PG&E 2007 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.97

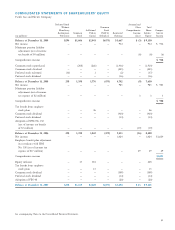

There was no material difference between PG&E

Corporation’s and the Utility’s accumulated other compre-

hensive income (loss) for the periods presented above.

REVENUE RECOGNITION

Electricity revenues, which are comprised of revenue from

generation, transmission, and distribution services, are billed

to the Utility’s customers at the CPUC-approved “bundled”

electricity rate. The “bundled” electricity rate also includes

the rate component set by the FERC for electric transmis-

sion services. Natural gas revenues, which are comprised

of transmission and distribution services, are also billed at

CPUC-approved rates. The Utility’s revenues are recognized

as electricity and natural gas are delivered, and include

amounts for services rendered but not yet billed at the

end of each year.

As further discussed in Note 17, in January 2001, the

California Department of Water Resources (“DWR”), began

purchasing electricity to meet the portion of demand of

the California investor-owned electric utilities that was not

being satisfi ed from their own generation facilities and exist-

ing electricity contracts. Under California law, the DWR is

deemed to sell the electricity directly to the Utility’s retail

customers, not to the Utility. The Utility acts as a pass-

through entity for electricity purchased by the DWR on

behalf of its customers. Although charges for electricity pro-

vided by the DWR are included in the amounts the Utility

bills its customers, the Utility deducts the amounts passed

through to the DWR from its electricity revenues. The pass-

through amounts are based on the quantities of electricity

provided by the DWR that are consumed by customers at

the CPUC-approved remittance rate. These pass-through

amounts are excluded from the Utility’s electricity revenues

in its Consolidated Statements of Income.

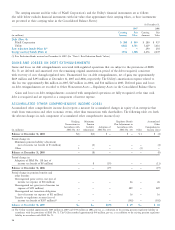

EARNINGS PER SHARE

PG&E Corporation applies the treasury stock method of

refl ecting the dilutive effect of outstanding stock-based com-

pensation in the calculation of diluted earnings per common

share (“EPS”) in accordance with SFAS No. 128, “Earnings

Per Share” (“SFAS No. 128”). Under SFAS No. 128, PG&E

Corporation is required to assume that shares underlying

stock options, other stock-based compensation, and war-

rants are issued and that the proceeds received by PG&E

Corporation from the exercise of these options and warrants

are assumed to be used to purchase common shares at the

average market price during the reported period. The incre-

mental shares, the difference between the number of shares

assumed to have been issued upon exercise and the number

of shares assumed to have been purchased, is included in

weighted average common shares outstanding for the pur-

pose of calculating diluted EPS.

INCOME TAXES

PG&E Corporation and the Utility use the liability method

of accounting for income taxes. Income tax expense (benefi t)

includes current and deferred income taxes resulting from

operations during the year. Investment tax credits are amor-

tized over the life of the related property.

PG&E Corporation fi les a consolidated U.S. federal

income tax return that includes domestic subsidiaries in

which its ownership is 80% or more. In addition, PG&E

Corporation fi les a combined state income tax return in

California. PG&E Corporation and the Utility are parties to

a tax-sharing arrangement under which the Utility determines

its income tax provision (benefi t) on a stand-alone basis.

SHARE-BASED PAYMENT

On January 1, 2006, PG&E Corporation and the Utility

adopted the provisions of SFAS No. 123R, “Share-Based

Payment” (“SFAS No. 123R”), using the modifi ed prospective

application method which requires that compensation cost

be recognized for all share-based payment awards, including

unvested stock options, based on the grant-date fair value.

SFAS No. 123R requires that an estimate of future forfei-

tures be made and that compensation cost be recognized

only for share-based payment awards that are expected to

vest. Prior to January 1, 2006, PG&E Corporation and the

Utility accounted for share-based payment awards, such as

stock options, restricted stock, and other share-based incen-

tive awards, under the recognition and measurement provi-

sions of Accounting Principles Board Opinion No. 25,

“Accounting for Stock Issued to Employees” (“Opinion 25”)

as permitted by SFAS No. 123, “Accounting for Stock-Based

Compensation” (“SFAS No. 123”). Under the provisions of

Opinion 25, PG&E Corporation and the Utility did not

recognize compensation cost for stock options for periods

prior to January 1, 2006 because the exercise prices of all

stock options were equal to the market value of the under-

lying common stock on the date of grant of the options.

Prior to the adoption of SFAS No. 123R, PG&E

Corporation and the Utility expensed share-based awards

over the stated vesting period regardless of terms that acceler-

ate vesting upon retirement. Subsequent to the adoption of