Samsung 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014

SAMSUNG ELECTRONICS

ANNUAL REPORT

Table of contents

-

Page 1

2014 SAMSUNG ELECTRONICS ANNUAL REPORT -

Page 2

Contents 002 006 008 CEO Greetings About the Board Business Overview Consumer Electronics IT & Mobile Communications Device Solutions 029 Global Citizenship Social Contributions Green Management Health and Safety Sharing Growth 037 Financial Statements Proactive Possibility Partnership Prepared for... -

Page 3

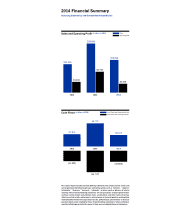

2014 Financial Summary Samsung Electronics and Consolidated Subsidiaries Sales and Operating Profit (in billions of KRW) 228,693 Sales Operating Profit 206,206 201,104 36,785 29,049 25,025 2012 2013 2014 Cash Flows (in billions of KRW) Cash Flows from Operating Activities Cash Flows from ... -

Page 4

... world-class company Accelerating growth engines in a difficult business environment In 2014, despite the economic and political uncertainties of China's slowed growth and rising tensions in Russia and the Middle East, Samsung Electronics focused on identifying growth engines, developing innovative... -

Page 5

2014 Samsung Electronics Annual Report 002 003 Enhancing product competency and reinforcing market leadership Our Memory Business significantly improved owing to greater cost competitiveness and advanced process technology development. In turn, that boosted sales of differentiated and high-value-... -

Page 6

... that builds a world-class B2B business, working closely with sales networks to develop corporate customers. By propelling momentum in advanced markets and realizing high growth in emerging markets, we will position Samsung as a global leader in the B2B business. We will further enhance our product... -

Page 7

2014 Samsung Electronics Annual Report 004 005 Growing together as a respected world-class company Looking ahead in 2015, we are committed to our social responsibility contributions, with a focus on education, job training and improving healthcare. Designed for corporate citizenship, our programs... -

Page 8

... the Board Our board of directors conducts transparent and responsible management to maximize corporate value Oh-Hyun Kwon ⦠⦠Vice Chairman & CEO (2012-Present) Vice Chairman & Head, Samsung Advanced Institute of Technology (2013-Present) Vice Chairman & Head, Device Solutions (2011-Present... -

Page 9

..., Strategy Team 1, Samsung Corporate Strategy Office (2010-2012) Head, Corporate Management Support Team (2008-2010) Strategy & Planning Office (2006-2008) Independent Director (2013-Present) Advisor, Kim & Chang Law Office (2007-Present) Prosecutor General, Supreme Prosecutors' Office (2003-2005... -

Page 10

...2014, Samsung Electronics embraced the challenges of growing despite the increased political and economic uncertainties of the complex global environment. We strengthened our product and market leadership and again elevated our corporate value and brand power. Management climates are always changing... -

Page 11

Business Overview Consumer Electronics Visual Display Business Digital Appliances Business Printing Solutions Business Health & Medical Equipment Business IT & Mobile Communications Mobile Communications Business Network Business Device Solutions Memory Business System LSI Business LED ... -

Page 12

... as the world's best TV maker in premium markets, including North America, with trendsetting differentiated products such as Curved TV and UHD TV. In 2015, Samsung Electronics is poised to secure that global TV leadership with a range of innovative products. We will increase sales of premium... -

Page 13

2014 Samsung Electronics Annual Report 010 011 28.3 % Top Global Flat Panel TV Market Share in 2014 Source: D.Search (based on annual sales) 34.3 % Top Global UHD TV Market Share in 2014 Source: D.Search (based on annual sales) SUHD TV JS9500 The innovative SUHD TV JS9500 offers the ... -

Page 14

...The dehumidifier function removes excess humidity in the air. In 2015, we will secure leadership in the global home appliance market by emphasizing sales capabilities and by launching additional exciting premium products that enhance family life. We are forcefully moving into the Smart Home era with... -

