Samsung 2014 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2014 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

081080

2014 Samsung Electronics Annual Report2014 Samsung Electronics Annual Report

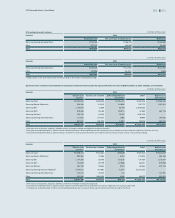

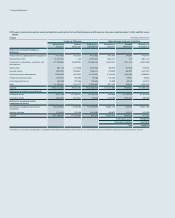

(H) The principal actuarial assumptions as at December 31, 2014 and 2013, are as follows: (In percentage, %)

2014 2013

Discount rate 1.2 - 6.5 1.0 - 7.0

Salary growth rate

(including the effects of inflation)

1.7 - 6.6 1.7 - 6.6

(I) The sensitivity of the defined benefit obligations as at December 31, 2014, to changes in the weighted principal assumptions is:

2014 2013

Discount rate:

1% increases 89% 90%

1% decreases 113% 112%

Salary growth rate:

1% increases 113% 112%

1% decreases 89% 90%

(J) The expected maturity analysis of pension benefits as at December 31, 2014, is as follows: (In millions of Korean won)

Less than 1 year Between 1 and 2 years Between 2 and 5 years Between 5 and 10 years Total

Pension benefits ₩350,687 ₩344,256 ₩1,390,932 ₩3,684,219 ₩5,770,094

The weighted average duration of the defined benefit obligations is 12.19 years.

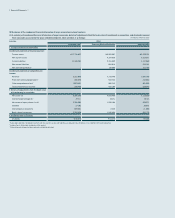

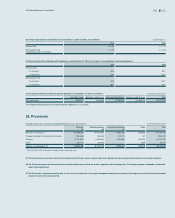

18. Provisions

Changes in provisions for the year ended December 31, 2014, are as follows: (In millions of Korean won)

Warranty

(A)

Royalty expenses

(B)

Long-term incentives

(C)

Other Total

Balance as at January 1 ₩1,945,992 ₩4,272,670 ₩921,848 ₩56,890 ₩7,197,400

Charged (credited) to the statement of income 2,261,665 956,350 217,075 (12)3,435,078

Payment (2,311,815) (1,444,681) (408,459) (45,750) (4,210,705)

Other1(66,774)133,453 - 2,348 69,027

Balance as at December 31 ₩1,829,068 ₩3,917,792 ₩730,464 ₩13,476 ₩6,490,800

1 Other includes effects of changes in foreign currency exchange rates.

(A) The Group accrues warranty reserves for estimated costs of future service, repairs and recalls, based on historical experience and terms of warranty programs.

(B) The Group recognizes provisions for the estimated royalty expenses that are under negotiation with counterparties. The timing of payment depends on the settle-

ment of the negotiations.

(C) The Group has a long-term incentive plan for its executives based on a three-year management performance criteria and recognizes a provision for the estimated

incentive cost for the accrued period.