Samsung 2014 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2014 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107106

2014 Samsung Electronics Annual Report2014 Samsung Electronics Annual Report

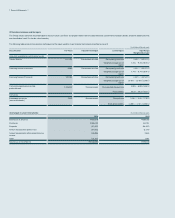

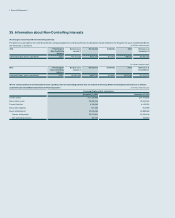

(3) Details of cumulative income or expense recognized in other comprehensive

income relating to the disposal group classified as held-for-sale as at Decem-

ber 31, 2014 and 2013, are as follows:

(In millions of Korean won)

Amount

Gain on valuation of available-for-sale

securities

₩24,750

Changes in equity under the equity-

method

54,118

Foreign exchange translation adjustment 1,233

Total ₩80,101

(B) As at December 31, 2013

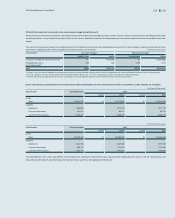

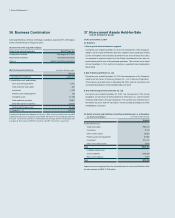

The Group entered into a comprehensive business cooperation agreement with

Corning Incorporated during the year ended December 31, 2013. During the year

ended December 31, 2014, the Group sold all of its shares of Samsung Corning

Precision Materials. The Group received an additional dividend declared following

the resolution of the general meeting of the Samsung Corning Precision Materials

shareholders. Also, the respective agreement includes ex-post settlement condi-

tions based on the business performance of Samsung Corning Precision Materi-

als which may result in the future outflow of or inflow to the Group’s resource. As at

the reporting date, the future inflow or outflow are uncertain and thus, its impact to

the Group’s financial statements cannot be estimated. The Group’s management,

however, believes the future inflow or outflow will not have a material impact on

the financial conditions of the Group.

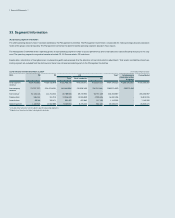

38. Events after the Reporting Period

(A) On January 1, 2015, Samsung Electronics America (SEA), a subsidiary of

the Group, merged with Samsung Telecommunications America (STA), also

a subsidiary of the Group. The merger was between two subsidiaries under

common control, therefore, the merger was accounted for by transferring the

book values on the consolidated financial statements. No additional goodwill

was recognized.

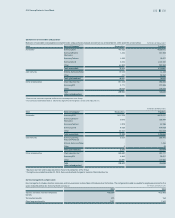

(B) Based on an agreement entered into in September 1999 related to Samsung

Motor Inc.’s (“SMI”) bankruptcy proceedings, SMI’s creditors (the “Creditors”)

filed a civil action in December 2005 against 28 Samsung Group affiliates,

including the Group, seeking to recover KRW 2,450 billion in losses as well

as additional penalty amounts. On January 29, 2015, the Supreme Court

ordered the Samsung Group affiliates to pay the Creditors an additional pen-

alty of KRW 600 billion plus an interest on late penalty payment (charged at

6% annual interest rate). On January 11, 2011, the Seoul High Court ordered

Samsung Group affiliates to pay to the Creditors a penalty of KRW 600 billion

and interest due to late payment. Compared to the January 2011 ruling, the

penalty amount remained the same and the interest charge on late penalty

payment increased by 1% annually, thus the total amount due to Creditors

increased by KRW 4 billion as a result of the Supreme Court’s January 2015

decision.