Page 15

2014 Samsung Electronics Annual Report 012 013 Q9000 Smart Air Conditioner The Q9000 provides year-round comfort by monitoring temperature, humidity and air cleanliness. Chef Collection Refrigerator With our revolutionary Precise Chef Coolingâ„¢ and Triple Metal Cooling technology the super-... -

Page 16

... optimized solutions and services that advance their business, such as the launch of our SMART MultiXpress X7600 Series, the world's first quad core CPU-installed A3 multifunction printer with Samsung Cloud Print services. SMART MultiXpress X7600 Series With quad core CPU and upgraded Android OS... -

Page 17

... global imaging industry SMART MultiXpress Line-up Applying the industry-first Android OS-based Smart UX with full touch screen, the A3/A4 multifunction series offers excellent convenience and features as well as a range of advanced solutions, including best-in-class print and scan speed, security... -

Page 18

...ray equipment by securing differentiated technologies, including image engine and usability features. Looking ahead, we are developing innovative medical devices that will expertly integrate our cutting-edge technologies to support advanced healthcare and healthful living. WS80A with Elite Enhanced... -

Page 19

2014 Samsung Electronics Annual Report 016 017 GC85A Our premium digital X-ray GC85A uses outstanding imaging technology to provide high-resolution images for greater diagnostic accuracy and sophisticated automation features to ease testing for medical teams. -

Page 20

... rising global wearable tech market with our stylishly innovative wearable products, including Samsung Gear 2, Gear S, Gear VR and Gear Circle. In the year ahead, the time looks right for the mobile business to take off again. We plan to propel smartphone sales with competitive new lines, to secure... -

Page 21

... Samsung Electronics Annual Report 018 019 22.1 24.7 Top Global Mobile Phone Market Share in 2014 % Top Global Smartphone Market Share in 2014 Source: Strategy Analytics % Galaxy S6 edge Beautifully crafted from metal and glass, the Galaxy S6 edge is the most advanced smartphone on the market... -

Page 22

... the market by supplying IP Telephony and the Smart WLAN solution. Our Smart WLAN ranked No. 1 in Korean market share with its security AP and we are expanding share in the UK and the US. Looking forward in 2015, we will enhance our business platform in the global market, particularly in Europe, the... -

Page 23

... Samsung Electronics Annual Report 020 021 Most Innovative Application/Service 2014 LTE Awards 1st Place in Wide Area Network-Core CTIA 2014 E-Tech Award Macro Cell (RRU) Small Cell Macro Cell (CDU) Smart Scheduler Smart LTE Networks with IBS By installing the IBS, which flexibly manages... -

Page 24

...NAND technology-based SSD '850 PRO' and portable SSD 'T1' to drive the fast-growing storage memory market. In 2015, we will expand the premium memory market with timely introduction of high-quality products and solutions based on our technological prowess. We also plan to continue driving the trends... -

Page 25

2014 Samsung Electronics Annual Report 022 023 40.4 36.5 % Top Global DRAM Market Share in 2014 Source: IHS iSuppli, based on 2014 sales % Top Global NAND Flash Market Share in 2014 Source: IHS iSuppli, based on 2014 sales 64GB 3D Through Silicon Via (TSV) RDIMM High-speed, high-density and ... -

Page 26

... technology and advanced development of next-generation products, Samsung Electronics has achieved leadership in the global system LSI market. By focusing on the key segments of SoC, LSI and the foundry business, we are consistently enhancing our leading position in the global market to provide... -

Page 27

2014 Samsung Electronics Annual Report 024 025 18 % Top Global DDI Market Share in 2014 Source: IHS iSuppli, based on 2014 sales 20 % No. 3 Global CMOS Image Sensor Market Share in 2014 Source: TSR Report, based on 1H 2014 sales Exynos 7420 High-performance, low-power mobile AP fabricated ... -

Page 28

... differentiated solutions, Samsung Electronics also redefined the LED TV market by developing innovative LED TV components. Our LED lighting solutions integrate world-class semiconductor technology and manufacturing expertise to produce advanced LED components, display modules and light engines that... -

