Starwood 2009 Annual Report Download - page 154

Download and view the complete annual report

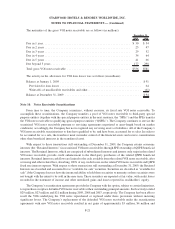

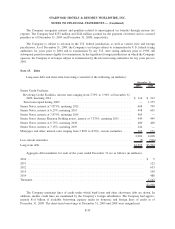

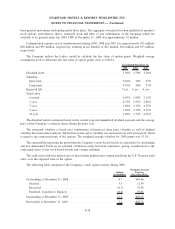

Please find page 154 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company is subject to certain restrictive debt covenants under its short-term borrowing and long-term debt

obligations including defined financial covenants, limitations on incurring additional debt ability to pay dividends,

escrow account funding requirements for debt service, capital expenditures, tax payments and insurance premiums,

among other restrictions. The Company was in compliance with all of the short-term and long-term debt covenants

at December 31, 2009.

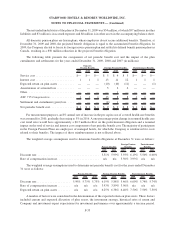

During 2009, the Company reduced debt by over $1 billion. The Company issued new debt of $750 million and

prepaid debt of $1.675 billion including term loans maturing in 2009, 2010, and 2011 totaling $1.375 billion.

Additional sources of cash generated to pay down debt were proceeds from asset sales, securitizations and a co-

branding arrangement, as described in Notes 5, 10 and 16.

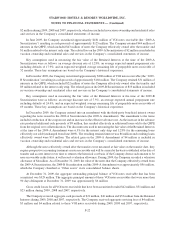

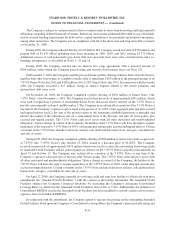

During 2009, the Company entered into six interest rate swap agreements with a notional amount of

$500 million, under which the Company pays floating and receives fixed interest rates (see Note 22).

On December 7, 2009, the Company used the proceeds from a public offering of Senior Notes described below,

together with other borrowings, to complete a tender offer to repurchase $195 million of the principal amount of its

7.875% Senior Notes due 2012 and $105 million of its 6.25% Senior Notes due 2013. In connection with this tender

offer, the Company recorded a $17 million charge to interest expense related to the tender premium and

unamortized debt issue costs.

On November 24, 2009,the Company completed a public offering of $250 million of Senior Notes (“the

7.15% Notes”) due December 1, 2019. The Company received net proceeds of approximately $241 million, which

were used to repurchase a portion of outstanding Senior Notes (discussed above). Interest on the 7.15% Notes is

payable semi-annually on June 1 and December 1. The Company may redeem all or a portion of the 7.15% Notes at

any time at the Company’s option at a price equal to the greater of (1) 100% of the aggregate principal plus accrued

and unpaid interest and (2) the sum of the present values of the remaining scheduled payments of principal and

interest discounted at the redemption rate on a semi-annual basis at the Treasury rate plus 50 basis points, plus

accrued and unpaid interest. The 7.15% Notes rank parri passu with all other unsecured and unsubordinated

obligations. Upon a change in control of the Company, the holders of the 7.15% Notes will have the right to require

repurchase of the respective 7.15% Notes at 101% of the principal amount plus accrued and unpaid interest. Certain

covenants on the 7.15% Notes include restrictions on liens, sale and leaseback transactions, mergers, consolidations

and sale of assets.

On April 30, 2009, the Company completed a public offering of $500 million of senior notes with a coupon rate

of 7.875% (the “7.875% Notes”) due October 15, 2014, issued at a discount price of 96.285%. The Company

received net proceeds of approximately $475 million which were used to reduce the outstanding borrowings under

its Amended Credit Facilities and for general purposes. Interest on the 7.875% Notes is payable semi-annually on

April 15 and October 15. The Company may redeem all or a portion of the 7.875% Notes at any time at the

Company’s option at a discount rate of Treasury plus 50 basis points. The 7.875% Notes will rank parri passu with

all other unsecured and unsubordinated obligations. Upon a change in control of the Company, the holders of the

7.875% Notes will have the right to require repurchase of the 7.875% Notes at 101% of the principal amount plus

accrued and unpaid interest. Certain covenants on the 7.875% Notes include restrictions on liens, sale and leaseback

transactions, mergers, consolidations and sale of assets.

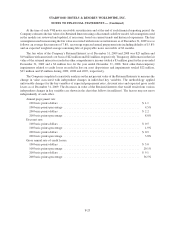

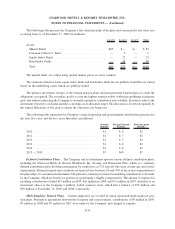

On April 27, 2009, the Company amended its revolving credit and term loan facilities (collectively with prior

amendments the “Amended Credit Facilities”) with the consent of the lenders thereunder. The Amended Credit

Facilities enhance the Company’s financial flexibility by increasing the Company’s maximum Consolidated

Leverage Ratio (as defined in the Amended Credit Facilities) from 4.50x to 5.50x. Additionally, the definition of

Consolidated EBITDA used in the Amended Credit Facilities has been modified to exclude certain cash severance

expenses from Consolidated EBITDA.

In connection with the amendment, the Company agreed to increase the pricing on the outstanding Amended

Credit Facilities based upon the Company’s Consolidated Leverage Ratio, the Company’s unsecured debt rating and

F-31

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)