PG&E 2007 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

126

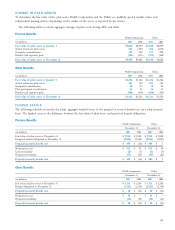

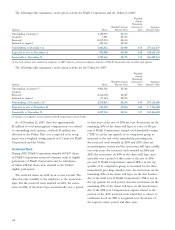

The following table summarizes stock option activity for PG&E Corporation and the Utility for 2007:

Weighted

Average

Remaining

Weighted Average Contractual Aggregate

Options Shares Exercise Price Term Intrinsic Value

Outstanding at January 1 6,398,970 $ 23.52

Granted(1) 7,285 $ 47.27

Exercised (2,419,272) $ 24.30

Forfeited or expired (104,311) $ 29.28

Outstanding at December 31 3,882,672 $24.00 4.38 $74,131,879

Expected to vest at December 31 872,088 $31.00 6.50 $10,619,107

Exercisable at December 31 2,999,566 $21.93 3.75 $63,459,514

(1) No stock options were awarded to employees in 2007; however, certain non-employee directors of PG&E Corporation were awarded stock options.

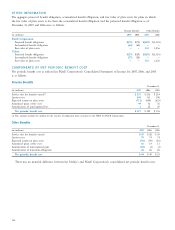

The following table summarizes stock option activity for the Utility for 2007:

Weighted

Average

Remaining

Weighted Average Contractual Aggregate

Options Shares Exercise Price Term Intrinsic Value

Outstanding at January 1(1) 4,402,506 $ 23.66

Granted — —

Exercised (1,414,078) $ 23.89

Forfeited or expired (77,563) $ 29.92

Outstanding at December 31(1) 2,910,865 $23.40 4.49 $57,312,688

Expected to vest at December 31 613,950 $30.65 6.41 $ 7,726,688

Exercisable at December 31 2,289,714 $21.43 3.97 $49,586,001

(1) Includes net employee transfers between PG&E Corporation and the Utility.

As of December 31, 2007, there was approximately

$2 million of total unrecognized compensation cost related

to outstanding stock options, of which $1 million was

allocated to the Utility. That cost is expected to be recog-

nized over a weighted average period of 0.5 years for PG&E

Corporation and the Utility.

Restricted Stock

During 2007, PG&E Corporation awarded 607,459 shares

of PG&E Corporation restricted common stock to eligible

participants of PG&E Corporation and its subsidiaries,

of which 428,960 shares were awarded to the Utility’s

eligible participants.

The restricted shares are held in an escrow account. The

shares become available to the employees as the restrictions

lapse. For the restricted stock awarded in 2003, the restric-

tions on 80% of the shares lapse automatically over a period

of four years at the rate of 20% per year. Restrictions on the

remaining 20% of the shares will lapse at a rate of 5% per

year if PG&E Corporation’s annual total shareholder return

(“TSR”) is in the top quartile of its comparator group as

measured at the end of the immediately preceding year.

For restricted stock awarded in 2004 and 2005, there are

no performance criteria and the restrictions will lapse ratably

over four years. For restricted stock awarded in 2006 and

2007, the restrictions on 60% of the shares will lapse auto-

matically over a period of three years at the rate of 20%

per year. If PG&E Corporation’s annual TSR is in the top

quartile of its comparator group, as measured for the three

immediately preceding calendar years, the restrictions on the

remaining 40% of the shares will lapse on the fi rst business

day of the third year. If PG&E Corporation’s TSR is not in

the top quartile for such period, then the restrictions on the

remaining 40% of the shares will lapse on the fi rst business

day of the fi fth year. Compensation expense related to the

portion of the 2007 restricted stock award that is subject to

conditions based on TSR is recognized over the shorter of

the requisite service period and three years.