Page 29

2014 Samsung Electronics Annual Report 026 027 8 % Top Global LED TV Module Market Share in 2014 Source: Strategies Unlimited, based on 2014 sales LM561B The most advanced mid-power LED package in its class, delivering the industry's highest light efficacy of 179lm/W at 65mA, 5000K CCT and ... -

Page 30

.... Samsung Electronics develops technologies, innovates products and provides solutions that create happier lives in an enriched world. With our semiconductor components, visual display, home appliances, office solutions, medical equipment, ICT and mobile products, we are advancing our shared futures... -

Page 31

Global Citizenship Samsung Electronics believes that our continuous and effective social responsibility programs build a better world. We look for ways to instill joy by helping to resolve community challenges, protect the environment and share growth with our employees and partners. With the ... -

Page 32

...developed and implemented to address local issues. ⦠⦠⦠Samsung Care Drive Samsung Electronics supports a variety of healthcare programs with its advanced medical equipment technology, products and services to promote the wellbeing and quality of life of local residents. We operate a mobile... -

Page 33

2014 Samsung Electronics Annual Report 030 031 11.3 hours Average number of our employee volunteer hours in Korea in 2014 523,109 Global social contributions in 2014 -

Page 34

... of the product life cycle, from resources to procureGreen Communications To share the value and benefits of Green Management, Samsung Electronics is expanding Green Communications to all our stakeholders, including global partners, employees, customer-tailored campaigns and community programs. In... -

Page 35

2014 Samsung Electronics Annual Report 032 033 53 37,594 million tons Amount of water we reused worldwide in 2014 % Reduction rate for our greenhouse gas emissions (KRW-based energy conversion as of end of 2013, based on 2008 standards) 92 3,027 products Number of our products certified green ... -

Page 36

...and Safety / Sharing Growth Creating Safe and Healthy Workplaces Building Health and Safety Management Systems Samsung Electronics makes every effort to operate safe workplaces and to protect employee health by creating comfortable and thoroughly safe conditions. Across our workplaces worldwide, we... -

Page 37

... of centers for education, career development, business consulting and win-win partnership research that together provide comprehensive and systematic support for first- and second-tier suppliers. The education center offers customized programs to train supplier employees. The career center helps... -

Page 38

...route to building a better world is to grow in harmony with people, community and the environment. Samsung Electronics helps people dream of brighter futures by offering education and job training programs. We help neighbors to anticipate better tomorrows by supporting healthcare and improved living... -

Page 39

... Auditor's Report 40 Consolidated Statements of Financial Position 42 Consolidated Statements of Income Consolidated Statements of Comprehensive Income 43 Consolidated Statements of Changes in Equity 46 Consolidated Statements of Cash Flows 47 Notes to the Consolidated Financial Statements -

Page 40

...'S REPORT To the Board of Directors and Shareholders of Samsung Electronics Co., Ltd. We have audited the accompanying consolidated financial statements of Samsung Electronics Co., Ltd. and its subsidiaries (collectively the "Group"), which comprise the consolidated statements of financial position... -

Page 41

2014 Samsung Electronics Annual Report 038 039 Auditor's responsibility Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with the Korean Standards on Auditing. Those standards require that we comply with ethical ... -

Page 42

...December 31, 2014 December 31, 2013 KRW Assets Current assets KRW USD USD Cash and cash equivalents Short-term financial instruments Short-term available-for-sale financial assets Trade receivables Non-trade receivables Advances Prepaid expenses Inventories Other current assets Assets held-for... -

Page 43

2014 Samsung Electronics Annual Report 040 041 (In millions of Korean won, in thousands of US dollars (Note 2.28)) Notes December 31, 2014 December 31, 2013 December 31, 2014 December 31, 2013 KRW Liabilities and Equity Current liabilities KRW USD USD Trade and other payables Short-term... -

