Starwood 2009 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

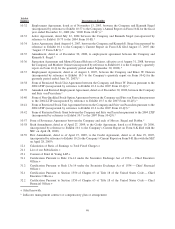

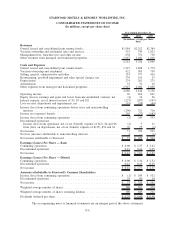

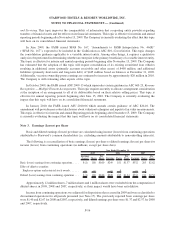

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

2009 2008 2007

Year Ended December 31,

(In millions)

Operating Activities

Net income .................................................................... $ 71 $329 $ 543

Adjustments to net income:

Discontinued operations:

(Gain) loss on dispositions, net ..................................................... (76) (75) 1

Depreciation and amortization ..................................................... 8 10 9

Other adjustments relating to discontinued operations . ....................................... — — —

Stock-based compensation expense . . . ................................................. 53 68 99

Excess stock-based compensation tax benefit (expense) . ....................................... — (16) (46)

Depreciation and amortization . ...................................................... 309 313 297

Amortization of deferred loan costs . . . ................................................. 10 5 4

Non-cash portion of restructuring, goodwill impairment and other special charges (credits), net ................ 332 74 48

Non-cash foreign currency (gains) losses, net . . ............................................ (6) (5) 11

Amortization of deferred gains . ...................................................... (82) (83) (81)

Provision for doubtful accounts ...................................................... 72 64 43

Distributions in excess (deficit) of equity earnings ........................................... 30 21 10

Gain on sale of VOI notes receivable . . ................................................. (24) (4) (2)

Loss (gain) on asset dispositions and impairments, net . ....................................... 91 98 44

Non-cash portion of income tax expense (benefit) ........................................... (260) 24 (142)

Changes in working capital:

Restricted cash . ............................................................... 46 102 134

Accounts receivable . . . .......................................................... 63 34 (34)

Inventories ................................................................... (98) (280) (143)

Prepaid expenses and other . . . ...................................................... 10 2 (2)

Accounts payable and accrued expenses ................................................. (44) 85 177

Accrued income taxes . . .......................................................... (50) (22) 210

VOI notes receivable activity, net. ...................................................... 167 (150) (209)

Other, net . .................................................................... (51) 52 (87)

Cash (used for) from operating activities ................................................. 571 646 884

Investing Activities

Purchases of plant, property and equipment ................................................ (196) (476) (384)

Proceeds from asset sales, net . . . ...................................................... 310 320 133

Issuance of notes receivable .......................................................... (4) (2) (10)

Collection of notes receivable, net ...................................................... 2 5 55

Acquisitions, net of acquired cash ...................................................... — — (74)

Purchases of investments . . .......................................................... (5) (37) (49)

Proceeds from investments. .......................................................... 35 39 112

Other, net . .................................................................... (26) (21) 2

Cash (used for) from investing activities ................................................. 116 (172) (215)

Financing Activities

Revolving credit facility and short-term borrowings (repayments), net . . . .............................. (102) (570) 341

Long-term debt issued . . . .......................................................... 726 986 1,400

Long-term debt repaid . . . .......................................................... (1,681) (4) (799)

Dividends paid . . . ............................................................... (165) (172) (90)

Proceeds from stock option exercises . . . ................................................. 2 120 190

Excess stock-based compensation tax benefit (expense) . . ....................................... — 16 46

Share repurchases . ............................................................... — (593) (1,787)

Other, net . .................................................................... 227 (26) (13)

Cash (used for) from financing activities ................................................. (993) (243) (712)

Exchange rate effect on cash and cash equivalents ............................................ 4 7 11

Increase (decrease) in cash and cash equivalents . . ............................................ (302) 238 (32)

Cash and cash equivalents — beginning of period . ............................................ 389 151 183

Cash and cash equivalents — end of period................................................. $ 87 $389 $ 151

Supplemental Disclosures of Cash Flow Information

Cash paid (received) during the period for:

Interest . .................................................................... $ 203 $186 $ 164

Income taxes, net of refunds . . ...................................................... $ 12 $ 58 $ 128

The accompanying notes to financial statements are an integral part of the above statements

F-7