PG&E 2007 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.46

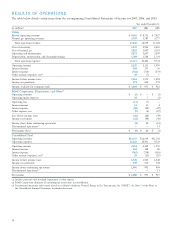

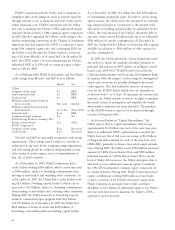

Depreciation, Amortization, and Decommissioning

The Utility’s depreciation, amortization, and decommission-

ing expenses increased by approximately $61 million, or 4%,

in 2007 compared to 2006, mainly due to an approximately

$121 million increase in depreciation expense as a result

of depreciation rate changes and plant additions in 2007

authorized by the 2007 GRC decision. This was partially

offset by:

• The Utility recorded lower decommissioning expense of

approximately $53 million as a result of the 2007 GRC

decision to refund over-collections of decommissioning

expense to customers.

• Other depreciation, amortization, and decommissioning

expenses, including amortization of the ERB regulatory

asset, decreased by $7 million.

The Utility’s depreciation, amortization, and decommission-

ing expenses decreased by approximately $26 million, or 1%,

in 2006 compared to 2005, refl ecting the following factors:

• The Utility recorded approximately $141 million in 2005

for amortization of the settlement regulatory asset. The

settlement regulatory asset was refi nanced with the issu-

ance of the fi rst series of ERBs on February 10, 2005. The

Utility recorded approximately $137 million in 2006 related

to the amortization of the ERB regulatory asset. During

2005, the Utility amortized only the ERB regulatory asset

for the fi rst series of ERBs that were issued on February 10,

2005. During 2006, the Utility amortized the ERB regula-

tory asset for the second series of ERBs that were issued

on November 9, 2005 in addition to the fi rst series. The

Utility did not have a similar expense related to the settle-

ment regulatory asset in 2006.

• In 2005, the Utility recorded depreciation expense of

approximately $30 million related to recovery of capital

plant costs associated with electric industry restructuring

costs that a December 2004 settlement agreement allowed

the Utility to collect through rates in 2005. There was no

similar depreciation expense in 2006.

• Amortization of the regulatory asset related to Rate

Reduction Bonds (“RRBs”), decreased by approximately

$19 million in 2006, compared to 2005, due to the

declining balance of the RRBs.

These were partially offset by the following:

• Depreciation expense increased by approximately $35 mil-

lion as a result of plant additions in 2006.

The Utility’s depreciation, amortization, and decommis-

sioning expenses in subsequent years are expected to increase

as a result of an overall increase in capital expenditures and

implementation of depreciation rates authorized by the 2007

GRC decision.

Interest Income

The Utility’s interest income decreased by approximately

$25 million, or 14%, in 2007 compared to 2006. In 2006,

the FERC approved the Utility’s recovery of SC costs it had

previously incurred, including interest of approximately

$47 million. No similar amount was recognized in 2007. This

decrease was partially offset by the receipt of approximately

$16 million in 2007 related to the settlement of Internal

Revenue Service refund claims. In addition, other interest

income, including interest income associated with certain

balancing accounts, increased by approximately $6 million.

The Utility’s interest income increased by approximately

$99 million, or 130%, in 2006 compared to 2005, primarily

due to an increase in interest earned on escrow related to

Disputed Claims, the FERC’s approval of the Utility’s recov-

ery of SC costs, including interest, and an increase in interest

rates associated with certain regulatory balancing accounts.

These increases were partially offset by a decrease in interest

earned in 2006, as compared to 2005, on short-term invest-

ments as a result of lower short-term investment balances.

The Utility’s interest income in 2008 will be primarily

affected by changes in the amount of escrowed funds related

to Disputed Claims and interest rate levels.

Interest Expense

The Utility’s interest expense increased by approximately

$22 million, or 3%, in 2007 compared to 2006, primarily

due to an approximately $19 million increase in interest

expense related to Disputed Claims primarily due to an

increase in the interest rate. (See Note 15 of the Notes to

the Consolidated Financial Statements.) In addition, interest

expense related to $1.2 billion in long-term debt issued

in 2007 and variable rate pollution control bond loan

agreements increased by approximately $40 million. These

increases were partially offset by a reduction of approxi-

mately $34 million in the interest expense related to the

ERBs and RRBs as their balances decline. In addition, other

interest expense, including lower interest expense on balances

in certain regulatory balancing accounts, decreased approxi-

mately $3 million.