Page 44

Financial Statements CONSOLIDATED STATEMENTS OF INCOME Samsung Electronics Co., Ltd. and its subsidiaries (In millions of Korean won, in thousands of US dollars (Note 2.28)) For the year ended December 31, Notes Revenue Cost of sales Gross profit 25 2014 2013 2014 2013 KRW 206,205,987 128,278,800... -

Page 45

2014 Samsung Electronics Annual Report 042 043 CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY Samsung Electronics Co., Ltd. and its subsidiaries (In millions of Korean won) 2013 KRW Note Preferred stock Common stock Share premium Retained earnings Other components of equity Accumulated ... -

Page 46

...5,573,394 150,016,010 Profit for the year Changes in value of availablefor-sale financial assets, net of tax Share of other comprehensive income (loss) of associates and joint ventures, net of tax Foreign currency translation, net of tax Remeasurement of net defined benefit liabilities, net of tax... -

Page 47

2014 Samsung Electronics Annual Report 044 045 (In thousands of US dollars (Note 2.28)) 2014 USD Note Preferred stock Common stock Share premium Retained earnings Other components of equity Accumulated other comprehensive income attributable to assets held-forsale - Equity ... -

Page 48

... STATEMENTS OF CASH FLOWS Samsung Electronics Co., Ltd. and its subsidiaries (In millions of Korean won, in thousands of US dollars (Note 2.28) For the year ended December 31, Notes 2014 2013 2014 2013 KRW Cash flows from operating activities KRW USD USD Profit for the year Adjustments Changes... -

Page 49

... IFRS") 1110, Consolidated Financial Statements. SEC, as the controlling company, consolidates its 158 subsidiaries, including Samsung Display and Samsung Electronics America (Note 1.2). The Group also applies the equity method of accounting to its 37 affiliates, including Samsung Electro-Mechanics... -

Page 50

... Marketing and services Sale of electronic devices Sale of electronic devices Technology business, Venture capital investments Sale of heating and cooling products Sale of smart home electronics Sale of printing solutions Sale of printing solutions Sale of electronic devices Holding Company Sale... -

Page 51

...Samsung Russia Service Centre (SRSC) Samsung Electronics (London) Limited (SEL) Samsung Denmark Research Center (SDRC) Samsung France Research Center (SFRC) Samsung Cambridge Solution Centre (SCSC) Samsung Electronics Switzerland GmbH (SESG) PrinterOn Europe Samsung Electronics Caucasus (SECC) Sale... -

Page 52

...equipment Sale of semiconductor/LCD Manufacture of electronic devices Toll processing of LCD Manufacture of LCD Manufacture of communication equipment Sale of mobile communication and network equipment R&D R&D Manufacture of semiconductor Manufacture of optical fiber/cable Services Medical equipment... -

Page 53

... Communication system services Manufacture of communication equipment Medical equipment Sale of electronic devices Manufacture of LCD 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 91.8 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 1 Ownership represents the Group... -

Page 54

... Statements (B) A summary of financial data of major consolidated subsidiaries is as follows: (1) 2014 2014 Assets Liabilities â,© 6,728,991 Sales â,© 24,980,628 Net Income (Loss) â,© 1,698,239 (In millions of Korean won) Samsung Display (SDC) Samsung Electronics America (SEA) Samsung (China... -

Page 55

...Electronics Annual Report 052 053 (2) 2013 2013 Assets Liabilities â,© 6,682,229 Sales â,© 29,386,907 (In millions of Korean won) Net Income (Loss) â,© 2,400,779 Samsung Display (SDC) Samsung Electronics America (SEA) Samsung (China) Investment (SCIC) Samsung Semiconductor (SSI) Samsung Austin... -

Page 56

... Acquisition of shares Incorporation Incorporation Incorporation America RT SV CO-INVEST (RT-SV) Quietside SmartThings PrinterOn PrinterOn America 1397011 Ontario Europe PrinterOn Europe Samsung Electronics Caucasus (SECC) Middle East and Africa Asia Samsung Electronics South Africa Production... -

Page 57

2014 Samsung Electronics Annual Report 054 055 2. Summary of Significant Accounting Policies The principal accounting policies applied in the preparation of these consolidated financial statements are set out below. These policies have been consistently applied to all the years presented, unless ... -

