PG&E 2007 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.109

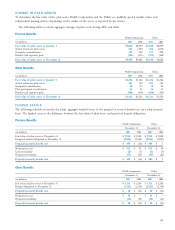

In 2005, PG&E Corporation repurchased a total of

61,139,700 shares of its outstanding common stock through

two ASRs with GS&Co. for an aggregate purchase price

of $2.2 billion, including price adjustments based on the

VWAP and other amounts. In 2006, PG&E Corporation

paid GS&Co. $114 million in additional payments (net of

amounts payable by GS&Co. to PG&E Corporation) to

satisfy obligations under the last of these ASRs entered into

in November 2005. PG&E Corporation’s payments reduced

common shareholders’ equity.

To refl ect the potential dilution that existed while the

obligations related to the ASRs were outstanding, PG&E

Corporation treated approximately one million and two mil-

lion additional shares of PG&E Corporation common stock

as outstanding for purposes of calculating diluted EPS for

2006 and 2005, respectively (see Note 10 for further discus-

sion). PG&E Corporation has no remaining obligation under

the November 2005 ASR as of December 31, 2007.

UTILITY

The Utility is authorized to issue 800 million shares of its

$5 par value common stock, of which 282,916,485 shares

were issued and outstanding as of December 31, 2007

and 279,624,823 shares were issued and outstanding as of

December 31, 2006. PG&E Holdings, LLC, a wholly owned

subsidiary of the Utility, holds 19,481,213 of the outstanding

shares. PG&E Corporation and PG&E Holdings, LLC hold

all of the Utility’s outstanding common stock.

The Utility may pay common stock dividends and repur-

chase its common stock, provided that cumulative preferred

dividends on its preferred stock are paid.

DIVIDENDS

PG&E Corporation and the Utility did not declare or

pay a dividend during the Utility’s Chapter 11 proceeding

as the Utility was prohibited from paying any common

or preferred stock dividends without Bankruptcy Court

approval and certain covenants in the indenture related

to senior secured notes of PG&E Corporation during that

period restricted the circumstances under which such a divi-

dend could be declared or paid. With the Utility’s emergence

from Chapter 11 on April 12, 2004, the Utility resumed the

payment of preferred stock dividends. The Utility reinstated

the payment of a regular quarterly common stock dividend

to PG&E Corporation in January 2005, upon the achieve-

ment of the 52% equity ratio targeted in the Chapter 11

Settlement Agreement.

During 2005, the Utility paid common stock dividends of

$476 million. Approximately $445 million of common stock

dividends were paid to PG&E Corporation and the remain-

ing amount was paid to PG&E Holdings, LLC. On April 15,

July 15, and October 15, 2005, PG&E Corporation paid

quarterly common stock dividends of $0.30 per share, total-

ing approximately $356 million, including approximately

$22 million to Elm Power Corporation.

During 2006, the Utility paid common stock dividends

of $494 million. Approximately $460 million of common

stock dividends were paid to PG&E Corporation and the

remaining amount was paid to PG&E Holdings, LLC. On

January 16, April 15, July 15, and October 15, 2006, PG&E

Corporation paid quarterly common stock dividends of

$0.33 per share, totaling $489 million, including approxi-

mately $33 million to Elm Power Corporation.

During 2007, the Utility paid common stock dividends

of $547 million. Approximately $509 million of common

stock dividends were paid to PG&E Corporation and the

remaining amount was paid to PG&E Holdings, LLC.

PG&E Holdings, LLC held approximately 7% of the Utility’s

common stock.

On January 15, 2007, PG&E Corporation paid a quarterly

common stock dividend of $0.33 per share. On April 15,

July 15, and October 15, 2007, PG&E Corporation paid

quarterly common stock dividends of $0.36 per share. The

above dividend payments totaled $529 million, including

approximately $35 million of common stock dividends paid

to Elm Power Corporation. Elm Power Corporation held

approximately 6% of PG&E Corporation’s common stock.

On December 19, 2007, the Board of Directors of PG&E

Corporation declared a dividend of $0.36 per share, totaling

approximately $137 million that was paid on January 15,

2008 to shareholders of record on December 31, 2007.

PG&E Corporation and the Utility record common stock

dividends declared to Reinvested Earnings.