Starwood 2009 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

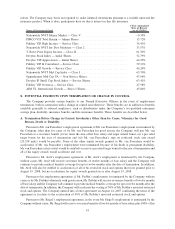

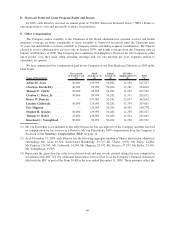

D. Starwood Preferred Guest Program Points and Rooms

In 2009, each Director received an annual grant of 750,000 Starwood Preferred Guest (“SPG”) Points to

encourage them to visit and personally evaluate our properties.

E. Other Compensation

The Company makes available to the Chairman of the Board administrative assistant services and health

insurance coverage on terms comparable to those available to Starwood executives until the Chairman turns

70 years old and thereafter on terms available to Company retirees (including required contributions). Mr. Duncan

elected to receive administrative services only in January 2009, and health coverage from the Company only in

January and February of 2009. The Company also reimburses Non-Employee Directors for travel expenses, other

out-of-pocket costs they incur when attending meetings and, for one meeting per year, expenses related to

attendance by spouses.

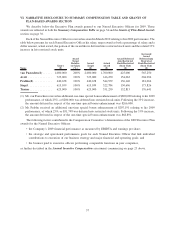

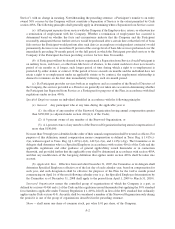

We have summarized the compensation paid by the Company to our Non-Employee Directors in 2009 in the

table below.

Name of Director(1)

Fees earned

or Paid in Cash

($)

Stock

Awards (2) (3)

($)

Option

Awards (4)

($)

All Other

compensation (5)

($)

Total

($)

Adam M. Aron ............ 20,000 129,995 50,282 11,250 211,527

Charlene Barshefsky........ 40,000 89,999 50,282 13,781 194,062

Thomas E. Clarke.......... 50,000 89,999 50,282 11,250 201,531

Clayton C. Daley, Jr. ....... 50,000 89,999 50,282 11,751 202,032

Bruce W. Duncan .......... — 279,983 50,282 32,697 362,962

Lizanne Galbreath ......... 10,000 129,995 50,282 13,374 203,651

Eric Hippeau ............. — 129,995 50,282 18,501 198,778

Stephen R. Quazzo ......... 10,000 129,995 50,282 11,250 201,527

Thomas O. Ryder .......... 25,000 129,995 50,282 16,324 221,601

Kneeland C. Youngblood .... 50,000 89,999 50,282 11,250 201,531

(1) Mr. van Paasschen is not included in this table because he was an employee of the Company and thus received

no compensation for his services as a Director. Mr. van Paasschen’s 2009 compensation from the Company is

disclosed in the Summary Compensation Table on page 34.

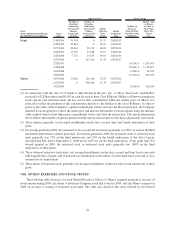

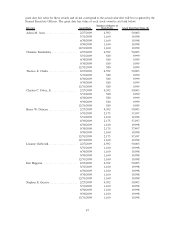

(2) As of December 31, 2009, each Director has the following aggregate number of Shares (deferred or otherwise)

outstanding: Mr. Aron, 43,324; Ambassador Barshefsky, 19,719; Mr. Clarke, 9,050; Mr. Daley, 12,884;

Mr. Duncan, 214,591; Ms. Galbreath, 14,568; Mr. Hippeau, 28,392; Mr. Quazzo, 37,297; Mr. Ryder, 23,141;

Mr. Youngblood, 13,965.

(3) Represents the grant date fair value for restricted stock and unit awards granted during the year computed in

accordance with ASC 718. For additional information, refer to Note 21 of the Company’s financial statements

filed with the SEC as part of the Form 10-K for the year ended December 31, 2009. These amounts reflect the

46