PG&E 2007 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103

REGULATORY BALANCING ACCOUNTS

The Utility uses regulatory balancing accounts as a mechanism

to recover amounts incurred for certain costs, primarily

commodity costs. Sales balancing accounts accumulate

differences between revenues and the Utility’s authorized

revenue requirements. Cost balancing accounts accumulate

differences between incurred costs and authorized revenue

requirements. The Utility also obtained CPUC approval for

balancing account treatment of variances between forecasted

and actual commodity costs and volumes. This approval

eliminates the earnings impact from any revenue variances

from adopted forecast levels. Under-collections that are

probable of recovery through regulated rates are recorded

as regulatory balancing account assets. Over-collections that

are probable of being credited to customers are recorded as

regulatory balancing account liabilities.

The Utility’s current regulatory balancing accounts accu-

mulate balances until they are refunded to or received from

the Utility’s customers through authorized rate adjustments

within the next 12 months. Regulatory balancing accounts

that the Utility does not expect to collect or refund in the

next 12 months are included in Other Noncurrent Assets

— Regulatory Assets and Noncurrent Liabilities — Regulatory

Liabilities. The CPUC does not allow the Utility to offset

regulatory balancing account assets against balancing

account liabilities.

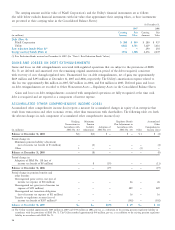

Regulatory Balancing Account Assets

Balance at December 31,

(in millions) 2007 2006

Electricity revenue and cost balancing accounts $678 $501

Natural gas revenue and cost balancing accounts 93 106

Total $771 $607

Regulatory Balancing Account Liabilities

Balance at December 31,

(in millions) 2007 2006

Electricity revenue and cost balancing accounts $618 $ 951

Natural gas revenue and cost balancing accounts 55 79

Total $673 $1,030

During 2007, the under-collection in the Utility’s electricity

revenue and cost balancing account assets increased from

2006 mainly due to higher procurement costs associated

with replacement power, as a result of lower hydroelectric

production. The under-collection was further increased due

to CPUC authorized rate reductions intended to reduce over-

collections in the electric revenue and cost balancing account

liabilities from 2006.

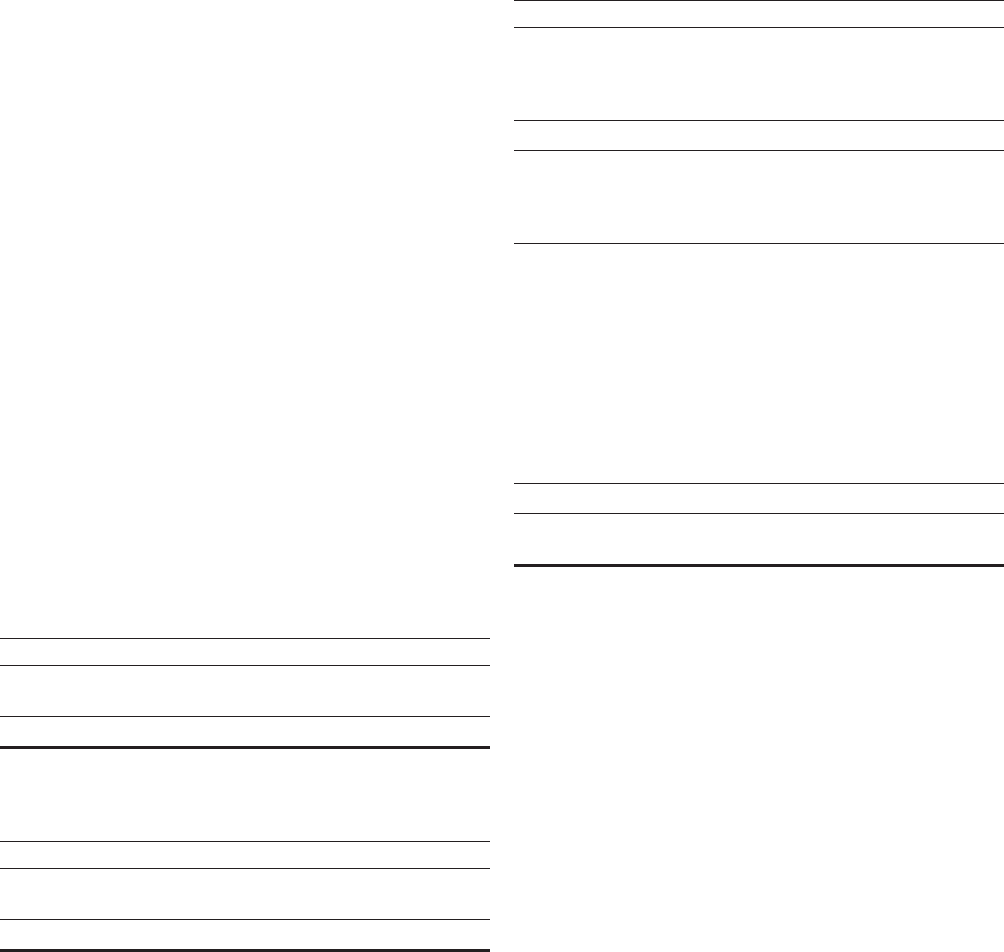

NOTE 4: DEBT

LONG-TERM DEBT

The following table summarizes PG&E Corporation’s and

the Utility’s long-term debt:

December 31,

(in millions) 2007 2006

PG&E Corporation

Convertible subordinated notes,

9.50%, due 2010 $ 280 $ 280

Less: current portion — (280)

280 —

Utility

Senior notes:

3.60% to 6.05% bonds, due 2009–2037 6,300 5,100

Unamortized discount (22) (16)

Total senior notes 6,278 5,084

Pollution control bond loan agreements,

variable rates(1), due 2026(2) 614 614

Pollution control bond loan agreement,

5.35%, due 2016 200 200

Pollution control bond loan agreements,

4.75%, due 2023 345 345

Pollution control bond loan agreements,

variable rates(3), due 2016–2026 454 454

Other — 1

Less: current portion — (1)

Long-term debt, net of current portion 7,891 6,697

Total consolidated long-term debt,

net of current portion $8,171 $6,697

(1) At December 31, 2007, interest rates on these loans ranged from 3.45%

to 3.73%.

(2) These bonds are supported by $620 million of letters of credit which

expire on February 24, 2012. Although the stated maturity date is 2026,

the bonds will remain outstanding only if the Utility extends or

replaces the letters of credit.

(3) At December 31, 2007, interest rates on these loans ranged from 3.75%

to 5.75%.

PG&E CORPORATION

Convertible Subordinated Notes

At December 31, 2007, PG&E Corporation had outstanding

approximately $280 million of 9.50% Convertible Subordi-

nated Notes that are scheduled to mature on June 30, 2010.

Interest is payable semi-annually in arrears on June 30 and

December 31. These Convertible Subordinated Notes may

be converted (at the option of the holder) at any time prior

to maturity into 18,558,059 shares of PG&E Corporation

common stock, at a conversion price of $15.09 per share.

The conversion price is subject to adjustment for signifi -

cant changes in the number of outstanding shares of PG&E

Corporation’s common stock. In addition, holders of the