Starwood 2009 Annual Report Download - page 111

Download and view the complete annual report

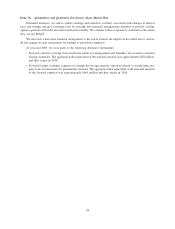

Please find page 111 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Due to the current credit liquidity crisis, we evaluated the commitments of each of the lenders in our Revolving

Credit Facilities (the “Facilities”). In addition, we have reviewed our debt covenants and restrictions and do not

anticipate any issues regarding the availability of funds under the Facilities.

See Note 15 of the consolidated financial statements for specifics related to our financing transactions,

issuances, and terms entered into for the years ended December 31, 2009 and 2008.

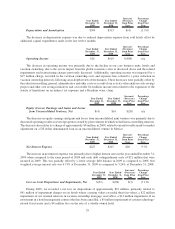

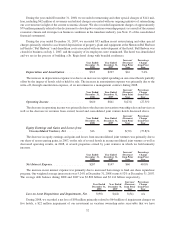

During 2009, we completed a series of dispositions and financing transactions that resulted in proceeds of

approximately $1.6 billion as outlined below:

On May 7, 2009, we completed a public offering of $500 million of 7.875% Senior Notes due 2014.

On June 5, 2009, we sold approximately $181 million of vacation ownership notes receivable realizing cash

proceeds of $125 million. We amended this transaction in the fourth quarter of 2009, which resulted in additional

proceeds of $9 million.

In June 2009, we entered into a multi-year extension and amendment to our existing co-branded credit card

agreement (“Amendment”) with American Express. In connection with the Amendment, we received $250 million

in cash in July 2009 and, in return, sold SPG points to American Express to be used by American Express in the

future. In accordance with the terms of the Amendment, if we fail to comply with certain financial covenants, we are

required to repay the remaining liability and, if we do not repay such liability, we are required to pledge certain

receivables as collateral for the remaining balance of the liability.

During 2009, we sold four non-core assets for cash proceeds of approximately $227 million and four wholly-

owned hotels for approximately $100 million.

In November 2009, we completed a public offering of $250 million of 7.150% Senior Notes due 2019.

On December 7, 2009, we sold approximately $200 million of vacation ownership notes receivables, realizing

cash proceeds of $166 million. We recorded a gain on the sale of these receivables of approximately $19 million.

The cash proceeds from the multiple transactions noted above were used to reduce indebtedness, resulting in

gross debt reduction of approximately $1.0 billion, from approximately $4.0 billion at December 31, 2008 to

approximately $3.0 billion at December 31, 2009. We repaid a $500 million term loan that was due in 2009, prepaid

$875 million of term loans due in 2010 and 2011 and completed a tender offer in which we purchased $195 million

of our 7.875% Senior Notes due 2012 and $105 million of our 6.25% Senior Notes due 2013. Excluding revolver

draws and scheduled mortgage amortization, we prepaid all 2010 and 2011 maturities and reduced maturities in

2012 and 2013 by $300 million.

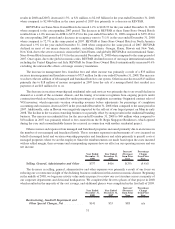

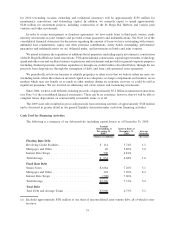

Our Facilities are used to fund general corporate cash needs. As of December 31, 2009, we have availability of

over $1.6 billion under the Facilities. We have reviewed the financial covenants associated with our Facilities, the

most restrictive being the leverage ratio. As of December 31, 2009, we were in compliance with this covenant and

expect to remain in compliance through the end of 2010. We have the ability to manage the business in order to

reduce our leverage ratio by reducing operating costs, selling, general and administrative costs and postponing

discretionary capital expenditures. However, there can be no assurance that we will stay below the required leverage

ratio if the current economic climate deteriorates.

Our current credit ratings and outlook are as follows: S&P BB (stable outlook); Moody’s Ba1 (stable outlook);

and; Fitch BB+ (negative outlook). The impact of the ratings could impact our current and future borrowing costs,

which cannot be currently estimated.

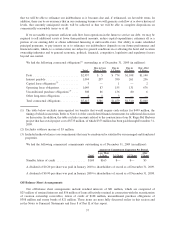

Based upon the current level of operations, management believes that our cash flow from operations and asset

sales, together with our significant cash balances (approximately $141 million at December 31, 2009, including

$54 million of short-term and long-term restricted cash), available borrowings under the Facilities and other bank

credit facilities (approximately $1.6 billion at December 31, 2009, our expected income tax refund of over

$200 million in 2010 (see Note 14 of the consolidated financial statements), and capacity for additional borrowings

will be adequate to meet anticipated requirements for scheduled maturities, dividends, working capital, capital

expenditures, marketing and advertising program expenditures, other discretionary investments, interest and

scheduled principal payments and share repurchases for the foreseeable future. However, there can be no assurance

36