Starwood 2009 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

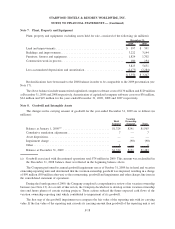

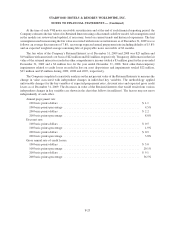

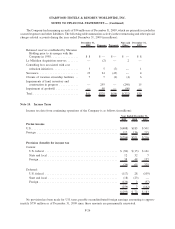

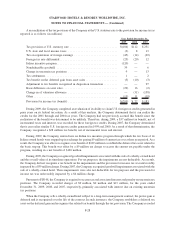

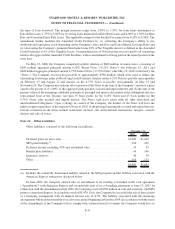

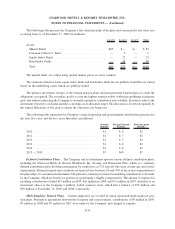

A reconciliation of the tax provision of the Company at the U.S. statutory rate to the provision for income tax as

reported is as follows (in millions):

2009 2008 2007

Year Ended December 31,

Tax provision at U.S. statutory rate .............................. $(104) $112 $ 251

U.S. state and local income taxes ............................... (3) 8 13

Tax on repatriation of foreign earnings ........................... (45) (14) (29)

Foreign tax rate differential . . .................................. (25) (20) 12

Italian incentive program...................................... (120) — —

Nondeductible goodwill ...................................... 39 — 6

Change in uncertain tax positions ............................... 9 — 13

Tax settlements ............................................. 1 — 2

Tax benefit on the deferred gain from asset sales .................... (3) (10) (3)

Adjustment to tax benefits recognized in disposition transaction ......... — — 97

Basis difference on asset sales .................................. (29) 16 (2)

Change in of valuation allowance ............................... — (31) (158)

Other .................................................... (13) 11 (19)

Provision for income tax (benefit) ............................... $(293) $ 72 $ 183

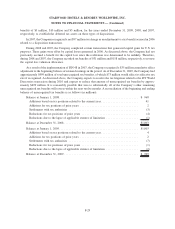

During 2009, the Company completed an evaluation of its ability to claim U.S. foreign tax credits generated in

prior years on its federal tax return. As a result of this analysis, the Company determined that it can realize the

credits for the 2001 through and 2004 tax years. The Company had not previously accrued this benefit since the

realization of the benefit was determined to be unlikely. Therefore, during 2009, a $37 million tax benefit, net of

incremental taxes and interest, was recorded for these foreign tax credits. During 2007, the Company determined

that it can realize similar U.S. foreign tax credits generated in 1999 and 2000. As a result of that determination, the

Company recognized a $28 million tax benefit, net of incremental taxes and interest.

During 2009, the Company entered into an Italian tax incentive program through which the tax basis of its

Italian owned hotels were stepped up in exchange for paying $9 million of current tax over a three year period. As a

result, the Company was able to recognize a tax benefit of $129 million to establish the deferred tax asset related to

the basis step up. This benefit was offset by a $9 million tax charge to accrue the current tax payable under the

program, resulting in a net benefit of $120 million.

During 2009, the Company recognized goodwill impairments associated with the sale of a wholly-owned hotel

and the overall value of its timeshare operations. For tax purposes, the impairments are not deductible. As a result,

the Company did not recognize a tax benefit on the impairments and the provision for income tax was unfavorably

impacted by a $39 million charge. During 2007, the Company recognized goodwill impairments associated with the

sale of a wholly-owned hotel. These impairments were also not deductible for tax purposes and the provision for

income tax was unfavorably impacted by a $6 million charge.

Pursuant to FIN 48, the Company is required to accrue tax and associated interest and penalty on uncertain tax

positions. The Company recorded charges of $9 million, $0 million and $13 million, for the years ended

December 31, 2009, 2008, and 2007, respectively, primarily associated with interest due on existing uncertain

tax positions.

When the Company sells a wholly-owned hotel subject to a long-term management contract, the pretax gain is

deferred and is recognized over the life of the contract. In such instances, the Company establishes a deferred tax

asset on the deferred gain and recognizes the related tax benefit through the tax provision. The Company recorded

F-28

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)