PG&E 2007 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

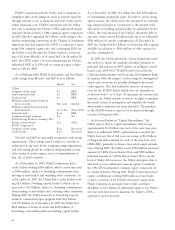

The following table summarizes the Utility’s net credit risk exposure to its wholesale customers and counterparties, as well

as the Utility’s credit risk exposure to its wholesale customers or counterparties with a greater than 10% net credit exposure,

at December 31, 2007 and December 31, 2006:

Net

Number of Exposure to

Gross Credit Wholesale Wholesale

Exposure Customers or Customers or

Before Credit Credit Net Credit Counterparties Counterparties

(in millions) Collateral(1) Collateral Exposure(2) >10% >10%

December 31, 2007 $311 $91 $220 2 $111

December 31, 2006 $255 $87 $168 2 $113

(1) Gross credit exposure equals mark-to-market value on fi nancially settled contracts, notes receivable, and net receivables (payables) where netting is

contractually allowed. Gross and net credit exposure amounts reported above do not include adjustments for time value or liquidity.

(2) Net credit exposure is the gross credit exposure minus credit collateral (cash deposits and letters of credit). For purposes of this table, parental guarantees

are not included as part of the calculation.

CONTINGENCIES

PG&E Corporation and the Utility have signifi cant contingencies that are discussed in Note 17 of the Notes to the

Consolidated Financial Statements.

REGULATORY MATTERS

The Utility is subject to substantial regulation. Set forth below are matters pending before the CPUC, the FERC, and the

Nuclear Regulatory Commission (“NRC”), the resolutions of which may affect the Utility’s and PG&E Corporation’s results

of operations or fi nancial condition.

2008 Cost of Capital Proceeding

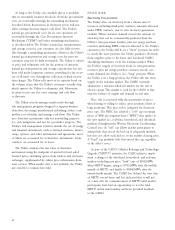

On December 20, 2007, the CPUC issued a decision in its proceeding to set the 2008 capital structure and ROEs of the three

California investor-owned electric utilities. The CPUC maintained the Utility’s authorized ROE at 11.35%, comparable to the

ROEs approved for the other utilities, and maintained the Utility’s common equity component at 52%. The following table

compares the authorized amounts for 2007 with the authorized amounts for 2008:

2007 Authorized 2008 Authorized

Capital Weighted Capital Weighted

Cost Structure Cost Cost Structure Cost

Long-term debt 6.02% 46.00% 2.77% 6.05% 46.00% 2.78%

Preferred stock 5.87% 2.00% 0.12% 5.68% 2.00% 0.11%

Common equity 11.35% 52.00% 5.90% 11.35% 52.00% 5.90%

Return on rate base 8.79% 8.79%

In a second phase of the proceeding, the Utility has also

proposed to replace the annual cost of capital proceeding

with an annual cost of capital adjustment mechanism for

the fi ve-year period from 2009 through 2013. The mechanism

would utilize an interest rate benchmark to trigger changes

in the authorized cost of equity. If the change is more than

75 basis points, the cost of equity would be adjusted by one-

half the change in the benchmark interest rate. The costs of

debt and preferred stock would be trued up to their recorded

values in each year. Other parties, including The Utility

Reform Network (“TURN”), Utility Consumers’ Action

Network, Southern California Edison, and the CPUC’s

Division of Ratepayer Advocates (“DRA”) have submitted

proposals to continue the annual proceeding or adopt a

biennial proceeding.

A fi nal decision in the second phase is scheduled to

be issued by April 24, 2008. PG&E Corporation and the

Utility are unable to predict the outcome of this phase of

the proceeding.