Samsung 2014 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2014 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Statements

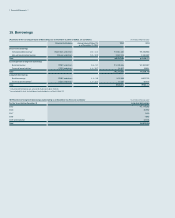

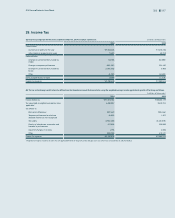

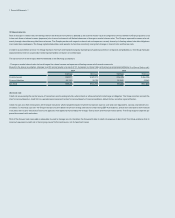

(C) Changes in deferred income tax assets and liabilities resulting from the tax effect of temporary differences for the years ended December 31, 2014 and 2013, are as

follows:

(1) 2014 (In millions of Korean won)

Temporary Differences Deferred Income Tax Assets (Liabilities)

Balance as at

January 1

Increase

(Decrease)

Balance as at

December 31

Balance as at

January 1

Increase

(Decrease)

Balance as at

December 31

Deferred tax arising from temporary

differences

Special reserves appropriated for tax purposes ₩(27,785)₩13,417 ₩(14,368)₩(6,724)₩3,247 ₩(3,477)

Revaluation of land (3,476,104)412 (3,475,692) (841,217)100 (841,117)

Investments in subsidiaries, associates and

joint ventures1

(27,819,662) (3,649,494) (31,469,156) (4,000,627) (241,471) (4,242,098)

Depreciation 834,746 1,774,306 2,609,052 135,376 507,818 643,194

Accrued income (303,790) (231,881) (535,671) (72,845) (59,392) (132,237)

Provisions and accrued expenses 12,345,693 (912,792)11,432,901 3,153,146 (194,336)2,958,810

Foreign currency translation (181,302)280,090 98,788 (44,025)69,541 25,516

Asset impairment losses 342,089 237,566 579,655 81,899 59,478 141,377

Other (4,185,045)1,951,177 (2,233,868) (877,479)338,305 (539,174)

Subtotal ₩(22,471,160)₩(537,199)₩(23,008,359)₩(2,472,496)₩483,290 ₩(1,989,206)

Deferred tax arising from carryforwards

Unused tax losses ₩107,228 ₩7,358,111 ₩7,465,339 ₩25,006 ₩1,792,553 ₩1,817,559

Unused tax credits 1,341,650 (602,202)739,448 1,312,192 (722,023)590,169

Deferred tax recognized in other

comprehensive income

Valuation of available-for-sale financial

instruments

₩(2,887,880)₩338,495 ₩(2,549,385)₩(664,172)₩53,434 ₩(610,738)

Actuarial valuation 1,718,454 922,439 2,640,893 408,879 212,121 621,000

Subtotal ₩(1,169,426)₩1,260,934 ₩91,508 ₩(255,293)₩265,555 ₩10,262

Deferred tax assets ₩4,526,595

Deferred tax liabilities (4,097,811)

Total ₩428,784

1 Deferred tax assets were not recognized if it is probable that the temporary differences will not reverse in the foreseeable future for investments in subsidiaries, associates and joint ventures.