PG&E 2007 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113

In recent months PG&E Corporation reached settlements

on a number of its open tax years with the IRS.

In the fi rst quarter of 2008, PG&E Corporation reached

a settlement with the IRS appellate division for tax years

1997–2000. This settlement would not result in material

changes to unrecognized tax benefi ts recognized under FIN

48, and it would resolve all open issues for those years with

the exception of reserving the right to fi le two refund claims.

The most signifi cant claim relates to the deferral of gains

from power plant sales and income from recovery of

transition costs during 1998 and 1999.

In addition, during the fi rst quarter of 2008, PG&E

Corporation reached a tentative settlement with the IRS for

tax years 2001–2002. The IRS has indicated that it intends

to apply aspects of this tentative settlement to resolution of

later tax years. That settlement, if fi nalized, would resolve

several signifi cant deductions taken in the 2002 tax return

with respect to assets abandoned at NEGT, as well as issues

affecting the Utility. However, this settlement would be

subject to approval by the Joint Committee on Taxation.

Two issues are not part of the audit settlement and will be

referred to the IRS appellate division. The most signifi cant

of these is a dispute over PG&E Corporation’s entitlement

to $104 million in synthetic fuel tax credits.

The IRS also has indicated that it intends to complete

its audit examination of tax years 2003–2004 by June 2008.

Based on the IRS’ proposed adjustments, this audit could be

resolved within the next 18 months.

Currently, PG&E Corporation has $247 million of federal

capital loss carry forwards based on tax returns as fi led from

the disposition of NEGT stock in 2004, which, if not used

by December 2009, will expire. The settlement of the 2001–

2002 audit together with the completion of the 2003–2004

audit could result in utilization of a signifi cant portion of

the federal capital loss carry forwards. However, because the

settlement of the 2003–2004 audit remains uncertain, no

benefi ts have been recognized.

The settlement of the 2001–2002 audit and the comple-

tion of the 2003–2004 audit could also result in net changes

to unrecognized tax benefi ts currently recorded pursuant to

FIN 48 (see Note 2 for further discussion of the impact of

adopting FIN 48).

The California Franchise Tax Board is currently auditing

PG&E Corporation’s 2004 and 2005 combined California

income tax returns. To date, no adjustments have been pro-

posed. In addition to the federal capital loss carry forwards,

PG&E Corporation has $2.1 billion of California capital loss

carry forwards based on tax returns as fi led, the majority of

which, if not used by 2008, will expire. PG&E Corporation

believes it has accrued adequate reserves for tax years that are

open for California tax purposes.

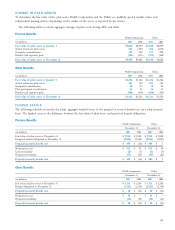

NOTE 12: DERIVATIVES

AND HEDGING ACTIVITIES

The Utility enters into contracts to procure electricity, natu-

ral gas, nuclear fuel, and fi rm electricity transmission rights.

Some of these contracts meet the defi nition of derivative

instruments under SFAS No. 133. All derivative instruments,

including instruments designated as cash fl ow hedges, are

recorded at fair value and presented as price risk manage-

ment assets and liabilities on the balance sheet (see table

below). Changes in the fair value of derivative instruments

are deferred and recorded in regulatory accounts because

they are expected to be recovered or refunded through

regulated rates. Under the same regulatory accounting treat-

ment, changes in the fair value of cash fl ow hedges are also

recorded in regulatory accounts, rather than being deferred

in accumulated other comprehensive income.

On PG&E Corporation’s and the Utility’s Consolidated

Balance Sheets, price risk management assets and liabilities

associated with the Utility’s electricity and gas procurement

activities are presented on a net basis by counterparty as

the right of offset exists, resulting in a net asset or liability

as follows:

Derivatives

December 31, December 31,

(in millions) 2007 2006

Current Assets — Prepaid expenses

and other $ 52 $ 16

Other Noncurrent Assets — Other 125 37

Current Liabilities — Other 83 192

Noncurrent Liabilities — Other 20 50