence at least five years later than the scheduled distribution

date. If a participant elects to receive a distribution upon employment termination, that election and the corre-

sponding form of payment election are irrevocable. Withdrawals for hardship that result from an unforeseeable

emergency are available, but no other unscheduled withdrawals are permitted.

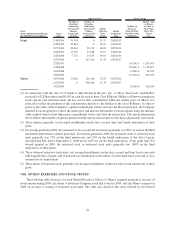

The Plan uses the investment funds listed below as potential indices for calculating investment returns on a

participant’s Plan account balance. The deferrals the participant directs for investment into these funds are adjusted

based on a deemed investment in the applicable funds. The participant does not actually own the investments that he

40