Starwood 2009 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2009 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

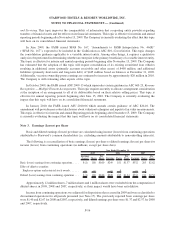

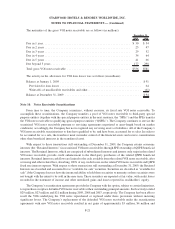

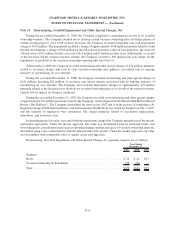

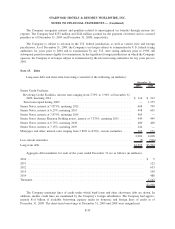

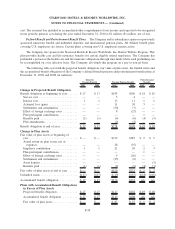

The Company had remaining accruals of $34 million as of December 31, 2009, which are primarily recorded in

accrued expenses and other liabilities. The following table summarizes activity in the restructuring and other special

charges related accounts during the year ended December 31, 2009 (in millions):

December 31,

2008 Expenses Payments

Non-cash

Other

December 31,

2009

Retained reserves established by Sheraton

Holding prior to its merger with the

Company in 1998 ................. $ 8 $ — $— $ — $ 8

Le Méridien Acquisition reserves ....... — (2) — 2 —

Consulting fees associated with cost

reduction initiatives................ 3 5 (7) — 1

Severance......................... 23 24 (43) — 4

Closure of vacation ownership facilities . . 7 7 (4) (4) 6

Impairments of land, inventory and

construction in progress ............ — 255 — (240) 15

Impairment of goodwill .............. — 90 — (90) —

Total ............................ $41 $379 $(54) $(332) $34

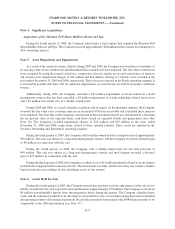

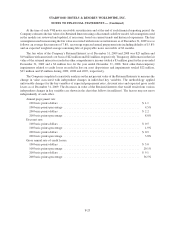

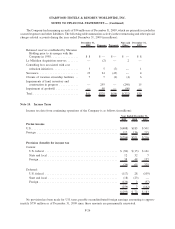

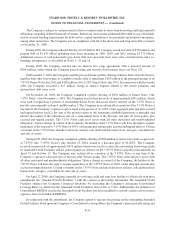

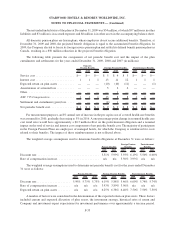

Note 14. Income Taxes

Income tax data from continuing operations of the Company is as follows (in millions):

2009 2008 2007

Year Ended December 31,

Pretax income

U.S. ..................................................... $(408) $185 $ 501

Foreign................................................... 112 136 215

$(296) $321 $ 716

Provision (benefit) for income tax

Current:

U.S. federal ............................................. $ (84) $ (15) $ 161

State and local ........................................... 12 32 7

Foreign ................................................. 38 48 157

(34) 65 325

Deferred:

U.S. federal ............................................. (117) 28 (105)

State and local ........................................... (18) (23) —

Foreign ................................................. (124) 2 (37)

(259) 7 (142)

$(293) $ 72 $ 183

No provision has been made for U.S. taxes payable on undistributed foreign earnings amounting to approx-

imately $759 million as of December 31, 2009 since these amounts are permanently reinvested.

F-26

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)