Page 58

.... If there is any objective evidence that the investment in the associate is impaired, the Group recognizes the difference between the recoverable amount of the associate and its book value as impairment loss. (F) Joint arrangements The results and financial position of all the foreign entities... -

Page 59

... banks, and other short-term highly liquid investments that are readily convertible to a known amount of cash and are subject to an insignificant risk of change in value. (B) Recognition and measurement Regular purchases and sales of financial assets are recognized on the trade date. At initial... -

Page 60

... useful lives Buildings and structures Machinery and equipment Other 15, 30 years 5 years 5 years The depreciation method, residual values and useful lives of property, plant and equipment are reviewed, and adjusted if appropriate, at the end of each reporting period. An asset's carrying amount... -

Page 61

2014 Samsung Electronics Annual Report 058 059 2.13 Impairment of Non-Financial Assets Goodwill or intangible assets with indefinite useful lives are not subject to amortization and are tested annually for impairment. Assets that are subject to amortization are reviewed for impairment whenever ... -

Page 62

... in the ordinary course of the Group's activities. Revenue is shown net of value-added tax, returns, sales incentives and discounts and after eliminating intercompany transactions. the dividends are approved. 2.23 Share Capital Common shares and preferred shares with no repayment obligations are... -

Page 63

...These consolidated financial statements were approved by the Board of Directors on January 29, 2015. 2.25 Government Grants Government grants are recognized at their fair values when there is reasonable assurance that the grant will be received and the Group will comply with the conditions attached... -

Page 64

... assets â,© 13,919 202 15 The fair value of financial instruments that are not traded in an active market is determined by using a variety of methods and assumptions that are mainly based on market conditions existing at the end of each reporting period. (D) Net defined benefit liabilities... -

Page 65

2014 Samsung Electronics Annual Report 062 063 6. Financial Instruments by Category (A) Categorizations of financial assets and liabilities as at December 31, 2014 and 2013, are as follows: (1) As at December 31, 2014 Assets Assets at fair value through profit or loss â,©Loans and receivables â,©... -

Page 66

...Loss on valuation/disposal (profit or loss) Interest expense Foreign exchange differences (profit or loss) - 466,371 (343,865) 126,569 61,644 592,940 (282,221) (2) As at December 31, 2013 Financial Assets Assets at fair value through profit or loss â,©Loans and receivables â,©Available-for-sale... -

Page 67

2014 Samsung Electronics Annual Report 064 065 7. Credit Quality of Financial Assets The credit quality of financial assets that are neither past due nor impaired is assessed by reference to external credit ratings as at December 31, 2014 and 2013, as follows: • Superior ability to repay: Aaa-... -

Page 68

... 31, 2014, the Group's ownership interest in Samsung SDI decreased. Consequently, KRW 1,550,241 million was reclassified from investment in associate to available-for-sale financial assets. Changes in valuation gains (losses) recognized in equity (other comprehensive income) on short-term available... -

Page 69

...: 2014 Number of Shares Owned Percentage of Ownership (%) (In millions of Korean won, number of shares and percentage) 2013 Acquisition Cost â,© 2,180,953 Book Value (Market Value) â,© 1,561,670 Book Value (Market Value) â,©- Samsung SDI Samsung Heavy Industries Samsung Fine Chemicals Hotel... -

Page 70

... 50,356 899,469 â,©1,056,769 Changes in valuation gain (loss) on long-term available-for-sale financial assets for the years ended December 31, 2014 and 2013, are as follows: 2014 (In millions of Korean won) 2013 â,©2,572,755 Balance as at January 1 Fair value gain (loss) Net (loss) transferred... -

Page 71

... to credit risk at the reporting date is the carrying value of each class of receivable mentioned above. As at December 31, 2014, the Group has credit insurance with Korea Trade Insurance and overseas insurance companies against its export accounts receivables. In accordance with the terms of... -

