PG&E 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

ineffective portions of the change in the fair value of the

derivative instrument, to the extent they are recoverable

through rates, are deferred and recorded in regulatory accounts.

Cash fl ow hedge accounting is discontinued prospectively

if it is determined that the derivative instrument no longer

qualifi es as an effective hedge, or when the forecasted

transaction is no longer probable of occurring. If cash fl ow

hedge accounting is discontinued, the derivative instrument

con tinues to be refl ected at fair value, with any subsequent

changes in fair value recognized immediately in earnings.

Gains and losses previously recorded in accumulated other

comprehensive income (loss) will remain there until the

hedged item is recognized in earnings, unless the forecasted

transaction is probable of not occurring, in which case

the gains and losses from the derivative instrument will be

immediately recognized in earnings. A hedged item is recog-

nized in earnings when it matures or is exercised. Any gains

and losses that would have been recognized in earnings or

deferred in accumulated other comprehensive income (loss),

to the extent they are recoverable through rates, are deferred

and recorded in regulatory accounts.

Net realized and unrealized gains or losses on deriva-

tive instruments are included in various items in PG&E

Corporation’s and the Utility’s Consolidated Statements of

Income, including Cost of Electricity and Cost of Natural

Gas. Cash infl ows and outfl ows associated with the settle-

ment of price risk management activities are recognized

in operating cash fl ows in PG&E Corporation’s and the

Utility’s Consolidated Statements of Cash Flows.

The fair value of derivative instruments is estimated

using the mid-point of quoted bid and asked forward prices,

including quotes from brokers, and electronic exchanges,

supplemented by online price information from news

services. When market data is not available, proprietary

models are used to estimate fair value.

The Utility has derivative instruments for the physical

delivery of commodities transacted in the normal course of

business as well as non-fi nancial assets that are not exchange-

traded. These derivative instruments are eligible for the

normal purchase and sales and non-exchange traded contract

exceptions under SFAS No. 133, and are not refl ected in

the Utility’s Consolidated Balance Sheets at fair value. They

are recorded and recognized in income under the accrual

method of accounting. Therefore, expenses are recognized

as incurred.

The Utility has certain commodity contracts for the pur-

chase of nuclear fuel and core gas transportation and storage

contracts that are not derivative instruments and are not

refl ected in the Utility’s Consolidated Balance Sheets at fair

value. Expenses are recognized as incurred.

See Note 12 of the Notes to the Consolidated Financial

Statements.

ADOPTION OF NEW ACCOUNTING

PRONOUNCEMENTS

Accounting for Uncertainty in Income Taxes

On January 1, 2007, PG&E Corporation and the Utility

adopted the provisions of FASB Interpretation No. 48,

“Accounting for Uncertainty in Income Taxes” (“FIN 48”).

FIN 48 clarifi es the accounting for uncertainty in income

taxes. FIN 48 prescribes a two-step process in the recognition

and measurement of a tax position taken or expected to be

taken in a tax return. The fi rst step is to determine if it is

more likely than not that a tax position will be sustained

upon examination by taxing authorities based on the merits

of the position. If this threshold is met, the second step is

to measure the tax position in PG&E Corporation’s and the

Utility’s Consolidated Balance Sheets by using the largest

amount of benefi t that is greater than 50% likely of being

realized upon ultimate settlement. The difference between a

tax position taken or expected to be taken in a tax return

and the benefi t recognized and measured pursuant to FIN 48

represents an unrecognized tax benefi t. An unrecognized tax

benefi t is a liability that represents a potential future obliga-

tion to the taxing authority.

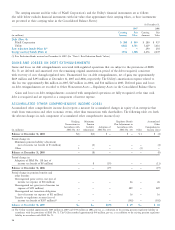

The effects of adopting FIN 48 were as follows:

PG&E

(in millions) Corporation Utility

At January 1, 2007

Cumulative effect of adoption — decrease

to Beginning Reinvested Earnings $18 $20

A reconciliation of the beginning and ending amount of

unrecognized tax benefi ts is as follows:

PG&E

(in millions) Corporation Utility

Balance at January 1, 2007 $ 212 $ 90

Additions for tax position of prior years 15 4

Reductions for tax position of prior years (18) —

Balance at December 31, 2007 $209 $94

The component of unrecognized tax benefi ts that, if rec-

ognized, would affect the effective tax rate at December 31,

2007 for PG&E Corporation and the Utility is $110 million

and $63 million, respectively.