PG&E 2007 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2007 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

Cost of Electricity

The Utility’s cost of electricity includes electricity purchase

costs, hedging costs, and the cost of fuel used by its genera-

tion facilities or supplied to other facilities under tolling

agreements. It excludes costs associated with the Utility’s

own generation facilities, which are included in Operating

and Maintenance expense in the Consolidated Statements of

Income. The Utility’s cost of purchased power and the cost

of fuel used in Utility-owned generation are passed through

to customers.

The Utility is required to dispatch, or schedule, all of the

electricity resources within its portfolio in the most cost-

effective way. This requirement, in certain cases, requires the

Utility to schedule more electricity than is necessary to meet

its load and therefore to sell this excess electricity on the

open market. The Utility typically schedules excess electricity

when the expected sales proceeds exceed the variable costs

to operate a generation facility or buy electricity under

an optional contract. The Utility’s net proceeds from the

sale of surplus electricity are recorded as a reduction to

the cost of electricity.

The following table provides a summary of the Utility’s

cost of electricity and the total amount and average cost of

purchased power:

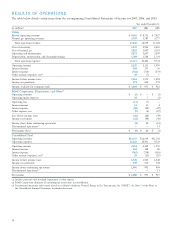

(in millions) 2007 2006 2005

Cost of purchased power(1) $ 3,443 $ 3,114 $ 2,706

Proceeds from surplus sales

allocated to the Utility (155) (343) (478)

Fuel used in own generation 149 151 182

Total cost of electricity $ 3,437 $ 2,922 $ 2,410

Average cost of purchased power

per kWh $ 0.089 $ 0.084 $ 0.079

Total purchased power

(in millions of kWh) 38,828 36,913 34,203

(1) Includes costs associated with RMR agreements.

The Utility’s total cost of electricity increased by approxi-

mately $515 million, or 18%, in 2007 compared to 2006.

This increase was primarily driven by a 6% increase in the

average cost of purchased power. The average cost of pur-

chased power increased $0.005 per kilowatt-hour (“kWh”)

from 2006 to 2007 primarily due to higher energy payments

made to qualifying facilities (“QFs”) after their fi ve-year

fi xed price contracts expired during the summer of 2006. In

addition, the Utility increased the volume of its third-party

power purchases primarily due to a reduction in the avail-

ability of lower-cost hydroelectric power resulting from less

than average precipitation during 2007 as compared to 2006.

These increases were partially offset by a decrease in costs

associated with RMR agreements.

The Utility’s cost of electricity increased by approximately

$512 million, or 21%, in 2006 compared to 2005, mainly

due to an increase in total purchased power of 2,710 million

kWh, or 8%, and an increase in the average cost of pur-

chased power of $0.005 per kWh, or 6%, in 2006, compared

to 2005. This was primarily caused by an increase in volume

of purchased power due to greater customer demand during

unseasonably warm weather during the summer of 2006

and a decrease in the volume of electricity provided by the

DWR to the Utility’s customers. Additionally, the Utility’s

service to customers who purchase “bundled” services

(i.e., generation, transmission, and distribution) grew, further

increasing volume.

The Utility’s cost of electricity in 2008 and future years

will depend upon electricity and natural gas prices, the level

of hydroelectric and nuclear power that the Utility produces,

the cost of procuring more renewable energy, impacts from

termination of DWR contracts, CPUC-ordered changes to

QF pricing, and changes in customer demand. (See the

“Risk Management Activities — Price Risk” below.)

The Utility’s future cost of electricity also may be

affected by federal or state legislation or rules which may

be adopted to regulate the emissions of greenhouse gases

from the Utility’s electricity generating facilities or the gen-

erating facilities from which the Utility procures electricity.

As directed by recent California legislation, the CPUC has

already adopted an interim greenhouse gas emissions perfor-

mance standard that would apply to electricity procured or

generated by the Utility. (See “Risk Factors” below.)

Natural Gas Operating Revenues

The Utility sells natural gas and natural gas transportation

services. The Utility’s transportation services are provided

by a transmission system and a distribution system. The

transmission system transports gas throughout California for

delivery to the Utility’s distribution system which, in turn,

delivers natural gas to end-use customers. The transmission

system also delivers natural gas to large end-use customers

who are connected directly to the transmission system.

In addition, the Utility delivers natural gas to off-system

markets, primarily in southern California, in competition

with interstate pipelines.