Page 72

... ventures as at December 31, 2014 and 2013, are as follows: (1) Investments in associates Investee Acquisition cost 2014 Net asset value of equity shares1 â,© 2,393,185 Book value â,© 2,354,026 (In millions of Korean won) Samsung Card Samsung Electro-Mechanics Samsung SDS Other Total â,© 1,538,540... -

Page 73

... of acquisitions, disposals, dividends, effects of changes in foreign exchange rates and reclassifications. During the year ended December 31, 2014, the Group's ownership interest in Samsung SDI decreased. Consequently, the investment was reclassified to available-for-sale financial assets. During... -

Page 74

... the book value of investments in associates, and dividends received (In millions of Korean won) from associates as at and for the years ended December 31, 2014 and 2013, is as follows: Investee Samsung Card1 1. Condensed financial information Condensed statement of financial position: 2014 Samsung... -

Page 75

2014 Samsung Electronics Annual Report 072 073 (In millions of Korean won) Investee Samsung Card1 1. Condensed financial information Condensed statement of financial position: Samsung ElectroMechanics 2013 Samsung SDI Samsung SDS Samsung Techwin Current assets Non-current assets Current ... -

Page 76

... the book value of investments in joint ventures, and dividends from (In millions of Korean won) joint ventures as at and for the years ended December 31, 2014 and 2013, is as follows: Investee 2014 Samsung Corning Advanced Glass 1. Condensed financial information Condensed statements of financial... -

Page 77

...Samsung Electronics Annual Report 074 075 (F) Fair value of marketable investments in associates as at December 31, 2014 and 2013, is as follows: 2014 Number of shares held (In millions of Korean won and number of shares) 2013 Market value â,© 967,812 Market value â,© 1,291,595 Samsung Electro... -

Page 78

... and equipment for the years ended December 31, 2014 and 2013, are as follows: 2014 (In millions of Korean won) 2013 â,© 14,053,512 Cost of sales Selling and administrative expenses Total â,© 15,309,212 1,600,814 â,© 16,910,026 1,416,500 â,© 15,470,012 14. Intangible Assets (A) Changes in... -

Page 79

... growth rate assumption is used for perpetual cash flow calculation. (1) For the year ended December 31, 2014, pursuant to the results of the goodwill impairment reviews performed, the Group recognized an impairment of KRW 7,838 million on goodwill recognized at Samsung France Research Center (SFRC... -

Page 80

Financial Statements 15. Borrowings (A) Details of the carrying amounts of borrowings as at December 31, 2014 and 2013, are as follows: Financial Institutions Short-term borrowings Annual Interest Rates (%) as at December 31, 2014 2014 (In millions of Korean won) 2013 Collateralized borrowings1 ... -

Page 81

2014 Samsung Electronics Annual Report 078 079 16. Debentures Details of the carrying amount of debentures as at December 31, 2014 and 2013, are as follows: 2014 (In millions of Korean won) 2013 â,© 198,566 Korean won denominated debentures (A) Foreign currency denominated debentures (B) Total... -

Page 82

...Other Benefits paid Foreign exchange differences Other Balance as at December 31 2014 2013 â,© 836,916 Current service cost Net interest cost Past service cost Other Total â,© 959,182 104,040 132,286 29,994 â,©1,225,503 82,487 8,164 â,© 927,567 (F) Changes in the fair value of plan assets for... -

Page 83

... 6,490,800 Other includes effects of changes in foreign currency exchange rates. (A) The Group accrues warranty reserves for estimated costs of future service, repairs and recalls, based on historical experience and terms of warranty programs. (B) The Group recognizes provisions for the estimated... -

Page 84

... against the investee's debt (Note 9). (B) Leases The Group leases certain property, plant and equipment under vtarious finance lease arrangements and recognizes the related amounts as lease assets or liabilities. Assets with a net book value of KRW 102,569 million (2013: KRW 110,655 million) are... -

