Samsung 2014 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2014 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

069068

2014 Samsung Electronics Annual Report2014 Samsung Electronics Annual Report

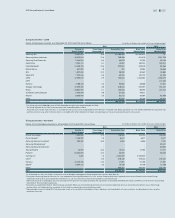

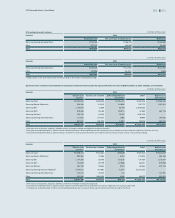

(C) The aging analysis of trade and other receivables as at December 31, 2014 and 2013, is as follows: (In millions of Korean won)

2014 2013

Receivables not past due ₩25,271,779 ₩25,420,912

Past due but not impaired1:

Less than 31 days overdue 2,333,812 2,058,708

Impaired2:

31 days to 90 days overdue 378,242 184,405

Over 90 days overdue 583,291 559,811

Total ₩28,567,124 ₩28,223,836

1 The Group does not consider receivables that are overdue for less than or equal to 31 days as impaired.

2 Provisions for impaired receivables amount to KRW 287,682 million as at December 31, 2014 (2013: KRW 287,721 million).

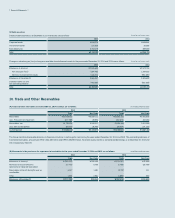

(D) The maximum exposure to credit risk at the reporting date is the carrying value of each class of receivable mentioned above. As at December 31, 2014, the Group has

credit insurance with Korea Trade Insurance and overseas insurance companies against its export accounts receivables. In accordance with the terms of the con-

tract, the Group is entitled to a compensation on bad debts if the criteria set forth in the agreement, such as customer’s refusal of payment, are satisfied.

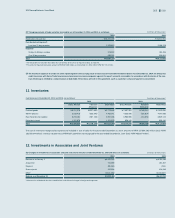

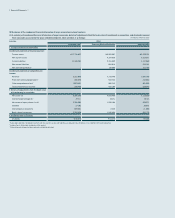

11. Inventories

Inventories as at December 31, 2014 and 2013, are as follows: (In millions of Korean won)

2014 2013

Gross Amount Valuation

Allowance

Book Value Gross Amount Valuation

Allowance

Book Value

Finished goods ₩6,011,078 ₩(237,630)₩5,773,448 ₩7,597,391 ₩(168,041)₩7,429,350

Work in process 5,018,416 (553,345)4,465,071 4,352,080 (281,814)4,070,266

Raw materials and supplies 6,244,161 (287,155)5,957,006 6,960,985 (151,873)6,809,112

Materials in transit 1,121,979 - 1,121,979 826,140 - 826,140

Total ₩18,395,634 ₩(1,078,130)₩17,317,504 ₩19,736,596 ₩(601,728)₩19,134,868

The cost of inventories recognized as expense and included in ‘cost of sales’ for the year ended December 31, 2014, amounts to KRW 127,584,292 million (2013: KRW

136,755,644 million). Inventory valuation loss of KRW 637,233 million was recognized for the year ended December 31, 2014 (2013: KRW 435,607 million).

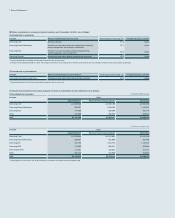

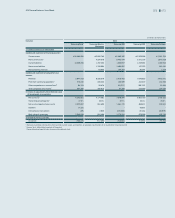

12. Investments in Associates and Joint Ventures

(A) Changes in investments in associates and joint ventures for the years ended December 31, 2014 and 2013, are as follows: (In millions of Korean won)

2014 2013

Balance as at January 1 ₩6,422,292 ₩8,785,489

Acquisition 721,299 181,307

Disposal (38,450) (240)

Share of profit 342,516 504,063

Other1(2,215,196) (3,048,327)

Balance as at December 31 ₩5,232,461 ₩6,422,292

1 Other consists of dividends, business combinations, and effects of changes in foreign exchange rates.