PG&E 2007 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.115

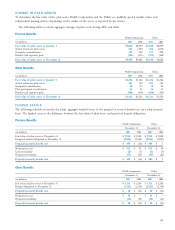

Balance Sheet. The total nuclear decommissioning obliga-

tion accrued in accordance with GAAP was approximately

$1.3 billion at December 31, 2007 and $1.2 billion at

December 31, 2006. The primary difference between the

Utility’s estimated nuclear decommissioning obligation as

recorded in accordance with GAAP and the estimate pre-

pared in accordance with the CPUC requirements is that

GAAP incorporates various potential settlement dates for the

obligation and includes an estimated amount for third-party

labor costs in the fair value calculation. Differences between

amounts collected in rates for decommissioning the Utility’s

nuclear power facilities and the decommissioning obligation

recorded in accordance with GAAP are refl ected in regula-

tory accounts. (See Note 3 of the Notes to the Consolidated

Financial Statements.)

Decommissioning costs recovered in rates are placed in

nuclear decommissioning trusts. The Utility has three decom-

missioning trusts for its Diablo Canyon and Humboldt Bay

Unit 3 nuclear facilities. The Utility has elected that two of

these trusts be treated under the Code as qualifi ed trusts. If

certain conditions are met, the Utility is allowed a deduction

for the payments made to the qualifi ed trusts. The qualifi ed

trusts are subject to a lower tax rate on income and capital

gains, thereby increasing the trusts’ after-tax returns. Among

other requirements, in order to maintain the qualifi ed trust

status, the IRS must approve the amount to be contributed

to the qualifi ed trusts for any taxable year. The remaining

non-qualifi ed trust is exclusively for decommissioning

Humboldt Bay Unit 3. The Utility cannot deduct amounts

contributed to the non-qualifi ed trust until such decommis-

sioning costs are actually incurred.

The funds in the decommissioning trusts, along with

accumulated earnings, will be used exclusively for decom-

missioning and dismantling the Utility’s nuclear facilities.

The trusts maintain substantially all of their investments in

debt and equity securities. The CPUC has authorized the

qualifi ed trust to invest a maximum of 60% of its funds in

publicly-traded equity securities, of which up to 20% may be

invested in publicly-traded non-U.S. equity securities. For the

non-qualifi ed trust, no more than 60% may be invested in

publicly-traded equities, of which up to 20% may be invested

in publicly-traded non-U.S. equity securities. The allocation

of the trust funds is monitored monthly. To the extent that

market movements cause the asset allocation to move out-

side these ranges, the investments are rebalanced toward the

target allocation.

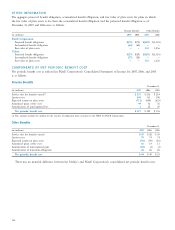

The Utility estimates after-tax annual earnings, including

realized gains and losses, in the qualifi ed trusts to be 5.33%

and in the non-qualifi ed trusts to be 4.22%. Trust earnings

are included in the nuclear decommissioning trust assets and

the corresponding asset retirement costs regulatory liability.

There is no impact on the Utility’s earnings. Annual returns

decrease in later years as higher portions of the trusts are

dedicated to fi xed income investments leading up to and

during the entire course of decommissioning activities.

During 2007, the trusts earned approximately $77 mil-

lion in interest and dividends. All earnings on the assets

held in the trusts, net of authorized disbursements from

the trusts and investment management and administrative

fees, are reinvested. Amounts may not be released from the

decommissioning trusts until authorized by the CPUC. At

December 31, 2007, the Utility had accumulated nuclear

decommissioning trust funds with an estimated fair value of

approximately $2.0 billion, based on quoted market prices

and net of deferred taxes on unrealized gains.

In general, investment securities are exposed to various

risks, such as interest rate, credit, and market volatility risks.

Due to the level of risk associated with certain investment

securities, it is reasonably possible that changes in the market

values of investment securities could occur in the near term,

and such changes could materially affect the trusts’ fair value.

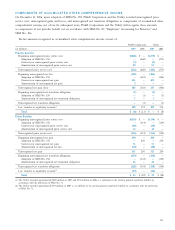

The Utility records unrealized gains and losses on

investments held in the trusts in other comprehensive

income in accordance with SFAS No. 115, “Accounting for

Certain Investments in Debt and Equity Securities.” Realized

gains and losses are recognized as additions or reductions

to trust asset balances. The Utility, however, accounts for

its nuclear decommissioning obligations in accordance with

SFAS No. 71; therefore, both realized and unrealized gains

and losses are ultimately recorded as regulatory assets

or liabilities.

In 2007, total unrealized losses on the investments held

in the trusts were $7 million. SFAS Nos. 115-1 and 124-1

state that an investment is impaired if the fair value of the

investment is less than its cost and if the impairment is

concluded to be other-than-temporary, an impairment loss

is recognized. Since the day-to-day investing activities of

the trusts are managed by external investment managers, the

Utility is unable to conclude that the $7 million impairment

is not other-than-temporary. As a result, an impairment loss

was recognized and the Utility recorded a $7 million reduc-

tion to the nuclear decommissioning trusts assets and the

asset retirement costs regulatory liability.