PG&E 2007 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

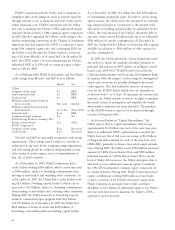

PG&E Corporations’ consolidated cash fl ows from

operating activities for 2007, 2006, and 2005 were as follows:

(in millions) 2007 2006 2005

Net income $1,006 $ 991 $ 917

Gain on disposal of NEGT (net of

income tax benefi t of $13 million

in 2005) — — 13

Net income from continuing

operations 1,006 991 904

Adjustments to reconcile net income

to net cash provided by operating

activities 2,141 1,611 1,122

Other changes in operating assets

and liabilities (601) 112 383

Net cash provided by

operating activities $2,546 $2,714 $2,409

In 2007, net cash provided by operating activities

decreased by $168 million as compared to 2006. The

decrease is primarily related to tax refunds received by

PG&E Corporation in 2006 with no similar refunds received

in 2007 and a decrease in the Utility’s net cash provided

by operating activities.

In 2006, net cash provided by operating activities

increased by $305 million compared to 2005, primarily due

to an increase in the Utility’s net cash provided by operating

activities and tax refunds received by PG&E Corporation

during the fi rst and third quarters of 2006 with no similar

refunds received during 2005.

Investing Activities

PG&E Corporation, on a stand-alone basis, did not have any

material cash fl ows associated with investing activities in the

years ended December 31, 2007, 2006, and 2005.

Financing Activities

PG&E Corporation’s primary sources of fi nancing funds,

on a stand-alone basis, are dividends from the Utility, equity

issuances, and external fi nancing. PG&E Corporation’s uses of

cash, on a stand-alone basis, primarily relate to the payment

of common stock dividends and common stock repurchases.

PG&E Corporation’s cash fl ows from fi nancing activities

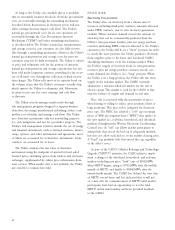

for 2007, 2006, and 2005 were as follows:

(in millions) 2007 2006 2005

Borrowings under accounts receivable

facility and working capital facility $ 850 $ 350 $ 260

Repayments under accounts receivable

facility and working capital facility (900) (310) (300)

Net issuance (repayments) of

commercial paper, net of discount

of $1 million in 2007 and

$2 million in 2006 (209) 458 —

Net proceeds from issuance of

long-term debt 1,184 — 451

Net proceeds from issuance of

energy recovery bonds — — 2,711

Long-term debt matured, redeemed,

or repurchased — — (1,556)

Rate reduction bonds matured (290) (290) (290)

Energy recovery bonds matured (340) (316) (140)

Preferred stock with mandatory

redemption provisions redeemed — — (122)

Preferred stock without mandatory

redemption provisions redeemed — — (37)

Common stock issued 175 131 243

Common stock repurchased — (114) (2,188)

Common stock dividends paid (496) (456) (334)

Other 35 3 32

Net cash provided by (used in)

fi nancing activities $ 9 $(544) $(1,270)

During 2007, PG&E Corporation’s consolidated net cash

provided by fi nancing activities increased by approximately

$553 million compared to 2006. The decrease in cash used

after consideration of the Utility’s cash fl ows provided

by fi nancing activities was primarily due to the payment

of $114 million in 2006 to settle obligations related to the

2005 repurchase of common stock, with no similar payments

in 2007.

During 2006, PG&E Corporation’s consolidated net

cash used in fi nancing activities decreased by approximately

$726 million compared to 2005 primarily due to the

following factors, after consideration of the Utility’s cash

fl ows from fi nancing activities:

• PG&E Corporation paid four quarterly common stock

dividends in 2006, but made only three payments in 2005.

• In 2005, PG&E Corporation repurchased approximately

$2.2 billion in common stock. There was no similar

share repurchase in 2006, but PG&E Corporation paid

$114 million to settle obligations related to the 2005

stock repurchase.