Samsung 2014 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2014 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

061060

2014 Samsung Electronics Annual Report2014 Samsung Electronics Annual Report

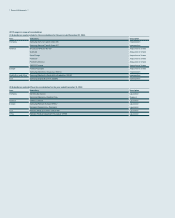

(A) Sales of goods

Sales of products and merchandise are recognized upon delivery when the sig-

nificant risks and rewards of ownership of goods have transferred to the buyer.

Revenue is recognized net of discounts and returns, estimated at the time of sale

based on past experience.

(B) Sales of services

Revenues from rendering services are generally recognized using the percent-

age-of-completion method based on the percentage of costs to date compared to

the total estimated costs, contractual milestones or performance.

(C) Interest income

Interest income is recognized using the effective interest method according to

the time passed. When a loan or receivable is impaired, the Group reduces the

carrying amount to its recoverable amount, to the extent of the estimated future

cash flow discounted at the original effective interest rate of the instrument, and

continues unwinding the discount as interest income. Interest income on impaired

loans and receivables is recognized using the original effective interest rate.

(D) Royalty income

Royalty income is recognized on an accrual basis in accordance with the sub-

stance of the relevant agreements.

(E) Dividend income

Dividend income is recognized when the right to receive payment is established.

2.25 Government Grants

Government grants are recognized at their fair values when there is reasonable

assurance that the grant will be received and the Group will comply with the con-

ditions attached to it. Government grants relating to costs are deferred and recog-

nized in the income statement over the period necessary to match them with the

costs that they are intended to compensate. Government grants relating to assets

are recognized in liabilities as deferred income government grants and are credit-

ed to the income statement on a straight – line basis over the expected lives of the

related assets.

2.26 Earnings per Share

Basic earnings per share is calculated by dividing net profit for the period available

to common shareholders by the weighted-average number of common shares

outstanding during the year. Diluted earnings per share is calculated using the

weighted-average number of common shares outstanding adjusted to include the

potentially dilutive effect of common equivalent shares outstanding.

2.27 Operating Segments

Operating segments are disclosed in the manner reported to the chief operating

decision-maker (Note 33). The chief operating decision-maker is responsible for

making strategic decisions on resource allocation and performance assessment

of the operating segments. The Management Committee, which makes strategic

decisions, is regarded as the chief operating decision-maker.

2.28 Convenience Translation into

United States Dollar Amounts

The Group operates primarily in Korean won and its official accounting records

are maintained in Korean won. The US dollar amounts provided in the financial

statements represent supplementary information solely for the convenience of

the reader. All Korean won amounts are expressed in US dollars at the rate of

KRW1,052.70 to US $1, the average exchange rate for the year ended December

31, 2014. Such presentation is not in accordance with generally accepted account-

ing principles, and should not be construed as a representation that the Korean

won amounts shown could be readily converted, realized or settled in US dollars

at this or at any other rate.

2.29 Approval of the Consolidated

Financial Statements

These consolidated financial statements were approved by the Board of Directors

on January 29, 2015.