PG&E 2007 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

125

Awards made under the PG&E Corporation Long-Term

Incentive Program before December 31, 2005 and still out-

standing continue to be governed by the terms and conditions

of the PG&E Corporation Long-Term Incentive Program.

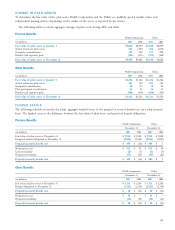

PG&E Corporation and the Utility use an estimated

annual forfeiture rate of 2%, based on historic forfeiture

rates, for purposes of determining compensation expense

for share-based incentive awards. The following table pro-

vides a summary of total compensation expense for PG&E

Corporation and the Utility for share-based incentive awards

for the year ended December 31, 2007:

Year ended December 31, 2007

PG&E

(in millions) Corporation Utility

Stock Options $ 7 $ 4

Restricted Stock 24 15

Performance Shares (8) (7)

Total Compensation Expense (pre-tax) $23 $12

Total Compensation Expense (after-tax) $14 $ 7

Year ended December 31, 2006

PG&E

(in millions) Corporation Utility

Stock Options $12 $ 8

Restricted Stock 20 14

Performance Shares 33 24

Total Compensation Expense (pre-tax) $65 $46

Total Compensation Expense (after-tax) $39 $27

Stock Options

Other than the grant of options to purchase 7,285 shares of

PG&E Corporation common stock to non-employee direc-

tors of PG&E Corporation in accordance with the formula

and nondiscretionary provisions of the 2006 LTIP, no other

stock options were granted during 2007. The exercise price

of stock options granted under the 2006 LTIP and all other

outstanding stock options is equal to the market price of

PG&E Corporation’s common stock on the date of grant.

Stock options generally have a ten-year term and vest over

four years of continuous service, subject to accelerated

vesting in certain circumstances.

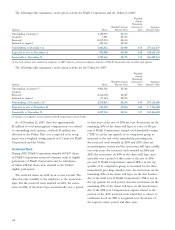

The fair value of each stock option on the date of grant

is estimated using the Black-Scholes valuation method. The

weighted average grant date fair value of options granted

using the Black-Scholes valuation method was $7.81, $6.98,

and $10.08 per share in 2007, 2006, and 2005, respectively.

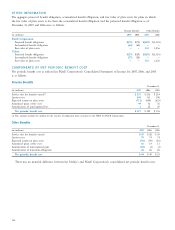

The signifi cant assumptions used for shares granted in 2007,

2006, and 2005 were:

2007 2006 2005

Expected stock price

volatility 16.5% 22.1% 40.6%

Expected annual dividend

payment $1.44 $1.32 $1.20

Risk-free interest rate 4.73% 4.46% 3.74%

Expected life 5.4 years 5.6 years 5.9 years

Expected volatilities are based on historical volatility of

PG&E Corporation’s common stock. The expected dividend

payment is the dividend yield at the date of grant. The

risk-free interest rate for periods within the contractual term

of the stock option is based on the U.S. Treasury rates in

effect at the date of grant. The expected life of stock options

is derived from historical data that estimates stock option

exercises and employee departure behavior.

The following table summarizes total intrinsic value (fair

market value of PG&E Corporation’s stock less stock option

strike price) of options exercised for PG&E Corporation and

the Utility in 2007, 2006, and 2005:

PG&E

(in millions) Corporation Utility

2007:

Intrinsic value of options exercised $ 59 $34

2006:

Intrinsic value of options exercised $ 97 $51

2005:

Intrinsic value of options exercised $125 $57

The tax benefi t from stock options exercised totaled $20 mil-

lion and $31 million for the year ended December 31, 2007

and December 31, 2006, respectively, of which approximately

$11 million and $44 million was recorded by the Utility.