Samsung 2014 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2014 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Statements

3. Critical Accounting Estimates and

Assumptions

The Group makes estimates and assumptions concerning the future. The esti-

mates and assumptions are continuously assessed, considering historical experi-

ence and other factors, including expectations of future events that are believed to

be reasonable under the circumstances. The resulting accounting estimates will,

by definition, seldom equal the related actual results. The estimates and assump-

tions that have a significant risk of causing a material adjustment to the carrying

amounts of assets and liabilities within the next financial year are addressed below.

(A) Revenue recognition

The Group uses the percentage-of-completion method in accounting for its fixed-

price contracts to deliver installation services. Use of the percentage-of-comple-

tion method requires the Group to estimate the services performed to date as a

proportion of the total services to be performed. Revenues and earnings are sub-

ject to significant change, effected by early steps in a long-term projects, change in

scope of a project, cost, period, and plans of the customers.

(B) Provision for warranty

The Group recognizes provision for warranty on products sold. The Group accrues

provision for warranty based on the best estimate of amounts necessary to settle

future and existing claims. The amounts are estimated based on past experience.

(C) Fair value of derivatives and other financial instruments

The fair value of financial instruments that are not traded in an active market is

determined by using a variety of methods and assumptions that are mainly based

on market conditions existing at the end of each reporting period.

(D) Net defined benefit liabilities

The net defined benefit liability depends on a number of factors that are deter-

mined on an actuarial basis using a number of assumptions. Any changes in these

assumptions will impact the carrying amount of the net defined benefit liability. The

Group, in consideration of the interest rates of high-quality corporate bonds, de-

termines the appropriate discount rate at the end of each year. This is the interest

rate that is used to determine the present value of estimated future cash outflows

expected to be required to settle the net defined benefit liability. The principal actu-

arial assumptions associated with the net defined benefit liability are based on the

current market expectations.

(E) Estimated impairment of goodwill

At the end of each reporting period, the Group tests whether goodwill has become

impaired by comparing the carrying amounts of cash-generating units to the re-

coverable amounts. The recoverable amounts of cash-generating units have been

determined based on value-in-use calculations, and these calculations are based

on estimates.

(F) Income taxes

Income taxes on the Group’s taxable income from operating activities are subject

to various tax laws and determinations of each tax authority across various coun-

tries throughout the world. There is uncertainty in determining the eventual tax

effects on the taxable income from operating activities. The Group has recognized

current tax and deferred tax at the end of the fiscal year based on the best estima-

tion of future taxes payable as a result of operating activities. However, the result-

ing deferred income tax assets and liabilities may not equal the actual future taxes

payable and such difference may impact the current tax and deferred income tax

assets and liabilities upon the determination of eventual tax effects.

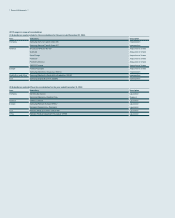

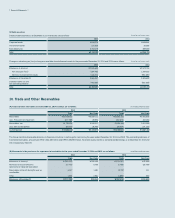

4. Cash and Cash Equivalents

Cash and cash equivalents include cash on hand, deposits held at call with banks,

and other short-term highly liquid investments that are readily convertible to a

known amount of cash and are subject to an insignificant risk of change in value.

Cash and cash equivalents as at December 31, 2014 and 2013, consist of the fol-

lowing: (In millions of Korean won)

2014 2013

Cash on hand ₩15,550 ₩14,454

Bank deposits and others 16,825,216 16,270,326

Total ₩16,840,766 ₩16,284,780

5. Financial Assets Subject to

Withdrawal Restrictions

Financial instruments subject to withdrawal restrictions as at December 31, 2014

and 2013, consist of the following: (In millions of Korean won)

2014 2013

Short-term financial instruments ₩13,919 ₩23,850

Other non-current assets 202 15