Page 85

2014 Samsung Electronics Annual Report 082 083 (D) Other commitments As at December 31, 2014, the Group has a trade financing agreement, trade notes receivable discounting facilities, and loan facilities with accounts receivable pledged as collateral with 15 financial institutions, including ... -

Page 86

Financial Statements 22. Dividends Details of interim and year-end dividends are as follows: (A) Interim dividends (Record date: June 30, 2014 and 2013) 2014 (In millions of Korean won and number of shares) 2013 Number of shares eligible for dividends Dividend rate Dividend amount Common stock ... -

Page 87

2014 Samsung Electronics Annual Report 084 085 24. Share-Based Compensation The Group has a stock option plan that provides for the granting of stock purchase options to employees or directors who have contributed, or are expected to contribute, to the management and technological innovation of ... -

Page 88

...ended December 31, 2014 and (In millions of Korean won) 2013, are as follows: 2014 Financial income 2013 Wages and salaries Pension Commissions and service charges Depreciation Amortization Advertising Sales promotion Transportation Warranty Other 2) Research and development expenses â,© 5,214,171... -

Page 89

... Samsung Electronics Annual Report 086 087 29. Income Tax (A) Income tax expense for the years ended December 31, 2014 and 2013, consists of: 2014 (In millions of Korean won) 2013 Current taxes: Current tax on profits for the year Adjustments in respect to prior years Deferred taxes: Changes... -

Page 90

Financial Statements (C) Changes in deferred income tax assets and liabilities resulting from the tax effect of temporary differences for the years ended December 31, 2014 and 2013, are as follows: (1) 2014 Temporary Differences Balance as at January 1 Deferred tax arising from temporary ... -

Page 91

2014 Samsung Electronics Annual Report 088 089 (2) 2013 Temporary Differences Balance as at January 1 Deferred tax arising from temporary differences Increase (Decrease) Balance as at December 31 (In millions of Korean won) Deferred Income Tax Assets (Liabilities) Balance as at January 1 ... -

Page 92

... of Korean won, except per share data, and thousands of number of shares) (1) Common stock 2014 2013 â,© 29,821,215 Profit attributable to owners of the Parent company Profit available for common stock Weighted-average number of common shares outstanding Basic earnings per share â,© 23,082,499 20... -

Page 93

...Adjustments 2014 (In millions of Korean won) 2013 Adjustments for: Income tax expense Financial income Financial costs Severance and retirement benefits Depreciation Amortization Bad debt expenses Gain on valuation of equity method investments Gain on disposal of property, plant and equipment Loss... -

Page 94

...,245) (B) The Group's statements of cash flows are prepared using indirect method. Significant transactions not affecting cash flows for the years ended December 31, 2014 (In millions of Korean won) and 2013, are as follows: 2014 2013 â,© 1,271,817 Valuation of available-for-sale financial assets... -

Page 95

...management officers are dispatched to the regional headquarters of each area including the United States, England, Singapore, China, Japan, Brazil and Russia to operate the local finance center in accordance with global financial risk management. The Group's financial assets that are under financial... -

Page 96

... of the statement of financial position, and future cash flows of interest income (expenses) of a financial instrument, will fluctuate because of changes in market interest rates. The Group is exposed to interest rate risk mainly through interest bearing liabilities and assets. The Group's position... -

Page 97

...equity in the consolidated financial statements. The Group's capital risk management policy has not changed since the fiscal year ended December 31, 2013. As at December 31, 2014, the Group has maintained an A+ and A1 credit rating from S&P and Moody's, respectively, on its long term debt. The total... -

Page 98

... 31, 2014 and 2013 are as follows: 2014 Carrying amount Fair value 2013 Carrying amount Fair value (In millions of Korean won) Financial assets Cash and cash equivalents1 Short-term financial instruments1 Short-term available-for-sale financial assets Trade receivables1 Long-term available-for-sale... -

Page 99

...) The fair value of financial instruments traded in active markets is based on quoted market prices at the statement of financial position date. A market is regarded as active if quoted prices are readily and regularly available from an exchange, dealer, broker, industry group, pricing service, or... -

