PG&E 2007 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

133

Under the Price-Anderson Act, public liability claims from

a nuclear incident are limited to $10.8 billion. As required

by the Price-Anderson Act, the Utility purchased the maxi-

mum available public liability insurance of $300 million for

Diablo Canyon. The balance of the $10.8 billion of liability

protection is covered by a loss-sharing program among utili-

ties owning nuclear reactors. Under the Price-Anderson Act,

owner participation in this loss-sharing program is required

for all owners of nuclear reactors that are licensed to operate,

designed for the production of electrical energy, and have a

rated capacity of 100 MW or higher. If a nuclear incident

results in costs in excess of $300 million, then the Utility

may be responsible for up to $100.6 million per reactor, with

payments in each year limited to a maximum of $15 mil-

lion per incident until the Utility has fully paid its share of

the liability. Since Diablo Canyon has two nuclear reactors,

each with a rated capacity of over 100 MW, the Utility may

be assessed up to $201.2 million per incident, with payments

in each year limited to a maximum of $30 million per inci-

dent. Both the maximum assessment per reactor and the

maximum yearly assessment are adjusted for infl ation at least

every fi ve years. The next scheduled adjustment is due on or

before August 31, 2008.

In addition, the Utility has $53.3 million of liability

insurance for Humboldt Bay Unit 3 and has a $500 million

indemnifi cation from the NRC for public liability arising

from nuclear incidents covering liabilities in excess of the

$53.3 million of liability insurance.

California Department of Water Resources Contracts

Electricity purchased under the DWR allocated contracts

with various generators provided approximately 25% of

the electricity delivered to the Utility’s customers for the

year ended December 31, 2007. The DWR remains legally

and fi nancially responsible for its electricity procurement

contracts. The Utility acts as a billing and collection agent

of the DWR’s revenue requirements from the Utility’s

customers.

The DWR has stated publicly in the past that it intends

to transfer full legal title of, and responsibility for, the

DWR power purchase contracts to the California investor-

owned electric utilities as soon as possible. However, the

DWR power purchase contracts cannot be transferred to

the Utility without the consent of the CPUC. The Chapter 11

Settlement Agreement provides that the CPUC will not require

the Utility to accept an assignment of, or to assume legal or

fi nancial responsibility for, the DWR power purchase con-

tracts unless each of the following conditions has been met:

• After assumption, the Utility’s issuer rating by Moody’s

will be no less than A2 and the Utility’s long-term issuer

credit rating by S&P will be no less than A. The Utility’s

current issuer rating by Moody’s is A3 and the Utility’s

long-term issuer credit rating by S&P is BBB+;

• The CPUC fi rst makes a fi nding that the DWR power

purchase contracts to be assumed are just and reasonable;

• The CPUC has acted to ensure that the Utility will receive

full and timely recovery in its retail electricity rates of all

costs associated with the DWR power purchase contracts to

be assumed without further review.

On February 28, 2008, the CPUC is scheduled to vote on

a proposed decision that states the CPUC would proactively

investigate how the DWR can terminate its obligations under

the power contracts, by assignment or otherwise, in order to

hasten the reinstatement of direct access.

SEVERANCE IN CONNECTION

WITH EFFORTS TO ACHIEVE COST

AND OPERATING EFFICIENCIES

In connection with the Utility’s initiatives to streamline

processes and achieve cost and operating effi ciencies, the

Utility is eliminating and consolidating various employee

positions. As a result, the Utility has incurred severance costs

and expects that it will incur additional severance costs. The

amount of future severance costs will depend on many vari-

ables, including whether affected employees elect to receive

severance benefi ts or reassignment, the number of available

vacant positions for those seeking reassignment and, for

those employees who elect severance benefi ts, their years of

service and annual salaries. At December 31, 2007, the Utility

estimated future severance costs will range from $30 mil-

lion to $74 million, given the uncertainty of each of these

variables. The Utility has recorded a liability of $30 million

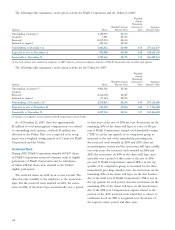

as of December 31, 2007. The following table presents the

changes in the liability from December 31, 2006:

(in millions)

Balance at December 31, 2006 $ 34

Additional severance accrued 8

Less: Payments (12)

Balance at December 31, 2007 $ 30