PG&E 2007 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.110

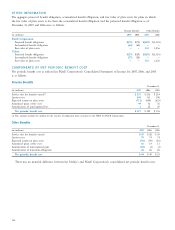

NOTE 9: PREFERRED STOCK

PG&E Corporation has authorized 85 million shares of

preferred stock, which may be issued as redeemable or non-

redeemable preferred stock. No preferred stock of PG&E

Corporation has been issued.

UTILITY

The Utility has authorized 75 million shares of $25 par value

preferred stock and 10 million shares of $100 par value pre-

ferred stock. The Utility specifi es that 5,784,825 shares of the

$25 par value preferred stock authorized are designated as

nonredeemable preferred stock without mandatory redemp-

tion provisions. The remainder of the 75 million shares

of $25 par value preferred stock and the 10 million shares of

$100 par value preferred stock may be issued as redeemable

or nonredeemable preferred stock.

At December 31, 2007 and 2006, the Utility had issued

and outstanding 5,784,825 shares of nonredeemable $25 par

value preferred stock without mandatory redemption provi-

sions. Holders of the Utility’s 5.0%, 5.5%, and 6.0% series

of nonredeemable $25 par value preferred stock have rights

to annual dividends ranging from $1.25 to $1.50 per share.

At December 31, 2007 and 2006, the Utility had issued

and outstanding 4,534,958 shares of redeemable $25 par

value preferred stock without mandatory redemption provi-

sions. The Utility’s redeemable $25 par value preferred stock

is subject to redemption at the Utility’s option, in whole

or in part, if the Utility pays the specifi ed redemption price

plus accumulated and unpaid dividends through the redemp-

tion date. At December 31, 2007, annual dividends ranged

from $1.09 to $1.25 per share and redemption prices

ranged from $25.75 to $27.25 per share.

The last of the Utility’s redeemable $25 par value preferred

stock with mandatory redemption provisions was redeemed

on May 31, 2005. Currently the Utility does not have any

shares of the $100 par value preferred stock with or without

mandatory redemption provisions outstanding.

Dividends on all Utility preferred stock are cumulative.

All shares of preferred stock have voting rights and an equal

preference in dividend and liquidation rights. During the

year ended December 31, 2005, the Utility paid approxi-

mately $16 million of dividends on preferred stock without

mandatory redemption provisions and approximately

$5 million of dividends on preferred stock with mandatory

redemption provisions. During the years ended December 31,

2007 and December 31, 2006, the Utility paid approximately

$14 million of dividends on preferred stock without man-

datory redemption provisions. On December 19, 2007, the

Board of Directors of the Utility declared a cash dividend

on various series of its preferred stock totaling approximately

$3 million that was paid on February 15, 2008 to sharehold-

ers of record on January 31, 2008. Upon liquidation or dis-

solution of the Utility, holders of preferred stock would be

entitled to the par value of such shares plus all accumulated

and unpaid dividends, as specifi ed for the class and series.

On June 15, 2005, the Utility’s Board of Directors

authorized the redemption of all of the outstanding shares

of the Utility’s 7.04% Redeemable First Preferred Stock

totaling approximately $36 million aggregate par value

plus approximately $1 million related to a $0.70 per share

redemption premium. This issue was fully redeemed on

August 31, 2005. In addition to the $25 per share redemp-

tion price, holders of the 7.04% Redeemable First Preferred

Stock received an amount equal to all accumulated and

unpaid dividends through August 31, 2005 on such shares

totaling approximately $211,000.

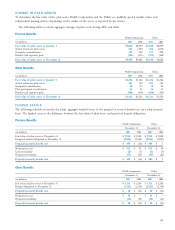

NOTE 10: EARNINGS PER SHARE

EPS is calculated, utilizing the “two-class” method, by divid-

ing the sum of distributed earnings to common shareholders

and undistributed earnings allocated to common sharehold-

ers by the weighted average number of common shares

outstanding during the period. In applying the “two-class”

method, undistributed earnings are allocated to both com-

mon shares and participating securities. PG&E Corporation’s

Convertible Subordinated Notes are entitled to receive pass-

through dividends and meet the criteria of a participating

security. All PG&E Corporation’s participating securities

participate on a 1:1 basis with shares of common stock.

PG&E Corporation applies the treasury stock method of

refl ecting the dilutive effect of outstanding stock-based com-

pensation in the calculation of diluted EPS in accordance

with SFAS No. 128. SFAS No. 128 requires that proceeds

from the exercise of options and warrants are assumed to

be used to purchase shares of common stock at the average

market price during the reported period. The incremental

shares (the difference between the number of shares assumed

issued upon exercise and the number of shares assumed

purchased) must be included in the number of weighted

average shares of common stock used for the calculation

of diluted EPS.