Page 100

Financial Statements (3) Valuation technique and the inputs The Group utilizes a present value technique to discount future cash flows at a proper interest rate for corporate bonds, government and public bonds, and bank debentures that are classified as Level 2 in the fair value hierarchy. The ... -

Page 101

2014 Samsung Electronics Annual Report 098 099 (5) Sensitivity analysis for recurring fair value measurements categorized within Level 3 Sensitivity analysis of financial instruments is performed to measure favorable and unfavorable changes in the fair value of financial instruments which are ... -

Page 102

... the operating segments based on these reports. The Management Committee reviews operating profits of each operating segment in order to assess performance and to make decisions about allocating resources to the segment. The operating segments are product based and include CE, IM, Semiconductor... -

Page 103

... of non-current assets other than financial instruments, deferred tax assets, and investments in associates and joint ventures. (In millions of Korean won) 2013 Korea America Europe Asia and Africa China Intercompany elimination within the group Consolidated Net segment revenue Non-current... -

Page 104

... December 31, 2014, the Group sold all of its Samsung Corning Precision Materials shares. During the year ended December 31, 2014, Samsung Everland changed its name to Cheil Industries Inc. (In millions of Korean won) 2013 Name of Company1 Sales â,© 35,166 Disposal of fixed assets â,© 130,771... -

Page 105

2014 Samsung Electronics Annual Report 102 103 (B) Balances of receivables and payables Balances of receivables and payables arising from sales and purchases of goods and services as at December 31, 2014 and 2013, are as follows: 2014 Name of Company1 Receivables â,© 3,353 (In millions of ... -

Page 106

... to the Group before intercompany eliminations is as follows: (1) Summarized consolidated statements of financial position Samsung Display and its subsidiaries December 31, 2014 December 31, 2013 â,© 14,473,616 (In millions of Korean won) Current assets Non-current assets Current liabilities... -

Page 107

2014 Samsung Electronics Annual Report 104 105 (2) Summarized consolidated statements of comprehensive income Samsung Display and its subsidiaries 2014 (In millions of Korean won) 2013 â,© 29,478,707 Sales Net income Other comprehensive income Total comprehensive income attributable to: Owners... -

Page 108

Financial Statements 36. Business Combination Samsung Electronics America, the Group's subsidiary, acquired 100% of the equity shares of SmartThings on August 18, 2014. (A) Overview of the acquired company Name of the acquired company SmartThings, Inc. 37. Non-current Assets Held-for-Sale (Assets ... -

Page 109

...subsidiary of the Group, merged with Samsung Telecommunications America (STA), also a subsidiary of the Group. The merger was between two subsidiaries under common control, therefore, the merger was accounted for by transferring the book values on the consolidated financial statements. No additional... -

Page 110

...31/32 Mapletree Business City, Singapore 117440 Samsung Electronics Southeast Asia Headquarters (DS) Samsung Asia Pte Ltd, 3 Church Street, #26-01 Samsung Hub, Singapore 049483 India Samsung Electronics Southwest Asia Headquarters 2nd, 3rd & 4th Floor, Tower - C, Vipul Tech Square, Sector - 43, Golf... -

Page 111

...-1111 MIDDLE EAST & AFRICA Egypt Samsung Electronics Egypt (Product) (SEEG-P), Beni Suef Tel: 20-2-2528-5971 South Africa Samsung Electronics South Africa (Pty) Production Ltd (SSAP), Durban Tel: 27-11-549-1500 SALES NETWORK ASIA PACIFIC China Samsung China Investment Company (SCIC), Beijing Tel... -

Page 112

... Samsung Electronics Caucasus Company (SECC), Baku Tel: 994-12-499-8950 NORTH AMERICA Canada Samsung Electronics Canada Inc. (SECA), Toronto Tel: 905-542-3535 USA Samsung Electronics America Inc. (SEA), New Jersey Tel: 1-201-229-4000 Mexico Samsung Electronics Mexico (Sales) (SEM-S), Mexico City... -

Page 113

110 www.samsung.com -

Page 114