Starwood 2009 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AUDIT COMMITTEE REPORT

The information contained in this Audit Committee Report shall not be deemed to be “soliciting material” or

“filed” or “incorporated by reference” in future filings with the SEC, or subject to the liabilities of Section 18 of the

Exchange Act, except to the extent that the Company specifically incorporates it by reference into a document filed

under the Securities Act of 1933, as amended, or the Exchange Act.

The Audit Committee (the “Audit Committee”) of the Board of Directors (the “Board”) of Starwood Hotels &

Resorts Worldwide, Inc. (the “Company”), which is comprised entirely of “independent” Directors, as determined by

the Board in accordance with the New York Stock Exchange (the “NYSE”) listing requirements and applicable federal

securities laws, serves as an independent and objective party to assist the Board in fulfilling its oversight respon-

sibilities including, but not limited to, (i) monitoring the quality and integrity of the Company’s financial statements,

(ii) monitoring compliance with legal and regulatory requirements, (iii) assessing the qualifications and independence

of the independent registered public accounting firm and (iv) establishing and monitoring the Company’s systems of

internal controls regarding finance, accounting and legal compliance. The Audit Committee operates under a written

charter which meets the requirements of applicable federal securities laws and the NYSE requirements.

In the first quarter of 2010, the Audit Committee reviewed and discussed the audited financial statements for

the year ended December 31, 2009 with management, the Company’s internal auditors and the independent

registered public accounting firm, Ernst & Young LLP. The Audit Committee also discussed with the independent

registered public accounting firm matters relating to its independence, including a review of audit and non-audit

fees and the written disclosures and letter from Ernst & Young LLP to the Audit Committee pursuant to Rule 3526

of the Public Company Accounting Oversight Board regarding the independent accountants’ communications with

the Audit Committee concerning independence.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board that

the financial statements referred to above be included in the Company’s Annual Report on Form 10-K for the year

ended December 31, 2009.

Audit Committee of the Board of Directors

Thomas O. Ryder (chairman)

Adam M. Aron

Thomas E. Clarke

Clayton C. Daley, Jr.

Kneeland C. Youngblood

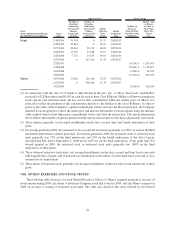

Audit Fees

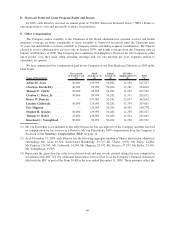

The aggregate amounts paid by the Company for the fiscal years ended December 31, 2009 and 2008 to the

Company’s principal accounting firm, Ernst & Young, are as follows (in millions):

2009 2008

Audit Fees(1) ........................................ $5.4 $4.9

Audit-Related Fees(2) .................................. $0.6 $0.9

Tax Fees(3) ......................................... $0.4 $0.4

Total .............................................. $6.4 $6.2

(1) Audit fees include the fees paid for the annual audit, the review of quarterly financial statements and assistance

with financial reports required as part of regulatory and statutory filings and the audit of the Company’s internal

controls over financial reporting with the objective of obtaining reasonable assurance about whether effective

internal controls over financial reporting were maintained in all material respects.

(2) Audit-related fees include fees for audits of employee benefit plans, audit and accounting consultation and

other attest services.

(3) Tax fees include fees for the preparation and review of certain foreign tax returns.

49