Samsung 2014 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2014 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

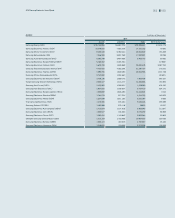

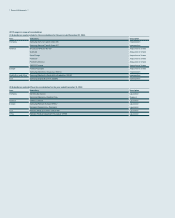

Financial Statements

(C) Disposal of subsidiaries

If the Group loses control of a subsidiary, any investment continuously retained in

the subsidiary is re-measured at its fair value at the date when control is lost and

any resulting differences are recognized in profit or loss. Such fair value becomes

the initial carrying amount for the subsequent measurement of the retained inter-

est accounted for as an associate, joint venture, or financial asset. In addition, any

amounts previously recognized in other comprehensive income in respect of such

entity are accounted for as if the Group had directly disposed of the related assets

or liabilities. As a result, the previously recognized other comprehensive income

are reclassified into profit or loss.

(D) Non-controlling interests

Each component of profit or loss and other comprehensive income is attributed to

owners of the parent and to non-controlling interests. Total comprehensive income

is attributed to owners of the parent and to non-controlling interests even if this

results in a negative balance of non-controlling interests.

(E) Associates

Associates are all entities over which the Group has significant influence but does

not have control, generally investees of which from 20% to 50% of voting stock is

owned by the Group. Investments in associates are initially recognized at acquisi-

tion cost using the equity method. Unrealized gains on transactions between the

Group and its associates are eliminated to the extent of the Group’s interest in the

associates. If there is any objective evidence that the investment in the associate

is impaired, the Group recognizes the difference between the recoverable amount

of the associate and its book value as impairment loss.

(F) Joint arrangements

A joint arrangement of which two or more parties have joint control is classified as

either a joint operation or a joint venture. A joint operator has rights to the assets,

and obligations for the liabilities, relating to the joint operation and recognizes the

assets, liabilities, revenues and expenses relating to its interest in a joint opera-

tion. A joint venturer has rights to the net assets relating to the joint venture and

accounts for that investment using the equity method.

2.4 Foreign Currency Translation

(A) Functional and presentation currency

Items included in the financial statements of each of the Group’s entities are

measured using the currency of the primary economic environment in which each

entity operates (the “functional currency”). The consolidated financial statements

are presented in Korean won, which is the parent company’s functional and pre-

sentation currency.

(B) Transactions and balances

Foreign currency transactions are translated into the functional currency using the

exchange rates prevailing at the dates of the transactions or valuation where items

are re-measured. Foreign exchange gains and losses resulting from the settle-

ment of such transactions and from the translation at year-end exchange rates of

monetary assets and liabilities denominated in foreign currencies are recognized

in profit or loss.

Exchange differences arising on non-monetary financial assets and liabilities such

as equity instruments at fair value through profit or loss and available-for-sale eq-

uity instruments are recognized in profit or loss and other comprehensive income,

respectively, as part of the fair value gain or loss.

(C) Translation into the presentation currency

The results and financial position of all the foreign entities that have a functional

currency different from the presentation currency of the Group are translated into

the presentation currency as follows:

• Assets and liabilities for each statement of financial position presented are trans-

lated at the closing rate at the end of the reporting date.

• Income and expenses for each statement of income are translated at average

exchange rates, unless this average is not a reasonable approximation of the

cumulative effect of the rates prevailing on the transaction dates, in which case

income and expenses are translated at the rate on the dates of the transactions.

•

All resulting exchange differences are recognized in other comprehensive income.

On consolidation, exchange differences arising from the translation of the net

investment in foreign operations are recognized in other comprehensive income.

When a foreign operation is partially disposed of or sold, the exchange differences

that were recorded in equity are reclassified as part of gains and losses on dispo-

sition in the statement of income. When the Group loses control over foreign sub-

sidiaries, the exchange differences that were recorded in equity are reclassified

into profit or loss when such gain or loss on disposition is recognized.

Any goodwill arising on the acquisition of a foreign operation and any fair value ad-

justments are treated as the foreign operation’s assets and liabilities. Such good-

will is expressed in the foreign operation’s functional currency and is translated

at the closing rate. Exchange differences are recognized in other comprehensive

income.