Samsung 2014 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2014 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

067066

2014 Samsung Electronics Annual Report2014 Samsung Electronics Annual Report

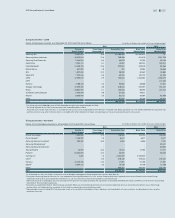

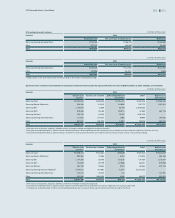

(1) Equity securities - Listed

Details of listed equity securities as at December 31, 2014 and 2013, are as follows: (In millions of Korean won, number of shares and percentage)

2014 2013

Number of

Shares Owned

Percentage of

Ownership (%)

Acquisition Cost Book Value

(Market Value)

Book Value

(Market Value)

Samsung SDI 13,462,673 19.6 ₩2,180,953 ₩1,561,670 ₩-

Samsung Heavy Industries 40,675,641 17.6 258,299 811,479 1,547,708

Samsung Fine Chemicals 2,164,970 8.4 45,678 70,795 96,449

Hotel Shilla 2,004,717 5.1 13,957 183,231 133,314

Cheil Worldwide114,498,725 12.6 223,941 249,378 82,465

iMarket Korea 647,320 1.8 324 18,384 16,668

SFA 1,822,000 10.2 38,262 90,462 74,884

Wonik IPS 7,220,216 9.0 63,250 100,722 61,949

ASML 12,595,575 2.9 726,024 1,506,664 1,248,019

CSR2- -- - 110,135

Rambus 4,788,125 4.2 92,682 58,368 47,851

Seagate Technology 12,539,490 3.8 218,544 916,597 743,161

Sharp 35,804,000 2.1 122,535 88,292 120,143

SunEdison Semiconductor 2,425,578 5.8 37,553 49,511 -

Wacom 8,398,400 5.0 62,013 36,084 62,268

Other 51,837 35,199 54,300

Total ₩4,135,852 ₩5,776,836 ₩4,399,314

1 The Group acquired 11,500,000 shares of Cheil Worldwide during the year ended December 31, 2014.

2 The Group disposed all of its CSR shares during the year ended December 31, 2014.

Acquisition cost includes impairment loss on available-for-sale financial assets recognized due to the decline in realizable value below acquisition cost. The difference between the acquisition cost

and the current fair value, after income tax effects, is recorded within other components of equity (unrealized gains or losses on available-for-sale financial assets).

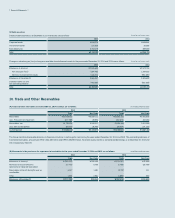

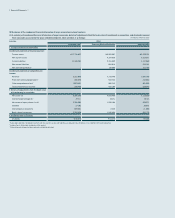

(2) Equity securities - Non-listed

Details of non-listed equity securities as at December 31, 2014 and 2013, are as follows: (In millions of Korean won, number of shares and percentage)

2014 2013

Number of

Shares Owned

Percentage of

Ownership (%)

Acquisition Cost Book Value Book Value

Kihyup Technology 1,000,000 17.2 ₩5,000 ₩5,000 ₩5,000

Pusan Newport11,135,307 1.0 5,677 5,677 5,677

Samsung Venture Investment 980,000 16.3 4,900 6,586 7,021

Samsung Petrochemical2- -- - 80,347

Samsung General Chemicals2- -- - 80,653

Taewon Electric 45,000 15.0 16,544 17,094 17,072

Pantech353,000,000 10.0 53,000 - 53,053

Corning Inc.42,300 7.4 2,434,320 3,106,332 -

CSOT5- 9.5 278,130 278,130 278,130

Nanosys 13,100,436 11.2 17,861 21,786 17,861

OpenX58,899,172 3.2 10,738 10,738 10,738

Other3339,361 295,050 226,745

Total ₩3,165,531 ₩3,746,393 ₩782,297

1 As at December 31, 2014, the Group’s investments in Pusan Newport are pledged as collateral against the investee's debt (Note 19).

2 During 2014, Samsung General Chemicals Co., Ltd. merged with Samsung Petrochemical Co., Ltd., and the Group entered into an agreement with Hanwha Chemical and Hanwha Energy

Corporation to sell all of its Samsung General Chemincals Co., Ltd. As a result, the shares are reclassified as assets held-for-sale.

3 Impairment losses on unlisted equity securities resulting from the decline in realizable value below the acquisition cost amounted to KRW 58,357 million and KRW 5,177 million for the years ended

December 31, 2014 and 2013, respectively.

4 During the year ended December 31, 2014, the Group acquired 2,300 shares of convertible preferred shares of Corning Incorporated, which are convertible into common shares. Percentage

of ownership is calculated under the assumption that all shares have been converted into common shares.

5 Nonmarketable shares, including CSOT, are measured at cost as the variability of estimated cash flow is significant and the probability of various estimates, including discount rate, cannot be

reasonably assessed.