Samsung 2014 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2014 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Statements

(3) Interest rate risk

Risk of changes in interest rates for floating interest rate financial instruments is defined as the risk that the fair value of components of the statement of financial position, and

future cash flows of interest income (expenses) of a financial instrument, will fluctuate because of changes in market interest rates. The Group is exposed to interest rate risk

mainly through interest bearing liabilities and assets. The Group’s position with regard to interest rate risk exposure is mainly driven by its floating interest rate debt obligations

and interest-bearing deposits. The Group implemented policies and operates to minimize uncertainty arising from changes in interest rates and finance costs.

In order to avoid interest rate risk, the Group maintains minimum external borrowings by facilitating cash pooling systems on a regional and global basis. The Group manages

exposed interest rate risk via periodic monitoring and handles risk factors on a timely basis.

The sensitivity risk of the Group is determined based on the following assumptions:

- Changes in market interest rates that could impact the interest income and expenses of floating interest rate financial instruments

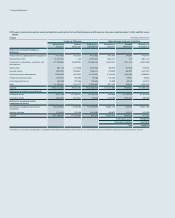

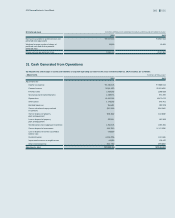

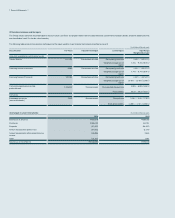

Based on the above assumption, changes to profit and net equity as a result of 1% increases in interest rates on borrowings are presented below:(In millions of Korean won)

2014 2013

Increase Decrease Increase Decrease

Financial assets ₩52,977 ₩(52,977)₩46,025 ₩(46,025)

Financial liabilities (30,722)30,722 (22,942)22,942

Net effect ₩22,255 ₩(22,255)₩23,083 ₩(23,083)

(B) Credit risk

Credit risk arises during the normal course of transactions and investing activities where clients or other parties fail to discharge an obligation. The Group monitors and sets the

client’s and counterparty’s credit limit on a periodic basis based on the client’s and counterparty’s financial conditions, default history and other important factors.

Credit risk can arise from transactions with financial institutions which include financial instrument transactions such as cash and cash equivalents, savings, and derivative in-

struments. To minimize such risk, the Group transacts only with banks which have strong international credit rating (S&P A and above), and all new transactions with financial

institutions with no prior transaction history are approved, managed and monitored by the Group’s finance team and the local finance center. The Group requires separate ap-

proval for contracts with restrictions.

Most of the Group’s trade receivable is adequately insured to manage any risk, therefore, the Group estimates its credit risk exposure to be limited. The Group estimates that its

maximum exposure to credit risk is the carrying value of its financial assets, net of impairment losses.