Samsung 2014 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2014 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Statements

2.8 Trade Receivables

Trade receivables are amounts due from customers for merchandise sold or ser-

vices performed in the ordinary course of business. If collection is expected in one

year or less, they are classified as current assets. If collection is expected beyond

one year, they are presented as non-current assets. Trade receivables are recog-

nized initially at fair value and subsequently measured at amortized cost using the

effective interest method, less provision for impairment.

2.9 Inventories

Inventories are stated at the lower of cost and net realizable value. Cost is deter-

mined using the average cost method, except for materials in transit. The cost of

finished goods and work in progress comprises design costs, raw materials, direct

labor, other direct costs and related production overheads (based on normal oper-

ating capacity). It excludes costs of idle plant and abnormal waste. Net realizable

value is the estimated selling price in the ordinary course of business, less appli-

cable variable selling expenses.

Inventories are reduced for the estimated losses arising from excess, obsoles-

cence, and decline in value. This reduction is determined by estimating market

value based on future customer demand. The losses on inventory obsolescence

are recorded as a part of cost of sales.

2.10 Disposal Group Held-for-Sale

Non-current assets (or disposal group) are classified as assets held-for-sale when

their carrying amount is to be recovered principally through a sale transaction and

a sale is considered highly probable. The assets are measured at the lower of their

carrying amount and the fair value less costs to sell.

2.11 Property, Plant and Equipment

Property, plant and equipment are stated at cost less accumulated depreciation

and accumulated impairment losses. Historical cost includes expenditures that are

directly attributable to the acquisition of the items. Subsequent costs are included

in the asset’s carrying amount or recognized as a separate asset, as appropriate,

only when it is probable that future economic benefits associated with the item will

flow to the Group and the cost of the item can be measured reliably. The carrying

amount of those parts that are replaced is derecognized and repairs and mainte-

nance expenses are recognized in profit or loss in the period they are incurred.

Depreciation on tangible assets is calculated using the straight-line method to

allocate the difference between their cost and their residual values over their

estimated useful lives. Land is not depreciated. Costs that are directly attributable

to the acquisition, construction or production of a qualifying asset, including capi-

talized interest costs, form part of the cost of that asset and are amortized over the

estimated useful lives.

