PG&E 2007 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.104

Convertible Subordinated Notes are entitled to receive

“pass-through dividends” determined by multiplying the cash

dividend paid by PG&E Corporation per share of common

stock by a number equal to the principal amount of the

Convertible Subordinated Notes divided by the conversion

price. During 2007, PG&E Corporation paid approximately

$26 million of “pass-through dividends” to the holders of

Convertible Subordinated Notes. On January 15, 2008, PG&E

Corporation paid approximately $7 million of “pass-through

dividends.” Since no holders of the Convertible Subordi-

nated Notes exercised the one-time right to require PG&E

Corporation to repurchase the Convertible Subordinated

Notes on June 30, 2007, PG&E Corporation reclassifi ed

the Convertible Subordinated Notes as a noncurrent liabil-

ity (in Noncurrent Liabilities — Long-Term Debt) in the

Consolidated Balance Sheets effective as of that date.

In accordance with SFAS No. 133, the dividend partici-

pation rights component of the Convertible Subordinated

Notes is considered to be an embedded derivative instrument

and, therefore, must be bifurcated from the Convertible

Subordinated Notes and recorded at fair value in PG&E

Corporation’s Consolidated Financial Statements. Dividend

participation rights are recognized as operating cash fl ows

in PG&E Corporation’s Consolidated Statements of Cash

Flows. Changes in the fair value are recognized in PG&E

Corporation’s Consolidated Statements of Income as a

non-operating expense or income (in Other Income, Net).

At December 31, 2007 and December 31, 2006, the total

estimated fair value of the dividend participation rights

component, on a pre-tax basis, was approximately $62 mil-

lion and $79 million, respectively, of which $25 million

and $23 million, respectively, was classifi ed as a current

liability (in Current Liabilities — Other) and $37 million

and $56 million, respectively, was classifi ed as a noncurrent

liability (in Noncurrent Liabilities — Other) in the accom-

panying Consolidated Balance Sheets.

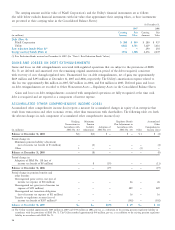

UTILITY

Senior Notes

In March 2007, the Utility issued $700 million principal

amount of 5.80% Senior Notes due March 1, 2037. The

Utility received proceeds of $690 million from the offering,

net of a $4 million discount and $6 million in issuance costs.

In December 2007, the Utility issued $500 million principal

amount of 5.625% Senior Notes due November 30, 2017.

The Utility received proceeds of $494 million from the offer-

ing, net of a $3 million discount and $3 million in issuance

costs. The proceeds from the sale of the Senior Notes were

used for capital expenditures and working capital purposes.

The Utility’s Senior Notes are unsecured and rank equally

with the Utility’s other senior unsecured and unsubordinated

debt. Under the indenture for the Senior Notes, the Utility

has agreed that it will not incur secured debt or engage in

sale leaseback transactions (except for (1) debt secured by

specifi ed liens, and (2) aggregate other secured debt and sales

and leaseback transactions not exceeding 10% of the Utility’s

net tangible assets, as defi ned in the indenture) unless the

Utility provides that the Senior Notes will be equally and

ratably secured.

Pollution Control Bonds

The California Pollution Control Financing Authority and

the California Infrastructure and Economic Development

Bank issued various series of tax-exempt pollution control

bonds for the benefi t of the Utility. At December 31, 2007,

pollution control bonds in the aggregate principal amount

of $1.6 billion were outstanding. Under the pollution control

bond loan agreements, the Utility is obligated to pay on the

due dates an amount equal to the principal, premium, if any,

and interest on these bonds to the trustees for these bonds.

All of the pollution control bonds fi nanced or refi nanced

pollution control facilities at the Utility’s Geysers geothermal

power plant (“Geysers Project”), or at the Utility’s Diablo

Canyon Power Plant (“Diablo Canyon”). In 1999, the Utility

sold the Geysers Project to Geysers Power Company LLC, a

subsidiary of Calpine Corporation. The Geysers Project pur-

chase and sale agreements state that Geysers Power Company

LLC will use the facilities solely as pollution control facilities

within the meaning of Section 103(b)(4)(F) of the Internal

Revenue Code and associated regulations (“Code”).

On February 3, 2006, Geysers Power Company LLC fi led

a petition for relief under Chapter 11 of the Bankruptcy

Code with the United States Bankruptcy Court for the

Northern District of California (the “Bankruptcy Court”).

On December 19, 2007, the Bankruptcy Court entered an

order confi rming the Plan of Reorganization (the “Plan”)

fi led by Calpine Corporation and related debtors, including

Geysers Power Company LLC. The Plan became effective

on January 31, 2008. Pursuant to the Plan, Geysers Power

Company LLC assumed the purchase and sale agreements.

The Utility believes that the Geysers Project will continue to

meet the use requirements of the Code.