Samsung 2014 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2014 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

087086

2014 Samsung Electronics Annual Report2014 Samsung Electronics Annual Report

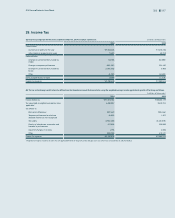

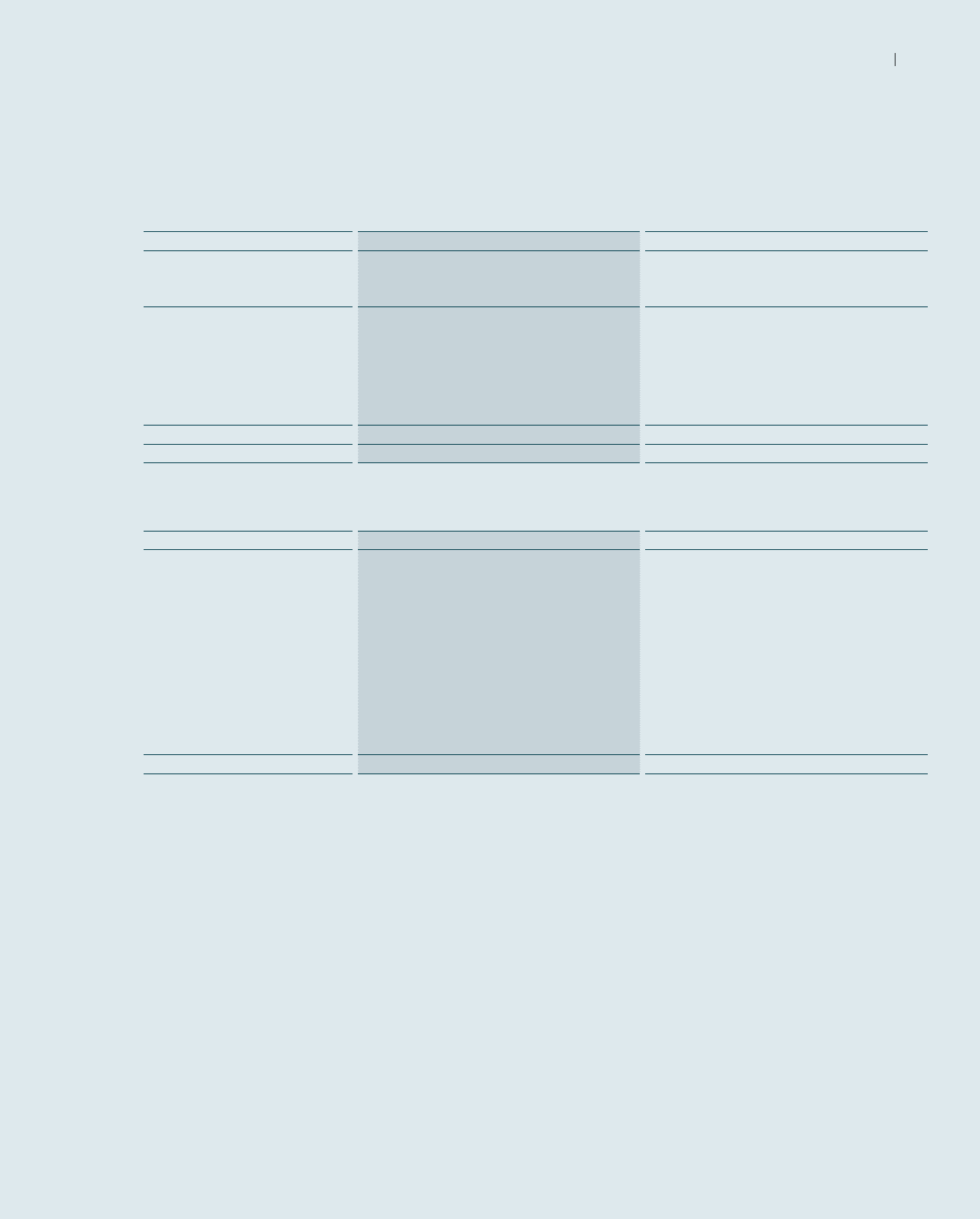

29. Income Tax

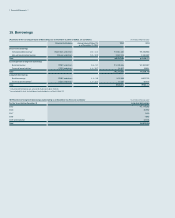

(A) Income tax expense for the years ended December 31, 2014 and 2013, consists of: (In millions of Korean won)

2014 2013

Current taxes:

Current tax on profits for the year ₩5,953,438 ₩7,406,736

Adjustments in respect to prior years 71,530 52,318

Deferred taxes:

Changes in carryforward of unused tax

credits

722,023 (52,085)

Changes in temporary differences (483,290)501,450

Changes in carryforward of unused tax

losses

(1,792,553)2,805

Other (3,430) (10,490)

Items charged directly to equity 12,958 (11,219)

Income tax expense ₩4,480,676 ₩7,889,515

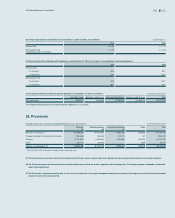

(B) The tax on the Group’s profit before tax differs from the theoretical amount that would arise using the weighted average tax rate applicable to profits of the Group as follows:

(In millions of Korean won)

2014 2013

Income before tax ₩27,875,034 ₩38,364,279

Tax calculated at weighted average tax rates

applicable1

6,880,857 9,576,241

Tax effects of:

Permanent differences (292,554) (335,146)

Temporary differences for which no

deferred income tax was recognized

(9,631)1,307

Tax credits (1,942,488) (2,156,519)

Results of subsidiaries, associates and

interests in joint ventures

201,835 318,359

Impact of changes in tax rates 1,756 5,526

Other (359,099)479,747

Income tax expense ₩4,480,676 ₩7,889,515

1 Weighted average of statutory tax rates that are applied differently for the profits of the Group at each tax authority as at December 31, 2014 and 2013.