PG&E 2007 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120

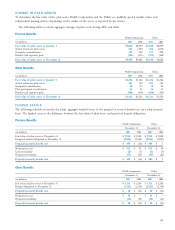

OTHER INFORMATION

The aggregate projected benefi t obligation, accumulated benefi t obligation, and fair value of plan assets for plans in which

the fair value of plan assets is less than the accumulated benefi t obligation and the projected benefi t obligation as of

December 31, 2007 and 2006 were as follows:

Pension Benefi ts Other Benefi ts

(in millions) 2007 2006 2007 2006

PG&E Corporation:

Projected benefi t obligation $(73) $(70) $(187) $(1,310)

Accumulated benefi t obligation (64) (62) — —

Fair value of plan assets — — 153 1,256

Utility:

Projected benefi t obligation $(27) $(29) $(187) $(1,310)

Accumulated benefi t obligation (27) (28) — —

Fair value of plan assets — — 153 1,256

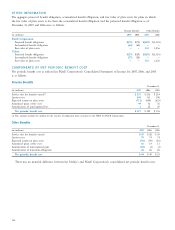

COMPONENTS OF NET PERIODIC BENEFIT COST

Net periodic benefi t cost as refl ected in PG&E Corporation’s Consolidated Statements of Income for 2007, 2006, and 2005

is as follows:

Pension Benefi ts

December 31,

(in millions) 2007 2006 2005

Service cost for benefi ts earned(1) $ 233 $ 236 $ 214

Interest cost 544 511 500

Expected return on plan assets (711) (640) (623)

Amortized prior service cost 49 56 56

Amortization of unrecognized loss 2 22 29

Net periodic benefi t cost $ 117 $ 185 $ 176

(1) This amount includes $2 million for the transfer of obligation from severance to the SERP for PG&E Corporation.

Other Benefi ts

December 31,

(in millions) 2007 2006 2005

Service cost for benefi ts earned $ 29 $ 28 $ 30

Interest cost 79 74 74

Expected return on plan assets (96) (90) (85)

Amortized prior service cost 16 14 11

Amortization of unrecognized gain (10) (3) (1)

Amortization of transition obligation 26 26 26

Net periodic benefi t cost $ 44 $ 49 $ 55

There was no material difference between the Utility’s and PG&E Corporation’s consolidated net periodic benefi t costs.