PG&E 2007 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

127

The tax benefi t from restricted stock which vested during

2007 and 2006 totaled $7 million and $4 million, respec-

tively, of which approximately $5 million and $2 million was

recorded by the Utility.

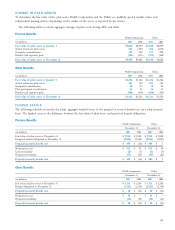

The following table summarizes restricted stock activity

for PG&E Corporation and the Utility for 2007:

Number of Weighted

Shares of Average

Restricted Grant-Date

Stock Fair Value

Nonvested at January 1 1,377,538 $ 29.27

Granted 607,459 $ 45.82

Vested (655,978) $ 23.19

Forfeited (67,894) $ 39.67

Nonvested at December 31 1,261,125 $39.84

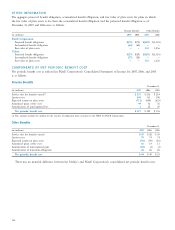

The following table summarizes restricted stock activity

for the Utility for 2007:

Number of Weighted

Shares of Average

Restricted Grant-Date

Stock Fair Value

Nonvested at January 1 932,728 $ 29.33

Granted 428,960 $ 45.82

Vested (446,032) $ 23.30

Forfeited (60,244) $ 39.69

Nonvested at December 31 855,412 $39.97

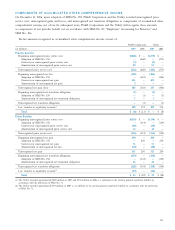

As of December 31, 2007, there was approximately

$20 million of total unrecognized compensation cost relat-

ing to restricted stock, of which $15 million related to the

Utility. The cost is expected to be recognized over a weighted

average period of 1.4 years by PG&E Corporation and

the Utility.

Performance Shares

During 2007, PG&E Corporation awarded 470,225 perfor-

mance shares to eligible participants of PG&E Corporation

and its subsidiaries, of which 320,495 shares were awarded

to the Utility’s eligible participants. Performance shares are

hypothetical shares of PG&E Corporation common stock

that vest at the end of a three-year period and are settled in

cash. Upon vesting, the amount of cash that recipients are

entitled to receive is based on the average closing price of

PG&E Corporation stock for the last 30 calendar days

of the year preceding the vesting date. A payout percentage

is also taken into account, ranging from 0% to 200%,

as measured by PG&E Corporation’s TSR, relative to its

comparator group, for the applicable three-year period.

During 2007, PG&E Corporation paid $18.7 million to

performance share recipients, of which $12.7 million

related to Utility employees.

As of December 31, 2007, $21 million was accrued as

the performance share liability for PG&E Corporation,

of which $14.7 million related to the Utility. The number of

performance shares that were outstanding at December 31,

2007 was 1,203,205, of which 853,868 was related to Utility

employees. Outstanding performance shares are classifi ed as a

liability on the Consolidated Financial Statements of PG&E

Corporation and the Utility because the performance shares

can only be settled in cash upon satisfaction of the perfor-

mance criteria. The liability related to the performance shares

is marked to market at the end of each reporting period

to refl ect the market price of PG&E Corporation common

stock and the payout percentage at the end of the reporting

period. Accordingly, compensation expense recognized for

performance shares will fl uctuate with PG&E Corporation’s

common stock price and its performance relative to its

comparator group.

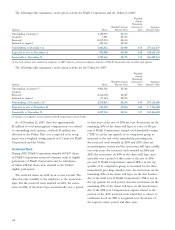

NOTE 15: RESOLUTION OF

REMAINING CHAPTER 11

DISPUTED CLAIMS

In connection with the Utility’s reorganization under

Chapter 11 of the U.S. Bankruptcy Code on April 12, 2004,

the Utility deposited approximately $1.7 billion into escrow

for the payment of certain Disputed Claims that had been

made by generators and power suppliers for transactions that

occurred during the 2000–2001 California energy crisis. The

Disputed Claims are being addressed in various FERC and

judicial proceedings seeking refunds on behalf of California

electricity purchasers (including the State of California and

the Utility) from electricity suppliers, including municipal

and governmental entities, for overcharges incurred in the

CAISO and the Power Exchange (“PX”) wholesale electric-

ity markets between May 2000 and June 2001. Many issues

raised in these proceedings, including the extent of the

FERC’s refund authority, and the amount of potential

refunds after taking into account certain costs incurred by

the electricity suppliers have not been resolved. It is uncer-

tain when these proceedings will be concluded.