Samsung 2014 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2014 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

099098

2014 Samsung Electronics Annual Report2014 Samsung Electronics Annual Report

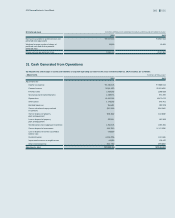

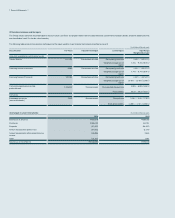

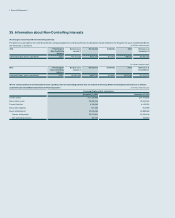

(5) Sensitivity analysis for recurring fair value measurements categorized within Level 3

Sensitivity analysis of financial instruments is performed to measure favorable and unfavorable changes in the fair value of financial instruments which are affected by the unob-

servable parameters, using a statistical technique. When the fair value is affected by more than two input parameters, the amounts represent the most favorable or most unfa-

vorable.

The results of the sensitivity analysis for the effect on profit or loss (before-tax amount for other comprehensive income or loss) from changes in inputs for each financial instru-

ment which is categorized within Level 3 and subject to sensitivity analysis, are as follows: (In mil

lions of Korean won)

Classification Favorable Changes Unfavorable Changes

Profit or Loss Equity Profit or Loss Equity

Long-term available-for-sale financial assets1₩- ₩231,909 ₩- ₩(225,568)

Embedded derivatives

(convertible bonds)2

466 466 (475) (475)

Total ₩466 ₩232,375 ₩(475)₩(226,043)

1 Changes in fair value are calculated by increasing or decreasing the correlation between volatility (30.5% to 36.5%) and discount rate for convertible preferred stock. Similarly, for other equity

securities, changes in fair value are calculated with the correlation between growth ratio (-1% to 1%) and discount rate, which are significant unobservable inputs.

2 For equity derivatives, changes in their fair value are calculated by increasing or decreasing the correlation between stock prices and volatility by 10%.

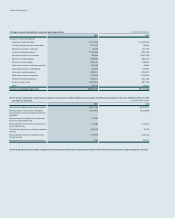

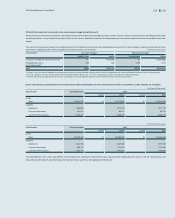

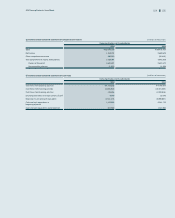

(6) Fair value hierarchy classifications of the financial assets and financial liabilities that are measured at fair value as at December 31, 2014 and 2013, are as follows:

(In millions of Korean won)

Classification Carrying amount 2014

Level 1 Level 2 Level 3 Total

Assets

Other ₩4,614,560 ₩- ₩4,576,852 ₩- ₩4,576,852

Liabilities

Debentures 1,355,882 - 1,377,113 - 1,377,113

Long-term borrowings 101,671 - 82,271 - 82,271

Long-term other payables 2,520,277 - 2,606,179 - 2,606,179

(In millions of Korean won)

Classification Carrying amount 2013

Level 1 Level 2 Level 3 Total

Assets

Other ₩5,432,404 ₩-₩5,395,918 ₩-₩5,395,918

Liabilities

Debentures 1,311,068 -1,327,569 -1,327,569

Long-term borrowings 985,117 -971,844 -971,844

Long-term other payables 1,023,714 -1,090,580 -1,090,580

As at December 31, 2014, assets and liabilities not measured at fair value but for which the fair value is disclosed and categorized within Level 2 in the fair value hierarchy, are

measured using the present value technique which discounts future cash flows with appropriate interest rates.