PG&E 2007 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.41

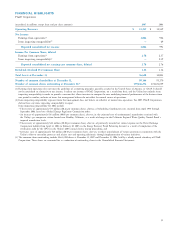

The Utility’s electric operating revenues increased in 2006

by approximately $825 million, or approximately 10%, com-

pared to 2005 mainly due to the following factors:

• Electricity procurement costs, which are passed through

to customers, increased by approximately $490 million.

(See “Cost of Electricity” below.)

• The dedicated rate component (“DRC”) charges related

to the ERBs increased by approximately $175 million.

(See Notes 3 and 6 of the Notes to the Consolidated

Financial Statements.) During 2005, the Utility collected

only the DRC for the fi rst series of ERBs that were issued

on February 10, 2005. During 2006, the Utility collected

the DRC associated with the fi rst series of ERBs and the

DRC related to the second series of ERBs, issued on

November 9, 2005.

• As discussed above, in 2006, the Utility recognized

approximately $136 million following the FERC’s order

allowing the Utility to recover SC costs that the Utility

incurred from April 1998 through December 2005.

No similar amount was recognized in 2005.

• The Utility recognized attrition adjustments to the Utility’s

authorized 2003 base revenue requirements of approxi-

mately $135 million, as authorized in the 2003 GRC.

• The Utility recorded approximately $112 million in revenue

requirements to recover a pension contribution attributable

to the Utility’s electric distribution and generation opera-

tions, but no similar amount was recognized in 2005.

• Transmission revenues increased by approximately $90 mil-

lion primarily due to an increase in revenues, as authorized

by the FERC.

• As discussed above, the Utility recognized approximately

$65 million due to the recovery of net interest costs

related to Disputed Claims for the period between the

effective date of the Utility’s plan of reorganization under

Chapter 11 and the date the fi rst series of ERBs was issued,

and for certain energy supplier refund litigation costs, but

no similar amount was recognized in 2005.

• The Utility recovered approximately $59 million of net

interest costs related to Disputed Claims incurred after the

issuance of the fi rst series of ERBs, as authorized by the

CPUC, but no similar amount was recognized in 2005.

These were partially offset by the following:

• In 2005, the Utility recognized approximately $160 million

due to the resolution of the Utility’s claims for shareholder

incentives related to energy effi ciency and other public

purpose programs, but no similar amount was recognized

in 2006.

• In 2005, the Utility recognized approximately $154 million

related to revenue requirements associated with the settle-

ment regulatory asset provided under the Chapter 11

Settlement Agreement and the recovery of costs on the

deferred tax component of the settlement regulatory asset,

but no similar amounts were recorded in 2006 after the

refi nancing of the settlement regulatory asset through

the issuance of the ERBs.

• The carrying cost credit, including both the debt and

equity components, associated with the issuance of the

second series of ERBs, decreased electric operating revenues

by approximately $123 million in 2006 from 2005. The

second series of ERBs was issued to pre-fund the Utility’s

tax liability that will be due as the Utility collects the DRC

related to the fi rst series from its customers over the term

of the ERBs. Until these taxes are fully paid, the Utility

provides customers a carrying cost credit, computed at

the Utility’s authorized rate of return on rate base to

compensate them for the use of proceeds from the second

series of ERBs as well as the after-tax proceeds of energy

supplier refunds used to reduce the size of the second

series of ERBs.

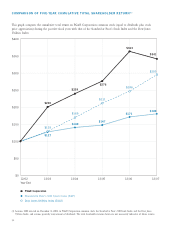

The Utility’s electric operating revenues for the period

2008 through 2010 are expected to increase, as authorized

by the CPUC in the 2007 GRC and by the FERC in future

TO rate cases. In addition, the Utility expects to continue

to collect revenue requirements related to CPUC-approved

capital expenditures, including the new Utility-owned gen-

eration projects and the SmartMeter™ project. (See “Capital

Expenditures” below.) Revenue requirements associated

with new or expanded public purpose programs, such as

the California Solar Initiative, will result in increased electric

operating revenues. In addition, the Utility may recognize

incentive revenues to the extent it achieves the CPUC’s energy

effi ciency goals. Finally, future electric operating revenues

will be impacted by changes in the cost of electricity.