Samsung 2014 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2014 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Statements

19. Commitments and Contingencies

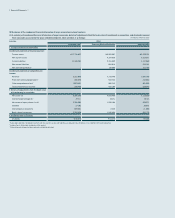

(A) Guarantees (In millions of Korean won)

2014 2013

Guarantees of debt for housing rental1₩76,558 ₩151,985

1 Represents the maximum amount of debt guarantee which was provided for employees who took debt from financial institutions in order to finance employee housing rental.

In addition to the guarantees described above, the Group provides guarantees for borrowings by Intellectual Keystone Technology (IKT), the Group’s associate, to Citibank in the

amount of KRW 32,976 million (USD 30 million).

As at December 31, 2014, the Group’s investments in Busan Newport are pledged as collateral against the investee's debt (Note 9).

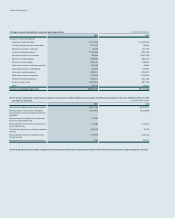

(B) Leases

The Group leases certain property, plant and equipment under vtarious finance lease arrangements and recognizes the related amounts as lease assets or liabilities. Assets

with a net book value of KRW 102,569 million (2013: KRW 110,655 million) are treated as finance lease agreements and are included in property, plant and equipment. Depreci-

ation expense for the finance lease assets amounted to KRW 11,787 million for the year ended December 31, 2014 (2013: KRW 10,587 million).

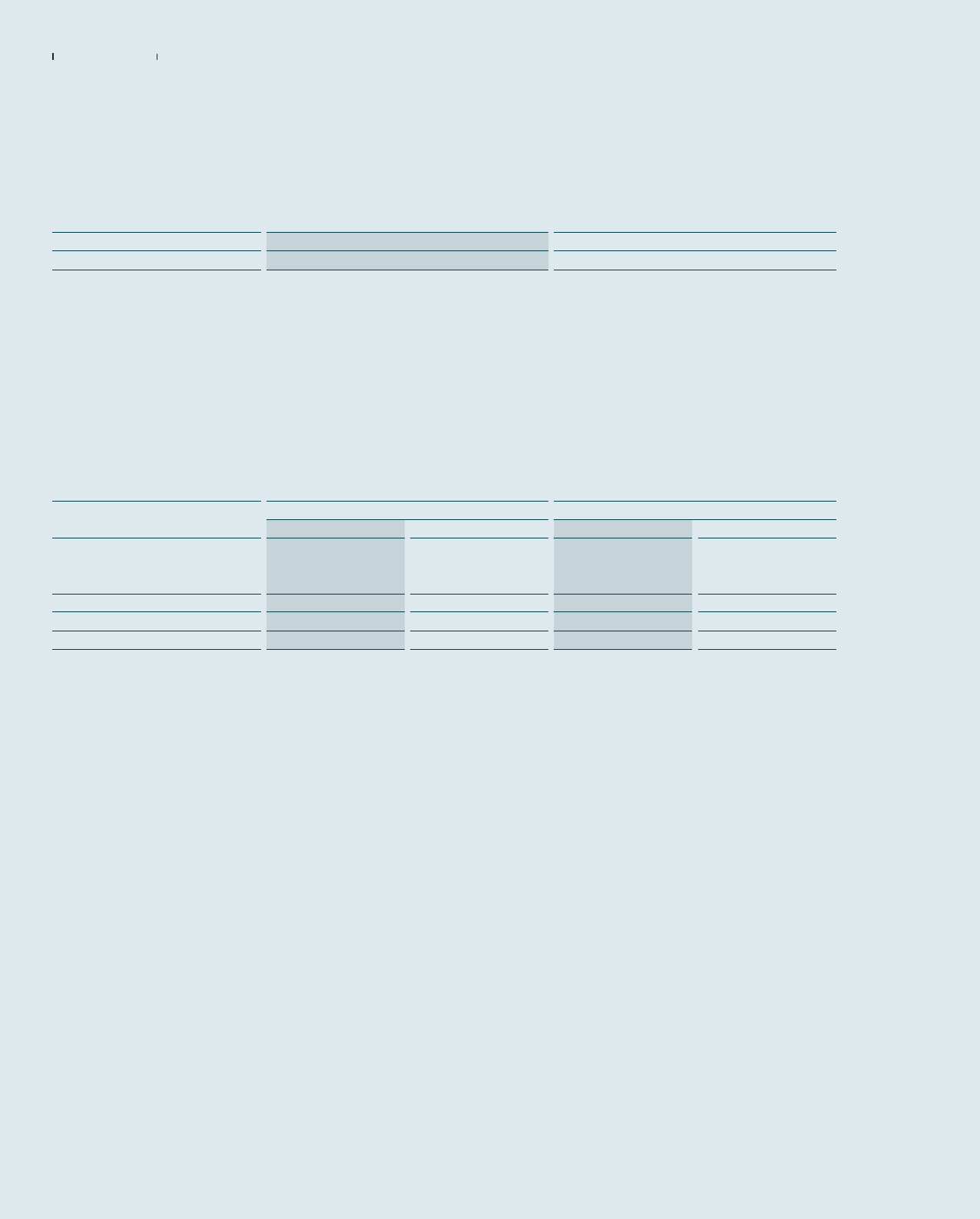

The minimum lease payments under finance lease agreements and their present value as at December 31, 2014 and 2013, are as follows: (In millions of Korean won)

2014 2013

Minimum Lease payments Present values Minimum Lease payments Present values

Within one year ₩22,691 ₩14,809 ₩27,893 ₩19,811

From one year to five years 59,123 30,577 57,508 28,213

More than five years 82,162 47,103 95,192 54,189

Total ₩163,976 ₩92,489 ₩180,593 ₩102,213

Present value adjustment (71,487) (78,380)

Finance lease payable ₩92,489 ₩102,213

(C) Litigation

(1) The litigation with Apple Inc. (“Apple”) is ongoing in the United States as at the reporting date. Regarding the ongoing lawsuit in the United States, on August 24, 2012, the jury

determined that the Group partially infringed Apple’s design and utility patent and should pay damages to Apple. On March 1, 2013, however, the Judge ordered a new trial for

a certain portion of the damages, ruling that it was originally miscalculated. On March 6, 2014, the Judge denied Apple’s bid for a permanent injunction against the Group and

made a final judgment restating the total damages amount determined by a jury verdict on November 21, 2013. The Group appealed the decision on the damages amount on

March 7, 2014, and a hearing on the appeal was held on December 4, 2014.

Additionally, on May 5, 2014, the jury in another ongoing lawsuit determined that the Group partially infringed Apple’s utility patent and should pay damages to Apple. On

November 25, 2014, first trial judgment was pronounced to confirm the jury’s verdict. The Group appealed the decision on the damages and the appeal is currently on-going.

The final conclusion and the effect of the patent lawsuits with Apple are uncertain as at the reporting date.

In August 2014, the Group and Apple reached an agreement to withdraw from ongoing litigation in all regions other than the United States, and the Group is currently in the

process of withdrawing all non-United States based lawsuits.

(2) In addition, during the normal course of business with numerous companies, the Group has been involved in various claims, disputes, and investigations conducted by reg-

ulatory bodies. Although, the outflow of resources and timing of these matters are uncertain, the Group believes the outcome will not have a material impact on the financial

condition of the Group.