Samsung 2014 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2014 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

083082

2014 Samsung Electronics Annual Report2014 Samsung Electronics Annual Report

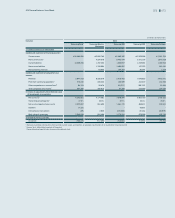

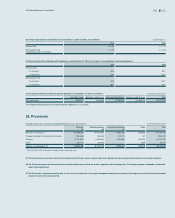

(D) Other commitments

As at December 31, 2014, the Group has a trade financing agreement, trade notes receivable discounting facilities, and loan facilities with accounts receivable pledged as collateral

with 15 financial institutions, including Woori Bank, with a combined limit of up to KRW 14,138,356 million.

In addition, the Group has a trade financing agreement with 21 financial institutions, including Korea Exchange Bank, for up to USD 5,073 million and KRW 103,000 million, and has

loan facilities with accounts receivable pledged as collateral with 5 financial institutions, including Industrial Bank of Korea, for up to KRW 263,559 million.

Samsung Display has a facility loan agreement with 3 financial institutions, including BTMU, for up to USD 200 million.

SEA, a foreign subsidiary, has a contract for issuing ABS (Asset Backed Securities) backed by accounts receivable with BTMU and other financial institutions for up to USD 700 million.

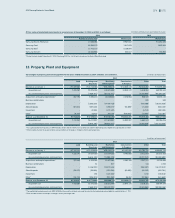

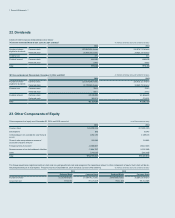

20. Share Capital

The Group’s total number of authorized shares is 500,000,000 shares (

KRW

5,000 per share). The Group has issued 147,299,337 shares of common stock and 22,833,427

shares of preferred stock as at December 31, 2014, excluding retired shares. Due to the retirement of shares, the total par value of the shares issued is

KRW

850,664 million

(common stock

KRW

736,497 million, preferred stock

KRW

114,167 million), which does not agree with paid-in capital of

KRW

897,514 million.

Changes in the number of shares outstanding for the years ended December 31, 2014 and 2013, are as follows: (In number of shares)

Preferred stock Common stock

Balance as at January 1, 2013 130,847,899 19,853,734

Disposal of treasury stock through exercise

of stock options

67,222 -

Balance as at December 31, 2013 130,915,121 19,853,734

Disposal of treasury stock through exercise

of stock options

47,530 -

Acquisition of treasury stock (758,055) (131,250)

Balance as at December 31, 2014 130,204,596 19,722,484

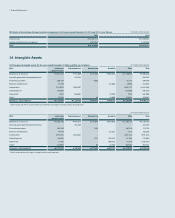

21. Retained Earnings

Retained earnings as at December 31, 2014 and 2013, consist of: (In millions of Korean won)

2014 2013

Appropriated ₩119,947,785 ₩104,175,235

Unappropriated 49,581,819 44,425,047

Total ₩169,529,604 ₩148,600,282