PG&E 2007 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.47

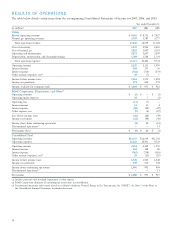

In 2006, the Utility’s interest expense increased by

approximately $156 million, or 28%, compared to 2005,

primarily due to an increase in interest expense related to

Disputed Claims, interest expense associated with the ERBs,

and accrued interest on higher balances in certain regula-

tory balancing accounts. Increased interest rates associated

with these accounts also contributed to this higher interest

expense. These increases were partially offset by lower

interest expense on the declining balance of RRBs.

The Utility’s interest expense in 2008 will be impacted by

changes in interest rates as the Utility’s short-term debt and

a portion of its long-term debt bear variable interest rates,

as well as by changes in the amount of debt, including debt

expected to be issued in subsequent periods to fi nance capital

expenditures. (See “Liquidity and Financial Resources” below.)

Income Tax Expense

The Utility’s income tax expense decreased by approximately

$31 million, or 5%, in 2007 compared to 2006, primarily

due to a decrease of approximately $29 million as a result of

fi xed asset related tax deductions, mainly due to an increase

in tax-deductible decommissioning expense in 2007 com-

pared to 2006. The effective tax rates were 35.8% and 38.0%

for 2007 and 2006, respectively.

The Utility’s income tax expense increased by approxi-

mately $28 million, or 5%, in 2006 compared to 2005, pri-

marily due to an increase in pre-tax income of $79 million

for 2006. The effective tax rate was 38.0% for both 2006

and 2005.

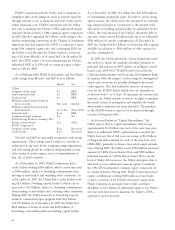

PG&E CORPORATION,

ELIMINATIONS, AND OTHER

Operating Revenues and Expenses

PG&E Corporation’s revenues consist mainly of billings to

its affi liates for services rendered, all of which are eliminated

in consolidation. PG&E Corporation’s operating expenses

consist mainly of employee compensation and payments

to third parties for goods and services. Generally, PG&E

Corporation’s operating expenses are allocated to affi liates.

These allocations are made without mark-up and are elimi-

nated in consolidation. PG&E Corporation’s interest expense

relates to its 9.50% Convertible Subordinated Notes and is

not allocated to affi liates.

There were no material changes to PG&E Corporation’s

operating income in 2007 compared to 2006 and in 2006

compared to 2005.

Income Tax Benefi t

PG&E Corporation’s income tax benefi t in 2007 decreased

approximately $16 million, or 33%, compared to 2006, pri-

marily due to a tax benefi t booked in 2006 related to capital

losses carried forward and used in PG&E Corporation’s

2005 consolidated federal and state income tax returns with

no comparable benefi t in 2007.

PG&E Corporation’s income tax benefi t in 2006 increased

approximately $18 million, or 60%, compared to 2005 pri-

marily due to tax benefi ts related to capital losses carried

forward and used in PG&E Corporation’s 2005 consolidated

federal and state income tax returns.

Discontinued Operations

In 2005, PG&E Corporation received additional informa-

tion from its former subsidiary, NEGT, regarding PG&E

Corporation’s 2004 and 2003 federal income tax returns. As

a result, PG&E Corporation recorded $13 million in income

from discontinued operations in 2005. (See Note 7 of the

Notes to the Consolidated Financial Statements.)

LIQUIDITY AND

FINANCIAL RESOURCES

OVERVIEW

The level of PG&E Corporation’s and the Utility’s current

assets and current liabilities may fl uctuate as a result of

seasonal demand for electricity and natural gas, energy com-

modity costs, collateral requirements, the timing and effect

of regulatory decisions and fi nancings, and the amount and

timing of capital expenditures, among other factors.

PG&E Corporation and the Utility manage liquidity and

debt levels in order to meet expected operating and fi nancial

needs and maintain access to credit for contingencies. At

December 31, 2007, PG&E Corporation and its subsidiar-

ies had consolidated cash and cash equivalents of approxi-

mately $345 million and restricted cash of approximately

$1.3 billion. At December 31, 2007, PG&E Corporation

on a stand-alone basis had cash and cash equivalents of

approximately $204 million; the Utility had cash and cash

equivalents of approximately $141 million and restricted

cash of approximately $1.3 billion. Restricted cash primarily

consists of approximately $1.2 billion of cash held in escrow

pending the resolution of the remaining Disputed Claims as

well as deposits made under certain third-party agreements.

PG&E Corporation and the Utility maintain separate bank

accounts. PG&E Corporation and the Utility primarily

invest their cash in money market funds.