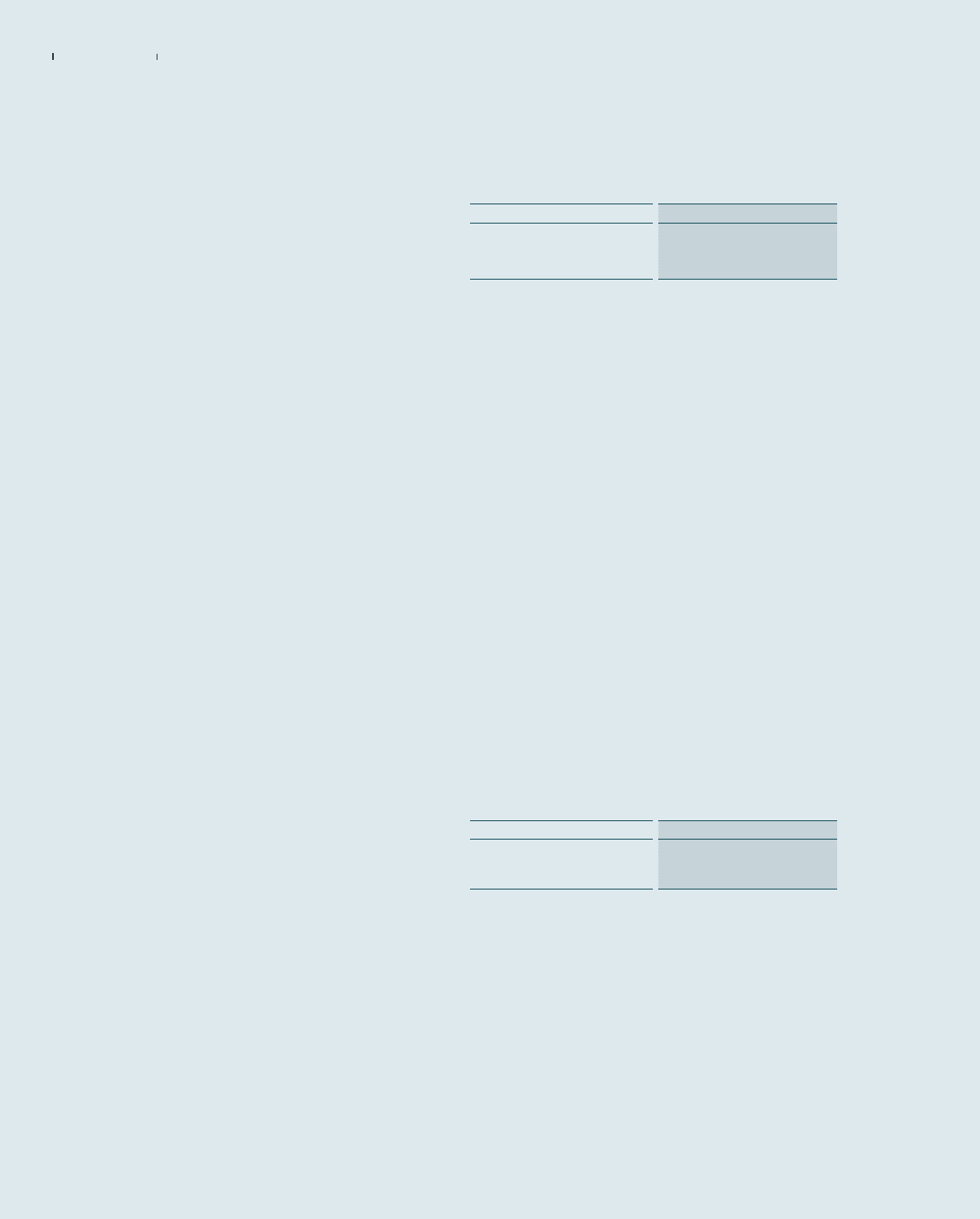

The Group’s policy is that property, plant and equipment should be depreciated

over the following estimated useful lives:

Estimated useful lives

Buildings and structures 15, 30 years

Machinery and equipment 5 years

Other 5 years

The depreciation method, residual values and useful lives of property, plant and

equipment are reviewed, and adjusted if appropriate, at the end of each reporting

period. An asset’s carrying amount is written down immediately to its recoverable

amount if the asset’s carrying amount is greater than its estimated recoverable

amount. Gains and losses on disposals are determined by comparing the pro-

ceeds with the carrying amount and are recognized within the statement of income

as part of other non-operating income and expenses.

2.12 Intangible Assets

Goodwill represents the excess of the cost of an acquisition over the fair value of

the Group’s share of the net identifiable assets of the acquired subsidiary, associ-

ates, joint ventures and businesses at the date of acquisition. Goodwill on acquisi-

tions of subsidiaries and businesses is included in intangible assets and goodwill

on acquisition of associates and joint ventures is included in the investments in

associates and joint ventures.

Intangible assets, except for goodwill, are initially recognized at their historical cost

and carried at cost less accumulated amortization and accumulated impairment

losses.

Internally generated development costs are the aggregate costs recognized after

meeting the asset recognition criteria, including technical feasibility, and deter-

mined to have future economic benefits. Membership rights are regarded as in-

tangible assets with an indefinite useful life and not amortized because there is no

foreseeable limit to the period over which the assets are expected to be utilized.

Intangible assets with definite useful lives such as trademarks and licenses, are

amortized using the straight-line method over their estimated useful lives.

The Group’s policy is that intangible assets should be amortized over the follow-

ing estimated useful lives:

Estimated useful lives

Development costs 2 years

Trademarks, licenses and other intangible

assets

5 - 10 years