Samsung 2014 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2014 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Statements

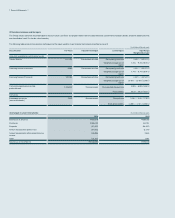

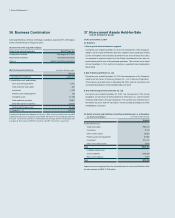

36. Business Combination

Samsung Electronics America, the Group’s subsidiary, acquired 100% of the equity

shares of SmartThings on August 18, 2014.

(A) Overview of the acquired company

Name of the acquired company SmartThings, Inc.

Headquarters location Washington D.C. USA.

Representative director Alexander Hawkinson

Industry Sale of smart home electronics

(B) Purchase price allocation (In millions of Korean won)

Amount

I. Consideration transferred ₩166,546

II. Identifiable assets and liabilities

Cash and cash equivalents 2,471

Trade and other receivables 667

Inventories 1,208

Property, plant and equipment 126

Intangible assets 47,763

Trade and other payables (5,681)

Deferred income tax liabilities (13,225)

Total net identifiable assets 33,329

III. Goodwill (I – II)133,217

Had SmartThings been consolidated from January 1, 2014, revenues would increase by KRW

2,469 million and net loss would increase by KRW 6,786 million on the consolidated statement

of income. The revenues and net loss contributed by SmartThings after the consolidation date

of August 18, 2014 amount to KRW 2,733 million and KRW 7,424 million, respectively.

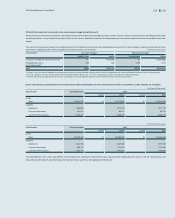

37. Non-current Assets Held-for-Sale

(Assets of disposal group)

(A) As at December 31, 2014

(1) Summary

I. Sale of optical materials business segment

During the year ended December 31, 2014, the management of the Group de-

cided to sell the Optical Materials business segment and accordingly related

assets and liabilities are classified as held-for-sale. Since the business does

not represent a separate major line of the Group, related profit or loss was not

presented as profit or loss of discontinued operations. The contract was entered

into on December 2, 2014, and the transaction is expected to be completed by

March 2015.

II. Sale of Samsung Techwin Co., Ltd

During the year ended December 31, 2014, the management of the Group de-

cided to sell all shares of Samsung Techwin Co., Ltd. to Hanwha Corporation.

The contract was entered into on November 26, 2014, and the transaction and

associated due diligence will be completed by June 2015.

III. Sale of Samsung General Chemicals Co., Ltd.

During the year ended December 31, 2014, the management of the Group

decided to sell all shares of Samsung General Chemicals Co., Ltd. to Hanwha

Chemical and Hanwha Energy Corporation. The contract was entered into on

November 26, 2014, and the transaction and associated due diligence will be

completed by June 2015.

(2) Details of assets and liabilities reclassified as held-for-sale, as at December

31, 2014, are as follows: (In millions of Korean won)

Amount

Assets held-for-sale

Trade receivables ₩60,173

Inventories 9,703

Other current assets 22,523

Property, plant and equipment 37,955

Investment 511,441

Other non-current assets 3,696

Total ₩645,491

Liabilities held-for-sale

Current liabilities ₩25,939

Non-current liabilities 2,377

Total ₩28,316

Impairment loss recognized from the reclassification of assets and liabilities held-

for-sale amounts to KRW 31,219 million.